Guide to Life Insurance for Single Dads

Introduction: The Role of Life Insurance for Single Dads

Being a single dad comes with its unique set of challenges and responsibilities, with the well-being and future of your children resting squarely on your shoulders.

In this comprehensive guide, we’ll explore the world of life insurance specifically tailored for single dads.

We’ll address crucial questions and provide helpful tips to help you make well-informed decisions and ensure a secure future for you and your little ones.

The Importance of Life Insurance for Single Dads

As a single dad, you bear the sole financial responsibility for your children, making life insurance and income protection fundamental considerations.

Let’s look at why life insurance matters for you as a single parent.

Protecting Your Family’s Financial Stability

You and your children face two monumental risks:

Loss of Income:

What happens if you become unable to work due to illness or injury?

How will you meet your children’s financial needs?

Future Security:

God forbid, you’re hit by a bus and your income stops.

What happens then?

Types of Life Insurance for Single Dads

Now that we’ve established the importance of life insurance (illness and death) let’s look at the different types of insurance policies tailored to meet your needs:

Income Protection for Single Dads

Your ability to earn income is your most significant asset.

Income protection insurance can be your financial lifeline in challenging times.

Here’s how it works:

Coverage: It can provide up to 75% of your income if you can’t work for more than four weeks due to any illness or disability.

Duration: It continue to pay you until you can return to work or until your retirement age.

Protection: It ensures that you can continue providing for your children as you do today.

Life Insurance Options for Single Dads

Now, let’s consider the specific life insurance options designed with single dad in mind:

Term Life Insurance

Purpose: Ideal for protecting your children during their most vulnerable years, especially when they rely on you financially.

Affordability: Typically more budget-friendly than whole life insurance.

Flexibility: Allows you to choose coverage amount and term length, often until your youngest child reaches financial independence.

Adaptability: Offers future extension options without additional health questions, adapting to your changing circumstances.

Guaranteed Whole of Life Insurance

Lifetime Coverage: Provides a payout whenever you pass away, ensuring financial security for your children.

Stable Premiums: Premiums remain constant over time, providing long-term cost-effectiveness.

Tax Benefits: Can be utilized for inheritance tax planning, with tax-free proceeds for your children.

So which to choose?

Whole of life is better but it’s 10-15 times the price of term life insurance 🤯

Making Informed Choices as a Single Dad

Choosing the right insurance coverage involves several factors.

Let’s take a look at them briefly.

Determining the Adequate Coverage

Guidelines: Consider aiming for 10-15 times your annual income as a general rule of thumb.

Individual Factors: Assess your specific circumstances, including age, workplace coverage, mortgage protection, and savings or investments.

Personalized Recommendations: Complete this short questionnaire and I can do all the grunt work for you. It’s what I’m here for 😊

