Hard market more about restructuring than price from here: BofA Securities

Commenting on the state of the global reinsurance market, analysts at BofA Securities Inc. believe that, while the hard market is deemed “here to stay”, reinsurers may now be more focused on further restructuring than price at the January renewals.

“The pendulum has swung,” in reinsurance and the hard market is “here to stay” the analysts proclaimed, but they feel that another quarter where the frequency of smaller weather and catastrophe loss events could weigh on some companies, may lead to a renewed focus on the structure of coverage.

They note that 2022 is “shaping up to be a good year for reinsurance”, but at the same time note that the third-quarter was “not that benign” in terms of loss activity.

“We think a more ‘normal’ quarter could negatively surprise against potentially very optimistic market expectations for a benign quarter,” the analysts stated.

Going on to explain that, “Standalone Q3 results could be somewhat mixed (depending on seasonality of nat cat budgets), though YTD operational performance should remain robust and we believe FY targets are comfortably within reach. The outlook also remains strong, with the reinsurance hard market set to continue supported by the lack of new capital inflows.

“We expect a difficult Q3 in terms of European nat cats can help reinsurers to set the tone for another tough set of renewals in January for primary insurers, who are already seeing more volatility creep into earnings.”

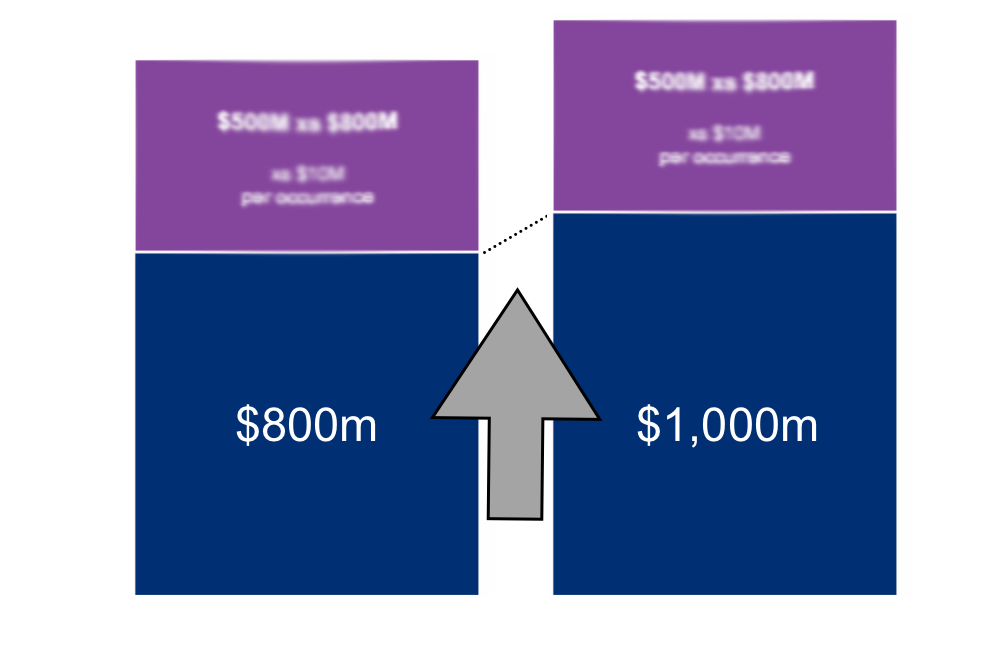

Adding that, “We are keen to understand to what extent reinsurers believe 2023 restructuring was enough to reduce their share of losses (and if there is appetite to grow from here), or if further restructuring is on the agenda. We think the latter is more likely as we head into 2024.”

They further explained that, “The higher prices and attachment points achieved in 2023 renewals appear to be paying off for global reinsurers, as we see evidence of greater earnings volatility creeping into primary insurance results.”

Also noting that, “The lack of meaningful capital inflows keeps us constructive on the medium-term outlook, as we expect reinsurers could drive further restructuring (rather than growth) in 2024 to sustain margins.”

The focus on reinsurance coverage terms and conditions looks set to continue, even if rates do not rise at the pace seen at renewals over the last year.

Which means the risk-adjusted returns possible from underwriting should be better sustained, even if pricing were to be relatively stable at the January 2024 renewals.