Goosehead Insurance Looks To Big-$ Investors As A Best Near-Term Finance Sector Buy – Seeking Alpha

Pgiam/iStock via Getty Images

Our Investment Thesis

Is expressed in the above bullet-points, where odds for, and size of near-term capital gains are put on a comparable basis with alternative investment candidates.

The dominance of Goosehead Insurance, Inc. (GSHD) in following the outcome of that analysis compared to investment-comparable alternatives makes reading the rest of this article worth your time and effort if you are interested in rates of near-term capital gains. Gains which are likely to be multiples of what market-index averages regularly offer.

Description of Principal Investment Subject

“Goosehead Insurance, Inc. operates as a holding company for Goosehead Financial, LLC that provides personal lines insurance agency services in the United States. The company operates in two segments, Corporate Channel and Franchise Channel. It offers homeowner’s, automotive, dwelling property, flood, wind, earthquake, excess liability or umbrella, motorcycle, recreational vehicle, general liability, property, and life insurance products and services. As of December 31, 2020, the company had 1,468 total franchises. Goosehead Insurance, Inc. was founded in 2003 and is headquartered in Westlake, Texas.”

source: Yahoo Finance

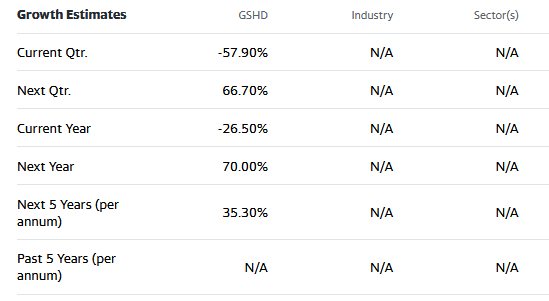

Yahoo Finance

Alternative Investment Competitor Rewards and Risks

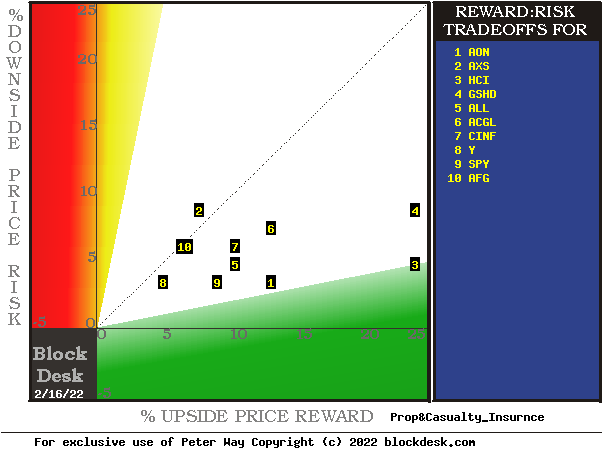

Figure 1

blockdesk.com

Used with permission

Upside price rewards are from the behavioral analysis (of what to do right, not of errors) by Market-Makers [MMs] as they protect their at-risk capital from possible damaging future price moves. Their potential reward forecasts are measured by the green horizontal scale.

The risk dimension is of actual price draw-downs likely at their most extreme point while being held in previous pursuit of upside rewards similar to the ones currently being seen. They are measured on the red vertical scale.

Both scales are of percent change from zero to 25%. Any stock or ETF whose present risk exposure exceeds its reward prospect will be above the dotted diagonal line.

Best reward-to-risk tradeoffs are to be found at the frontier of alternatives down and to the right. As a market-index “norm” currently, the S&P 500 Index ETF (NYSEARCA:SPY) is at location [3]. The current “frontier” trade-off of Risk vs. Reward extends from Y at [8] to SPY at [9] to AON at [1] and to HCI at [3]. Our present primary interest is in GSHD at location [4].

Is the added reward of GSHD worth the added risk compared to SPY or to HCI at [3]? A fuller description of investing considerations should add to investors’ decisions of the suitability and credibility of the available investment alternatives.

Additional value perspective information

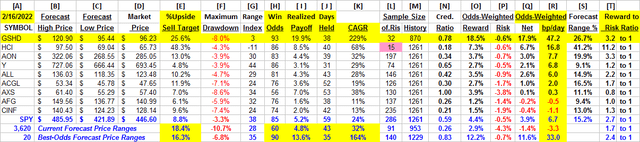

Figure 2 presents some of those considerations, drawn from outcomes of prior MM forecasts having the same up-to-down earlier expectation proportions as those of today.

Figure 2

blockdesk.com

used with permission

The advantage of determining Market-Maker forecasts for coming stock prices is that they offer many dimensions more than typical “street analyst” forecast of a single target-price at one point in time. Instead of only one higher (or lower) future price, the MM forecasts are drawn from market data valid across relevant (typically shorter) periods of time for both the upper and lower price limits seen as likely to be encountered in such a period.

That range of coming prices for each investment candidate is clearly split into upside and downside prospects by its today market price. We note what proportion of that whole forecast price range is between the today market quote and the low-end prospect, the downside exposure. We label that % of the range as the Range Index [RI] and note it in column [G] of Figure 2. It gets used to identify and average all prior RIs of similar size as a suitable sample of subsequent market outcomes in column [L], as a proportion of all price-range forecasts for the stock in the past 5 years of market days [M].

