Has there been a decline in competition in the US?

This is a difficult question to answer. Consider the following world views:

Decline-in-competition. Competition has declined because we observe increased market concentration, increased markets, decline in the labor share, and a lower rate of new-business formation at a macro level. Competition-in-action. If a few “superstar” firms in an industry grow by delivering greater value to customers based on their superior ability to adopt and use new technologies that involve higher fixed costs and lower marginal costs, we would expect both concentration and price/cost markups to rise, along the lines.

In short, the same empirical evidence could support vastly different world views.

Market concentration: Consider another example where the market concentration of the top 4 firms (known as the C4 statistic) increased from 50% to 90% over time. If this concentration was due to purely acquisition, there could be concerns of market concentration/market power. Alternatively, if the growth in C4 was due to internal growth by several large, efficient firms, leading to better products and lower prices, this increase in C4 would be less problematic.

Consider also how market definitions could both lead to upward or downward bias in market concentration.

Underestimating Market Concentration by Using Overly Broad Categories: NAICS code 325412 is “Pharmaceutical Preparation Manufacturing.” Using this as a “market,” a drug which treats one disease would be in the same “market” as all other drugs which treat other diseases. In the extreme, if there are many diseases of similar prevalence and severity, and each disease class had a single patented monopolist, measuring concentration in NAICS code 325412 would misleadingly find low concentration. By contrast, researchers studying the industrial organization of pharmaceutical markets have tended to define markets far more narrowly. For example, Cunningham, Ederer, and Ma (2021) define markets as a combination of therapeutic class and mechanism of action. This sensible procedure results in hundreds of separate pharmaceutical markets. Similarly, NAICS code 513210 is “Software Publishers.” This code lumps together all software whether it be desktop operating systems, enterprise databases, mobile apps, computer games, or specialized technical software. Overestimating Market Concentration by Using Overly Broad Regions: NAICS code 444130 is “Hardware Stores.” Consider competition among hardware stores before and after the expansion of Home Depot and Lowe’s. Suppose each city starts with its own monopoly hardware store with a different local owner. New technology then enables economies of scale across geographies, causing the most efficient hardware stores to expand nationally. Suppose the result is that each city is served by two big-box hardware stores, Home Depot and Lowe’s. Concentration measured at the national level will have increased dramatically, from a very fragmented industry to a duopoly. But consumers would benefit from greater local competition, having two choices rather than just one.

Price-markups may tell us if a firm is exercising market power. Mark-ups are prices far about marginal cost. However, even estimating marginal cost is problematic for a number of reasons.

First, distinguishing costs that vary with output (over the relevant range and time frame) from those that do not is extremely difficult to do at scale. Second, marginal costs often include hard-to-observe opportunity costs, especially when firms face capacity constraints. Third, multi-product firms typically have variable costs which are shared across different products and hard to apportion. Fourth, just how one aggregates estimated price/cost markups from the product level up to the firm level, and from the firm level up to summary measures for entire sectors or the whole economy, matters quantitatively and for interpretation. For example, a shift toward industries in which intellectual property is more important will itself cause an increase in economy-wide average markups, even without any within-industry changes.

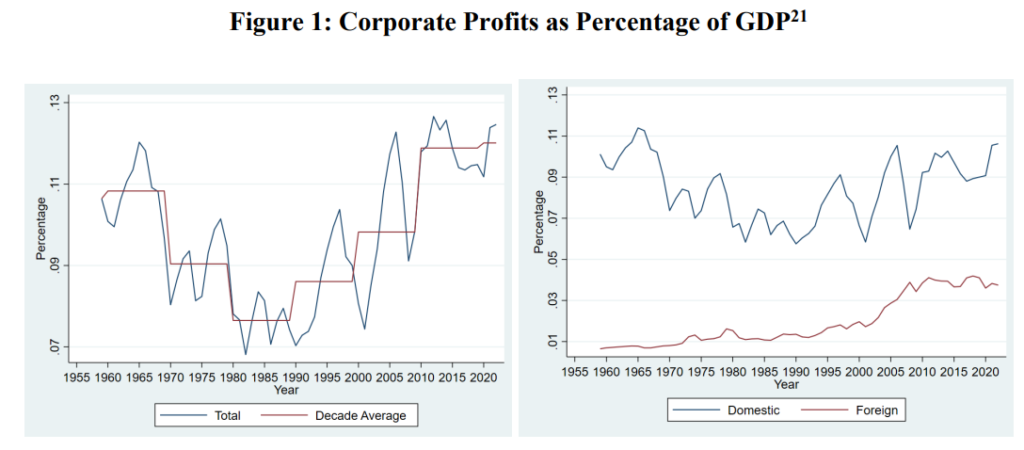

Consider for instance the graph below. Corporate profits have been growing over time (see graph at left) but this is largely because domestic firms have become more successful in foreign markets (see graph at right).

There are two primary approaches for estimating markups, the latter of which is more commonly used. The De Loecker, Eeckhout, and Unger (2020) (“DLEU”) method of applying the production approach has been influential in this literature.

Demand approach. One estimates a consumer demand system and makes assumptions about firm conduct to infer what marginal costs must have been to generate the observed prices, given that demand system and the assumed firm conduct. Production approach. One uses data on inputs and outputs to infer what the price/cost markup must have been such that a cost-minimizing firm would choose to produce the observed amount of output using the observed amount of the inputs.

Most of these arguments were put forth in a paper by Carl Shapiro and Ali Yurukoglu (2024), which aims to examine what is going on by focusing on detailed industry-level data rather than just aggregate economy-wide data. The article does a great job summarizing recent literature on trends in market concentration, price/markups, and retrospective analysis of recent mergers. The content above summarizes some of the challenges, but the full paper does a really nice review of the current literature on both sides of the argument.

Additional details:

Papers by Sutton (1991) and Sutton (1997) explain the competition in action argument in his two books on competition. The Clayton Act prohibits mergers and acquisitions where “the effect of such acquisition may be substantially to lessen competition, or to tend to create a monopoly.” Currently deals valued at more than $119.5 million must be reported under the Hart-Scott-Rodino (“HSR”) Act.