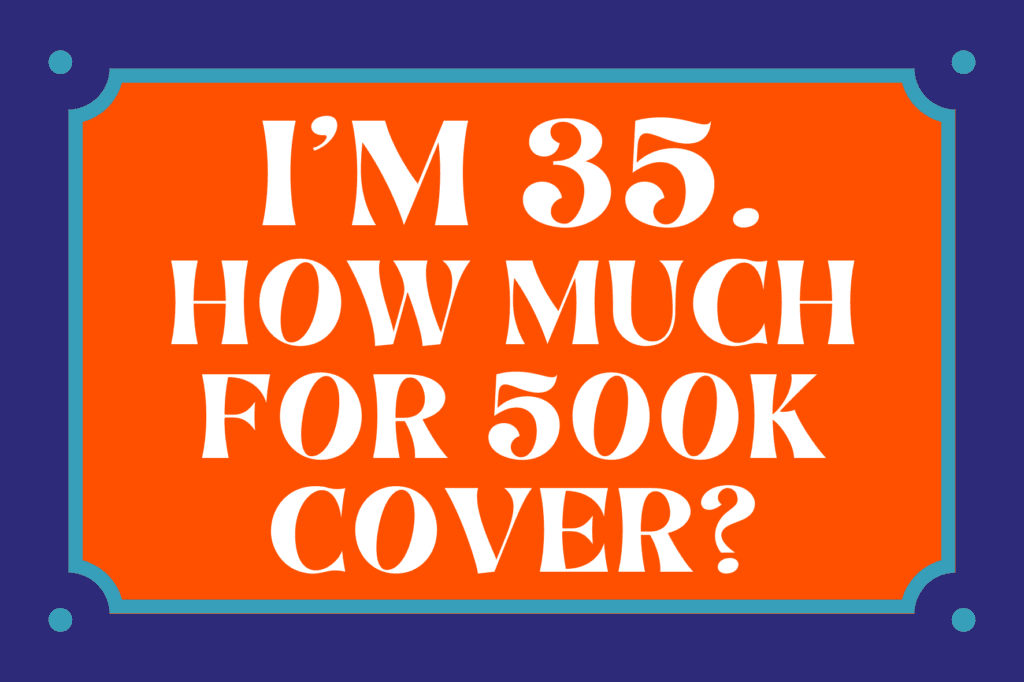

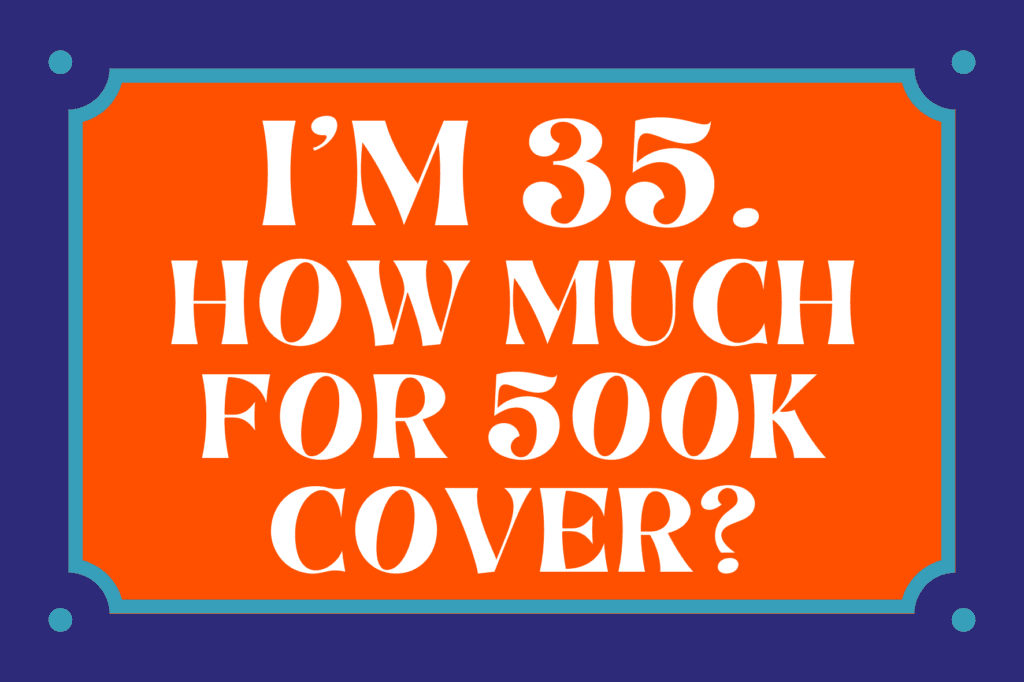

Affordability of Life Insurance

Life insurance is more affordable than you might think.

Go ahead and get an instant quote from our panel of insurers.

I guarantee you’ll be surprised at how cheap the quotes are.

For example, if you’re 35, securing half a million euros in coverage, until age 60, can cost just €34 per month – roughly €1 per day (assumng good health)

Where Does the Life Insurance Money Go?

To guarantee that your life insurance payout goes directly to your children, writing your policy in trust for them or making a will.

This ensures that your children benefit as intended.

Simplified Insurance for Single Dads

Purchasing life insurance as a single dad is a straightforward process.

You can complete it online, over email, or by phone – tis up to you!

Even if you have pre-existing health conditions, we can get you cover although you may pay more.

Ideal Policy Duration

We recommend selecting a policy that continues until your youngest child reaches financial independence, usually around age 25.

This approach protects them when they are smallies and keeps the cost affordable.

Trusted Insurers for Single Dads

Several insurers offer life insurance tailored to single dads’ needs.

Aviva offer the most comprehensive benefits, including AvivaCare, all five of the following life insurance providers can be trusted:

Aviva

Irish Life

New Ireland

Royal London

Zurich Life

Additional Protection: Critical Illness Cover

In addition to life insurance, consider critical illness cover.

This coverage provides a tax-free lump sum if you’re diagnosed with specific illnesses listed in your policy.

This lump sum can be used for various purposes, such as:

Making necessary home modifications

Covering medical treatment and expenses

Assisting with mortgage payments, loans, or bills

Enjoying a well-deserved holiday

Securing Your Children’s Future with Life Insurance

Life insurance is a vital safeguard for you and your children, providing financial security in uncertain times.

While life may throw unexpected challenges your way, the right insurance can help you prepare for the worst – while hoping for the best.

If you have questions or need guidance in selecting the right insurance policy, please don’t hesitate to contact us.

We’re here to assist you in making the process simple and straightforward.

Take the first step towards securing your family’s future by completing this questionnaire.

We’ll promptly respond via email with a personalised, no-obligation recommendation.

Thanks for reading and hopefully we’ll chat soon.

Slán!

Nick

Lion.ie | Protection Broker of the Year 🏆

Editor’s Note: We initially published this guide in 2023