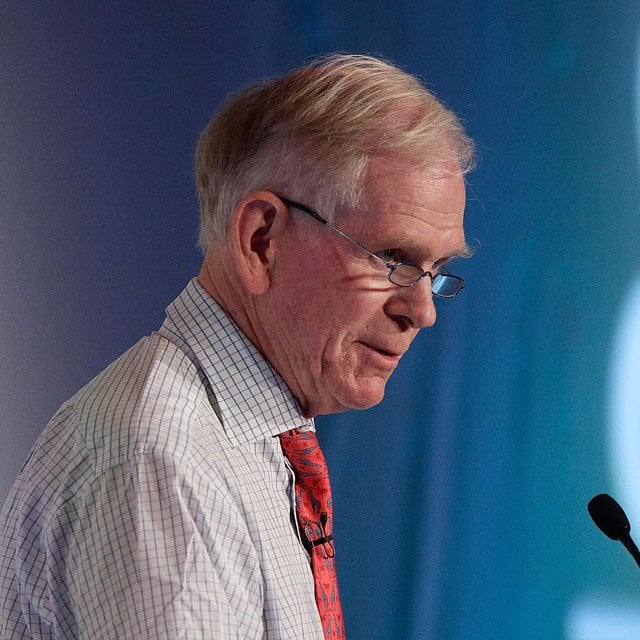

GMO's Grantham Says Rising Rates Will Crush Economy

What You Need to Know

The Fed is kidding itself on avoiding a recession, Grantham says.

Investor fervor surrounding AI has been something Grantham has been warning against.

The slow-moving influence of rising interest rates will end up torpedoing the economy, dashing Federal Reserve expectations that a recession can be avoided, according to renowned Wall Street curmudgeon Jeremy Grantham.

Grantham, whose own forecast for a brutal market reckoning has taken lumps in this year’s tech revival, doubled down on the gloom prophesy in an interview taped for an upcoming episode of Bloomberg Wealth with David Rubenstein.

“The Fed’s record on these things is wonderful. It’s almost guaranteed to be wrong,” said the co-founder of the Boston-based investment firm Grantham Mayo Van Otterloo, in response to a question about Chair Jerome Powell’s view that a downturn is avoidable. “They have never called a recession, and particularly not the ones following the great bubbles.”

Grantham, 84, is well known for gloomy forecasts that have occasionally presaged major market dislocations, such as in 2000 and 2008. He called the post-pandemic surge in equities “in many ways about equal to the 2000 tech bubble,” but said its deflation has been interrupted by speculation on artificial intelligence and economic stimulus that he linked to next year’s presidential election.

“Everything and its dog seems to have intruded,” he said. “It’s made life incredibly complicated. Personally I think AI is very important,” he said. “But I think it’s perhaps too little too late to save us from a recession.”

Volatility in the economy since the outbreak of Covid-19 has made miserable the lives of almost everyone trying to forecast the direction of markets. Grantham’s warnings around 2021’s unbridled bullishness — “we had some of the craziest investor behavior of all time,” he told Rubenstein — looked prescient when stocks were walloped last year. This year, with the Nasdaq 100 Index up more than 30%, they’ve occasionally seemed overblown.

Investor fervor surrounding AI, loosely defined as problem-solving using computers and big datasets that’s pushed tech stocks to lofty valuations, has been something Grantham has been warning against. And while excitement around it may be propelling equities for now, he said, it won’t keep the US economy from contracting.

Recession in 2024

The deflationary impact of last year’s fall in tech stocks is “too big,” he said. As higher rates continue to depress other corners of the market, particularly real estate, the U.S. economy will see “a recession running perhaps deep into next year and an accompanying decline in stock prices.”

In January, he projected the trendline value of the S&P 500 at about 3,200 by the end of the year, more than 1,000 points below its current level.