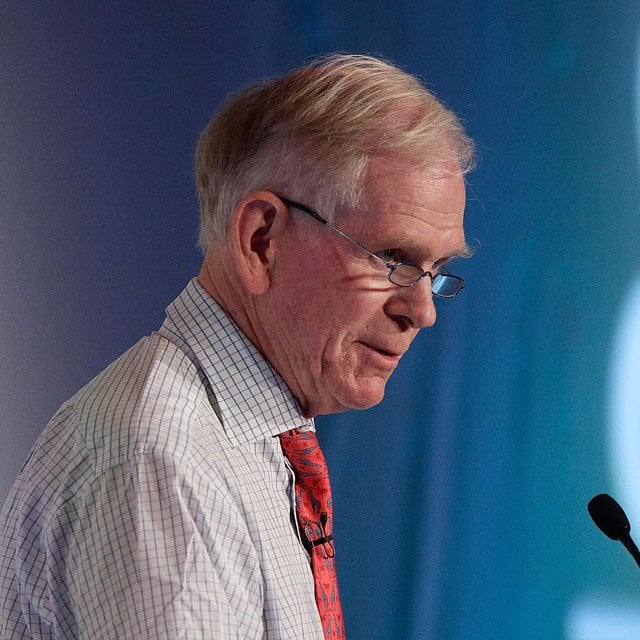

GMO's Grantham: 'Don't Invest in the U.S.'

What You Need to Know

The world outside the U.S. is investable, Grantham says.

The Russell 2000 is especially vulnerable, he notes.

Great bubbles take years to rise and years to fall, the strategist says.

The S&P 500 index could drop by 50%, Jeremy Grantham, GMO co-founder and investment strategist, said this week, recommending that investors avoid buying U.S. stocks.

He said he doesn’t expect the index to slide that far but considers it a possibility and does anticipate a major pullback.

Grantham warned in early 2021 that the market was experiencing “one of the great bubbles of financial history” and last year said that the “superbubble“ was entering its final act.

“In order to get the market down to a level where it would typically out-yield the long bond by 5% … the market would have to drop by more than 50%. This is not my forecast. I have a very genteel forecast that anything below 3,000 would make me think that it was reasonable,” Grantham said on Bloomberg’s Merryn Talks Money podcast.

“And if everything works out badly, which it sometimes does, I would not be amazed if it went to 2,000 on the S&P, but that would require a couple of wheels to fall off,” he added. “And wheels tend to fall off in the great bubbles unraveling, but it doesn’t mean they have to.”

The S&P 500 sat at 4,300 midday Friday, so a slide to 3,000 would represent a roughly 30% drop.

“The great bubbles take their time, quite a few years going up, quite a few years coming down and the market suffers from attention deficit disorder so it always thinks every rally is the beginning of the next great bull market,” Grantham said.

Russell 2000 stocks are particularly vulnerable, given the companies’ record debt, with about 40% lacking earnings, he suggested.

“The Russell 2000 almost has no collective earnings at all,” has record debt and includes zombie companies that can make interest payments only by issuing more debt, Grantham said.

The S&P 500 is about 18% below its highest close, in January 2022, and with 7% to 8% inflation, the market is down about 10%, the strategist said. “The markets are not doing as well as people think” because investors don’t account for inflation, he added.

A recession is coming and “it will probably go deep into next year,” Grantham projected, although he doesn’t know if it will be mild or serious. “Every bubble has been greeted with a chorus of soft landing, and there’s never been one.”

The market is unlikely to get more than a 3% return when the Shiller P/E ratio, or cyclically adjusted price-earnings ratio, reaches roughly 30, although the market expects twice that, Grantham said.

“Sooner or later, the simple arithmetic suggests you’ll either have a dismal return or you’ll have a nice bear market and then a normal return,” Grantham said. “And the nice bear market will be hopefully less than a 50% decline, but it won’t be a huge amount less from the peak than 50% in real terms.”