With those samples, scaled individually to each candidate’s relevant prior-sample outcomes, we now can make appropriate direct comparisons of answers to questions of:

How big a capital gain might be expected from this stock in the next few months? [ I ] Out of the sample, what are the Odds (how likely) that any one will be profitable? How long, on average, [J] might it take for a typical sample holding to come to a disciplined termination? In that average holding period, how bad an interim price drawdown might be experienced? How credible [N] is the current upside forecast [E] compared to what history realized [ I ]? Given [E] and [F], what is the current Reward to Risk [T] ratio?

Key attention-grabbers should be column [E], the % upside price changes between [D] and [B], and (based on past forecasts like today’s) how likely those forecasts are to come about in the next 3 months: Column [H], Win Odds.

Those odds are from [L] Sample Size prior forecasts with upside-to-downside price change balances like today’s, indicated by [G] Range Indexes, where the numeric tells what % proportion of the full [B] to [C] range lies between [D] and [C].

We further take those [H] odds, and their complement, 100 – H, as weights to the price drawdown Risk experiences of the sample [L] during its various attempts to achieve the [E] rewards, as shown in [ I ]. The net of that combination, as [O] + [P] = [Q], gets put in RATE of RETURN measured in “basis points per day” [R] by [Q] / [J], where a basis point = 1/100th of a percent. In other terms, a % of a %.

These [R] column measures provide a universal comparison means for the attractiveness of investment-capital, so the rows of Figure 2 are all ranked, with GSHD at the top rank.

Given that we are posed with a decision under the inevitable uncertainty of the future, no collection of answers or actual outcomes can be expected to prove perfection. But on balance they should help investors to tailor their candidate choices to best address the degree to which the data leads each investor to the most satisfying outcomes, most of the time.

Where the objective is to find from the candidates in Figure 2 the biggest, quickest, most likely capital gain in the next 3 months with the least interim price drawdown distress, it appears that the logical choice is with GSHD.

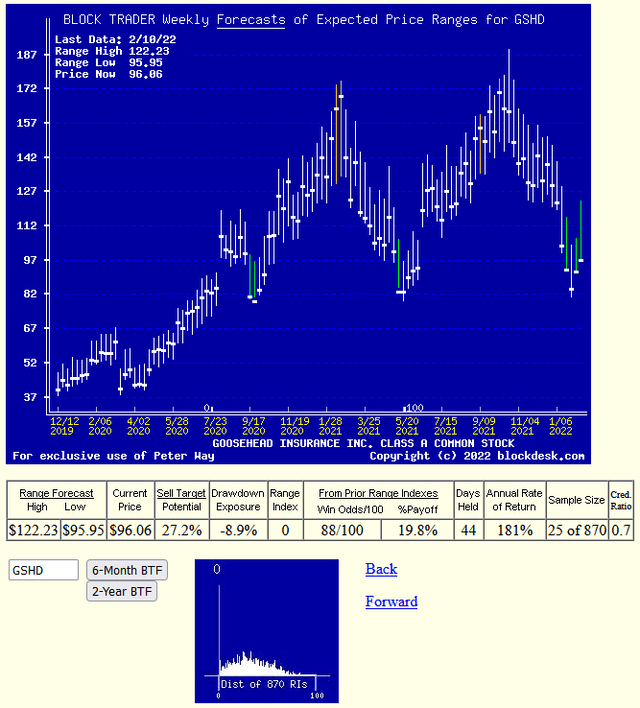

Recent Trends in GSHD Price-Range Forecasts

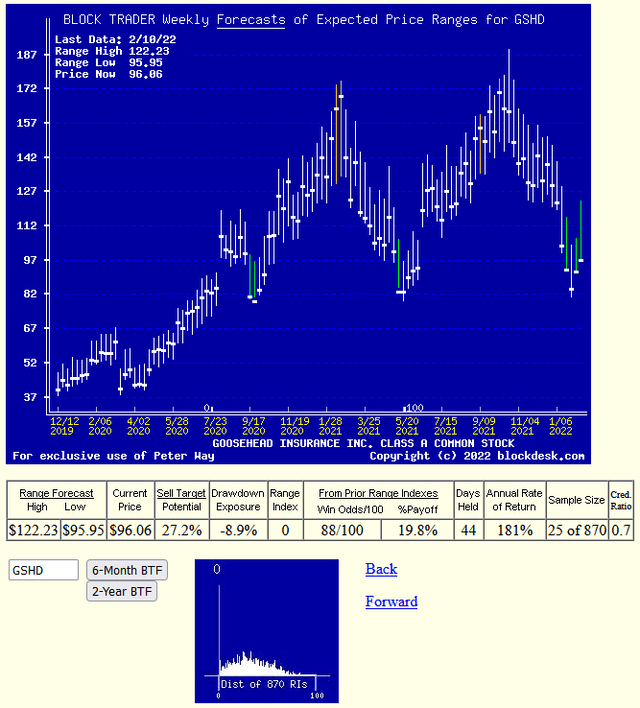

Figure 3

blockdesk.com

(used with permission)

With historic odds for a profitable experience of 9 out of every 10 and prior experience holdings of less than 2 months (of 21 market days) the prospect of strong triple-digit gain rates is powerful in comparison with other insurance industry investment alternatives and competitive when compared with averages of the best 20 of a large price-forecast population.

Some better perspective comes from once-a-week copies of MM forecasts over the past two years.

Figure 4

blockdesk.com

used with permission

Conclusion

Comparing these investment candidates to choose the best near-term capital gain prospect, Goosehead Insurance, Inc. appears to be far better suited than all the others.