Hannover Re’s vehicle Kaith Re issues $5m LI Re 2024-1 private cat bond

A new $5 million private catastrophe bond issued by German reinsurance company Hannover Re’s Bermuda domiciled vehicle Kaith Re Ltd. has come to light, with the LI Re (Series 2024-1) deal assumed to be providing privately placed collateralized and securitized catastrophe reinsurance capacity for an unknown sponsor.

Hannover Re has facilitated the transaction, helping the unnamed cedent to access sources of capital markets backed reinsurance capacity.

Using its Bermuda domiciled reinsurance transformer and segregated account vehicle Kaith Re Ltd., which was acting on behalf of its segregated account named LI Re, exactly $5,003,710 million of LI Re 2024-1 private cat bond notes have been issued and placed privately with qualified investors, we have learned.

Hannover Re has facilitated the issuance of numerous private cat bonds under its LI Re and Seaside Re programs, all issued using Kaith Re in Bermuda. Details of which can be found by filtering our extensive Deal Directory by type of transaction.

Hannover Re regularly assists investors in accessing reinsurance related risk and returns in securitized formats, and cedents to access the capital markets, by using structures to provide risk transformer and facilitation for 144a cat bonds, private catastrophe bonds such as this new deal, and other insurance-linked securities (ILS) arrangements in fronted collateralized reinsurance form.

The global reinsurer is a key actor in the ILS market, putting its expertise, balance-sheet and ratings strength to work in helping to expand the ILS market and facilitate the smooth transfer of cedent risk to capital markets investors and ILS funds.

This new slightly over $5 million LI Re 2024-1 private cat bond, transforms and securitizes an underlying reinsurance or retrocession related contract, with risk contained in the segregated account, and these notes are scheduled for maturity on July 15th 2025.

In recent years, most LI Re private cat bonds issued with the assistance of Hannover Re have provided cover for California earthquake risks. But in this case detail is more limited and we’re not certain of the exposure, although assume it is property cat risk related.

This new $5m of LI Re Series 2024-1 private cat bond notes are now listed on the Bermuda Stock Exchange (BSX) as Section V – Insurance Related Securities, while Ocorian Securities (Bermuda) Ltd. has acted as the listing sponsor, and the notes were sold to qualified institutional investors.

