Guy Carpenter urges retro buyers to “create competitive tension”

Broker Guy Carpenter is calling for retrocession buying clients to leverage both traditional and alternative sides of the market, in order to “create competitive tension” at the upcoming January 2024 reinsurance renewals and beyond.

After “one of the most challenging placement periods in decades” at 1/1 2023, Guy Carpenter looks forward to calmer waters at the next sets of renewals.

“Aa greater sense of stability returned at the mid-year renewals, however, the market remains challenged. Firming rate pressures in key markets continue, capacity at the lower end of programs is limited, we have witnessed large shifts in the appetite of reinsurers for certain covers, while terms and conditions are tight,” the broker explained in a new report released for the Monte Carlo Rendez-Vous today.

James Boyce, CEO, Global Specialties, explained how Guy Carpenter is helping its clients prepare for negotiations, “In the current environment, preparation is key. The ability of clients to articulate their portfolio effectively and demonstrate the success of their underwriting strategy will be central to productive negotiations.

“Furthermore, having access to a broad mix of products and capital pools and being armed with comprehensive market data underpinning a well-defined renewal strategy will be crucial.”

The broker notes that there is some excess capacity available, “at the upper end of programs, but limited availability at the lower levels, particularly for non-modelled or poorly modelled perils.”

Adding that, “Non-marine retro rates have stabilised after a period of hardening, but capacity is uncertain due to fluctuating investor appetite.”

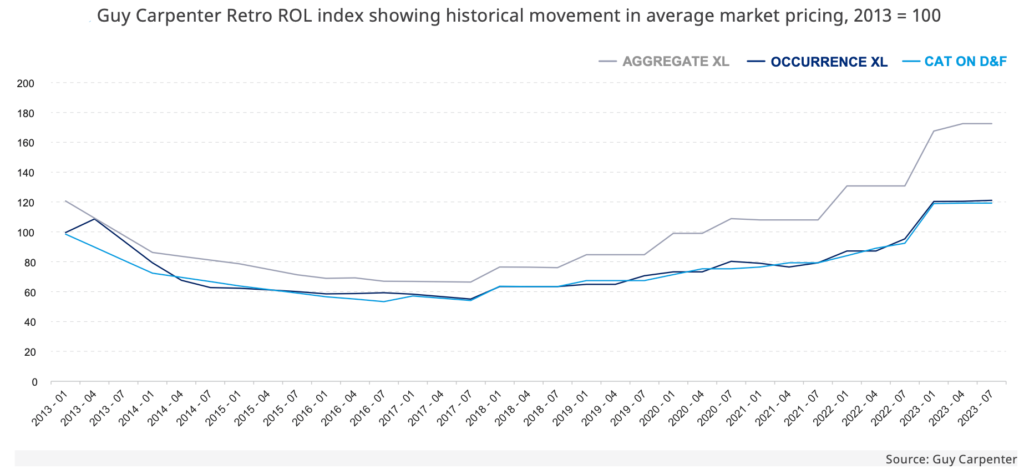

However, Guy Carpenter notes that “new capacity has entered the market” and points to its retro rate-on-line Index, which it says has flattened off in recent months (as seen below).

The broker said that retro renewal negotiations at the mid-year “transitioned from being capacity driven to focus more on price, attachment levels and coverage.”

Adding, “For many buyers, navigating the widest potential pool of capacity or capital providers will be the optimal retrocession strategy in 2024.”

“The non-marine retro market has experienced a period of significant rate hardening in recent years,” said Boyce. “However, greater price stability was witnessed between January 1, 2023 and the mid-year renewals. The mid-year placements also saw movement on minimum rate on line levels and greater reinsurer willingness to deploy capacity at lower rates.”

Talking about how retrocession buying strategies are evolving, he added, “The focus of negotiations in many cases since January 1 has transitioned from one of capacity, to a more pragmatic and considered discussion centred on price, attachment levels and coverage.

“Many retro providers have made clear their stance around minimum attachment levels that often exclude potential exposure to higher frequency perils and attritional losses.”

Meanwhile, Richard Morgan, Head of Non-Marine Specialties, added, “The ability of cedents to navigate the widest potential pool of capacity or capital providers will be important when optimizing retrocession strategies in 2024.”

Before going on to highlight the opportunity to leverage the appetites of both sides of the retro market, traditional and alternative capital or ILS.

Morgan said, “Current hard market dynamics, when expected margins look positive, create the right time for buyers to develop extensive relationships across both the traditional and alternative markets in order to create competitive tension not just for the January 1, 2024 negotiations, but through the wider market cycle.”