Hannover Re’s comprehensive retro drives investor confidence: Berenberg

Reinsurance as a sector and the major global reinsurers have suffered due to elevated catastrophe losses in recent years, but analysts at investment bank Berenberg believe that Hannover Re’s comprehensive retrocession program is giving investors confidence and helped to buoy its share price in 2021.

Of the big four European reinsurance firms, which are still the four largest in the world, Hannover Re’s share price performed the best in 2021.

In fact, Hannover Re’s share price was the only one of the big four to comfortably outperform the STOXX Europe 600 Insurance Index, which the analysts believe is down to investors perception that the reinsurer is better protected against major loss events than its peers.

Hannover Re’s retrocession program is one of the better established and longest-standing, especially among those that utilise insurance-linked securities (ILS) and tap into capital market investor appetite for reinsurance related investments.

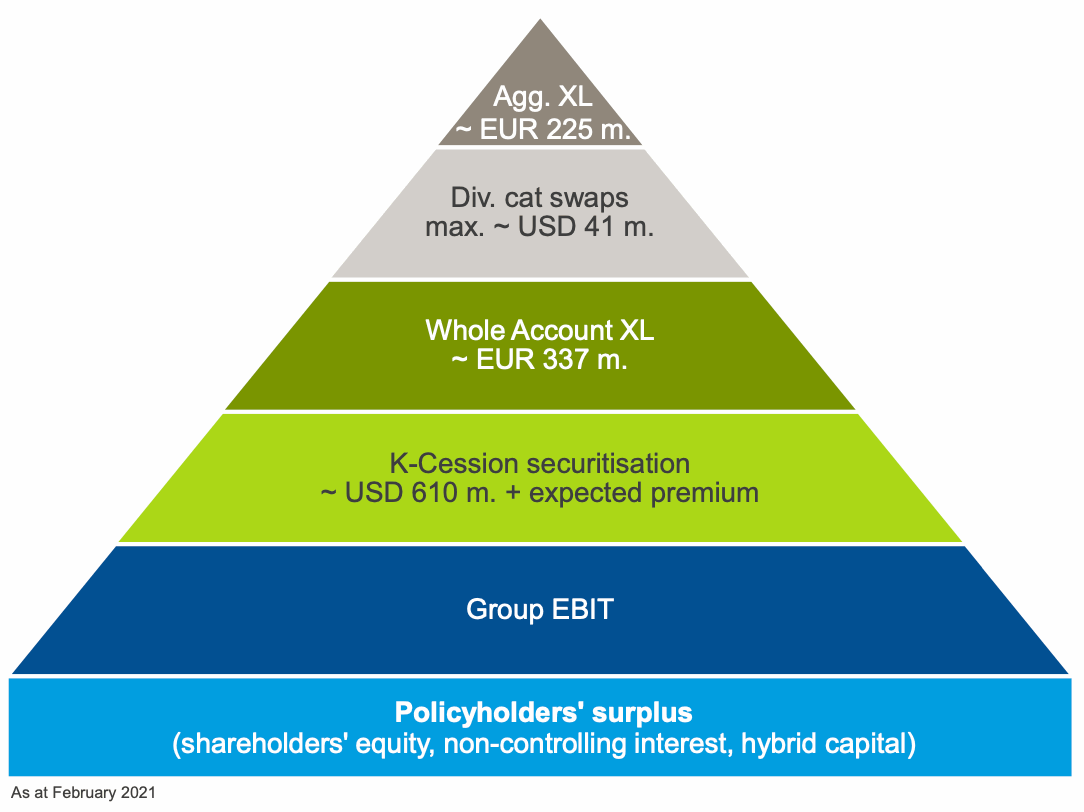

The reinsurer has its K-Cessions quota share retro sidecar vehicle, which it renewed at $610 million in size for 2021.

K-Cessions is a key retro structure for Hannover Re, enabling it to partner with institutional and insurance-linked securities (ILS) capital within its retrocession program, sharing in its underwriting profits and losses and the company has called the sidecar structure the backbone of its retro arrangements.

Alongside this, Hannover Re has a large loss aggregate excess-of-loss worldwide retro reinsurance arrangement, a number of catastrophe swaps and a whole account excess of loss retrocession cover.

There is capital market participation in most of these arrangements and Hannover Re has wholeheartedly embraced its engagement with the ILS market to help in building out its retro tower.

Berenberg’s analyst team commented, “The fact that Hannover Re has outperformed is, we believe, indicative of the market’s belief in its ability to continue to deliver attractive earnings even in the face of higher cat losses due to its comprehensive retrocession programme.”

Adding that, “Hannover’s mix of the k-cession, whole account excess of loss, cat swaps, and the aggregate excess of loss that sits on top of the annual cat budget undoubtedly means it is easier for investors to feel comfortable that, even in a relatively negative scenario, the stock should be less volatile than peers.”

The analysts say that they concur with the investor view of Hannover Re and the importance of its retrocession arrangements, but also note that other major players have “catch-up potential.”

In particular they cite SCOR’s adjustments to its retrocession and Swiss Re’s proactive work to manage its exposure to secondary perils and aggregates.

There could be a very simple answer as to why Hannover Re’s retrocession has been so positively viewed by investors and shareholders, compared to other major reinsurers.

The company has been far more transparent about these protection arrangements in recent years.

Hannover Re provided clear outlines of the retrocessional covers it had in-force for 2021, sharing far more granular information than the majority of its peers on this.

It’s going to be interesting to see whether retro arrangements are deemed as important this year by investors, especially as many retro arrangements have either shrunk or had to be redesigned in order to get them placed at the more challenging renewals.

Providing transparency on this is important for gaining investor confidence, as without an understanding of how protected a reinsurer actually is, it is hard to make a judgement as to how certain catastrophe scenarios may impact them.

The typical PML disclosures that many re/insurers provide don’t really cut it when it comes to trying to pick stocks that will better weather the weather, it seems.

It would be interesting to study reinsurer share price performance versus their disclosures on use and management or third-party capital as well, as we believe there is a definite advantage to being open about the scope of any third-party capital management operations, which investors see as both protection, alignment with capital and a source of fees.