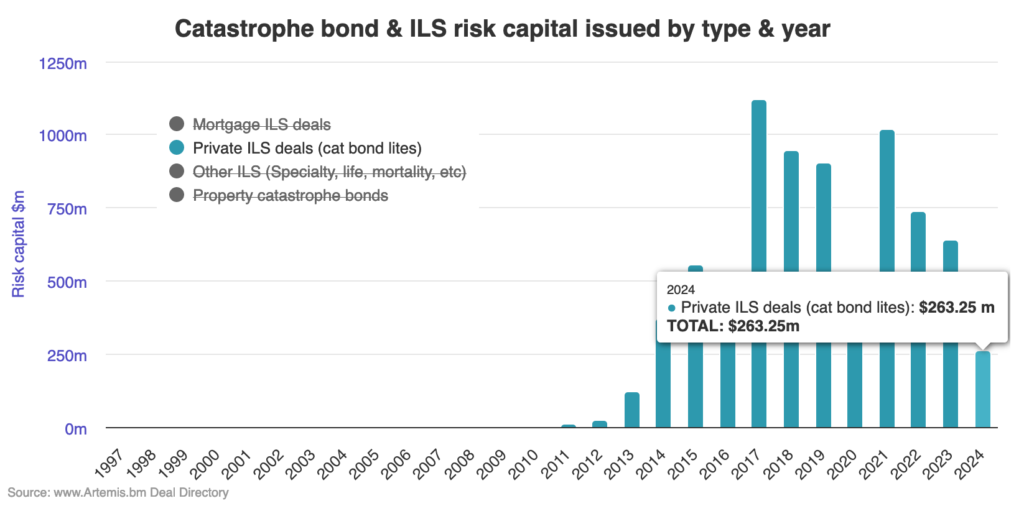

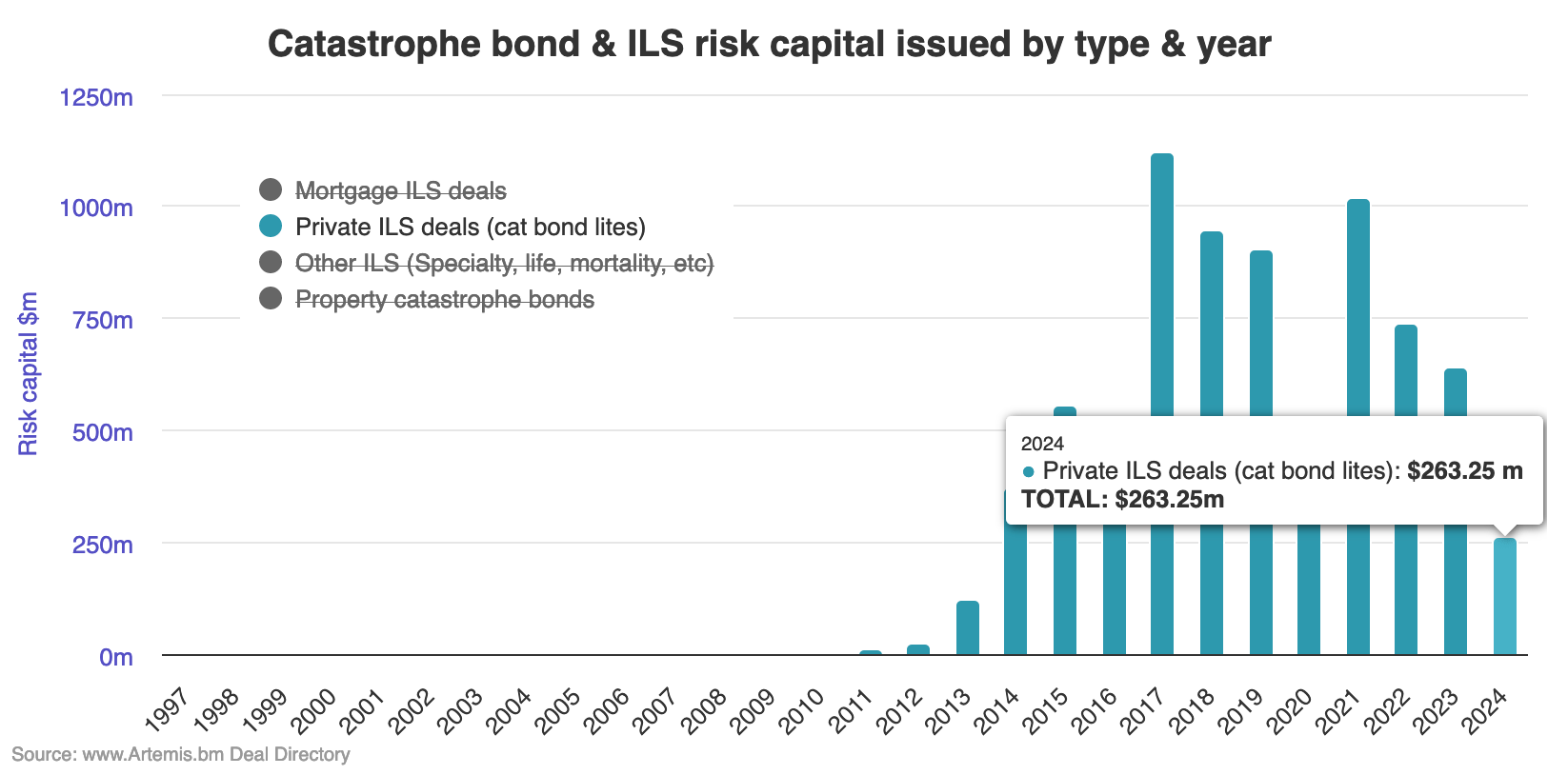

Adding this new private cat bond to our market data and analytics, 2024 private catastrophe bond issuance has reached almost $263.25 million so far this year, according to Artemis’ extensive cat bond market data.

You can analyse private cat bond issuance by year in our chart that breaks down all our tracked issuance by type here. Click on the chart below to access an interactive version:

Issuance of private catastrophe bonds has been increasing in 2024, but remains far below record levels. We don’t see many of these transactions though, so only have data on those where some information has become available to us.

2017 remains the record year for private cat bonds that we have tracked, at just over $1.12 billion of issuance recorded by Artemis.

Read more about this new LI Re (Series 2024-1) private catastrophe bond in our extensive cat bond Deal Directory.

You can filter our Deal Directory to view only private cat bond deals.