Health insurance: Incentivizing overspending or fueling innovation?

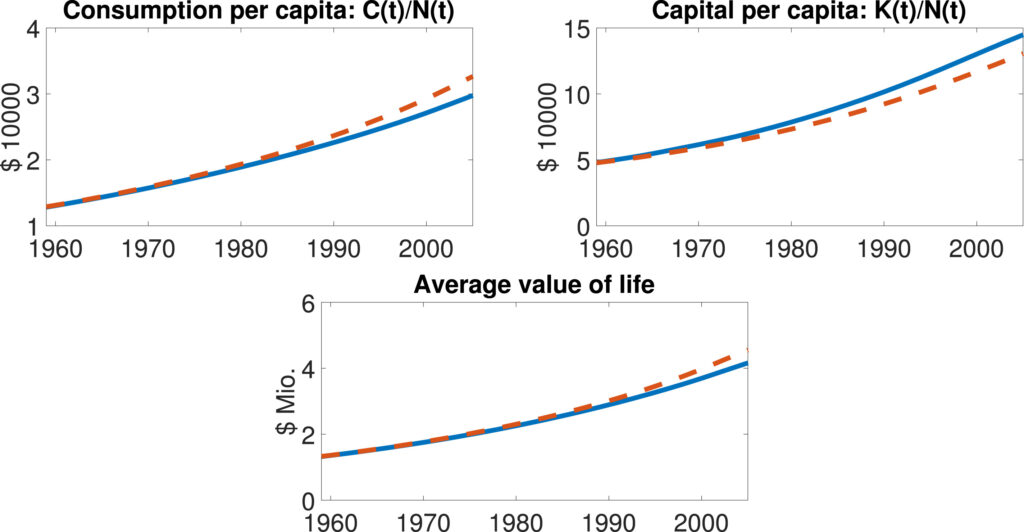

Based on a study by Frankovic and Kuhn (2022), the answer is both. However, the value of increased innovation–as measured through longevity gains–more than offset inefficiencies from overspending. Specifically, the authors use an overlapping generations model where individuals can purchase health insurance and medical progress depends on health care sector return on investment. The authors calibrate their model using longevity data from the Human Mortality Database from 19650 through 2005, earnings data from the Current Population Survey (CPS) and health care spending data from the National Center for Health Statistics (NCHS). This time frame is relevant as 1965 was the year Medicare was implemented in the US.

Using this methodology, the authors find that:

…more extensive health insurance accounts for a large share of the rise in US health spending but also boosts the rate of medical progress. A welfare analysis shows that while the subsidization of health care through health insurance creates excessive health care spending, the gains in life expectancy brought about by induced medical progress more than compensate for this.

Overall, increased levels of health insurance decrease consumption as more money is spent on health care. At the same time, capital–particularly capital invested in R&D–increases as health insurance increases returns on investment as more sick patients are able to afford treatment. The authors note that:

One explanation for why the benefits from medical progress increasingly outweigh the loss from moral hazard lies with the ongoing growth of income: As long as per capita consumption is increasing over time, individuals tend to assign an increasing value to life (Hall and Jones, 2007, Chen et al., 2021). This argument extends to the assessment of moral hazard, where individuals are willing to tolerate an increasing distortion from health insurance in exchange for an increase in lifetime, as long as this only slows down but does not reverse consumption growth.

The authors also note that medical prices increase over time due to the Baumol cost disease; specifically the joint impact of productivity growth in the final goods sectors and medical progress itself lead to higher prices.

Courtesy of the Journal of Health Economics.

You can read the full paper here.