GM, Stellantis invest in EV magnet startup to reduce China reliance: 'Permanent magnets are the unsung heroes'

General Motors and Stellantis announced this week they will invest in startup Niron Magnetics, part of a plan to develop electric-vehicle magnets without rare earths as the automotive industry aims to curb its reliance on China.

The automakers joined Niron’s latest $33 million funding round and plan to collaborate to help develop permanent magnets built without rare earths, a step that would, if successful, reshape how the materials are used for the transition to EVs. Rare earth minerals are used extensively in consumer products, and throughout modern vehicles, especially in EV motors.

“Permanent magnets are the unsung heroes and essential components of countless parts of your vehicle,” Niron CEO Jonathan Rowntree told reporters on a call. “Where they have the greatest impact for GM is in the drivetrain to their future EVs. Today, roughly 90% of the rare-earth magnet supply is dependent upon China.”

The move follows China’s announcement in October that it would require export permits for some graphite products, which are also used in EVs, to protect national security.

Financial terms of the Niron round were not disclosed by the companies, but a person familiar with the deal, who asked not to be identified, said GM invested $7 million and Stellantis $5 million.

“We believe Niron’s unique technology can play a key role in reducing rare earth minerals from EV motors and help us further scale our North American-based supply chain for EVs,” GM Ventures President Anirvan Coomer said.

Permanent magnets are essentially the motors of an EV, helping to transfer power into motion.

EV motors consist of parts typically made from rare-earth minerals like terbium, dysprosium, praseodymium and neodymium, which are expensive and currently processed almost entirely overseas.

“Making powerful magnets from plentiful commodity materials decouples new production from rare earth mine development and lowers overall environmental impact,” Stellantis Ventures managing partner Adam Bazih said.

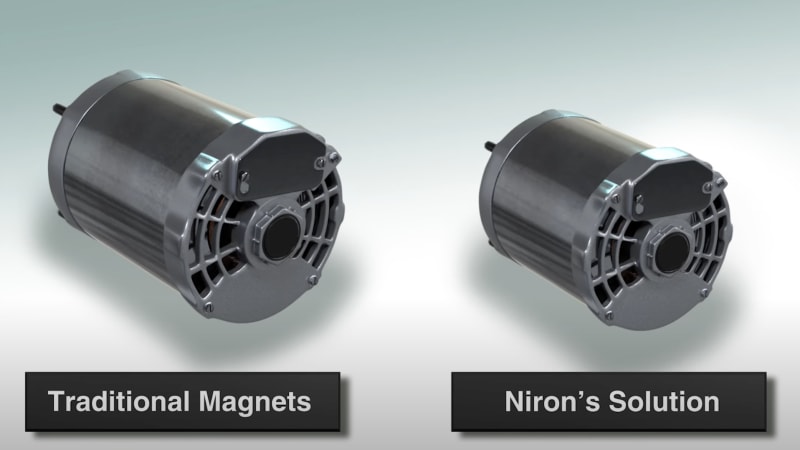

Minneapolis-based Niron said it believes its iron nitride magnet – which it has branded as a Clean Earth Magnet – is more magnetic than a traditional permanent magnet made with neodymium and praseodymium.

“There’s a lot of manufacturing steps and a lack of price transparency in this industry with rare earths, given the concentration of supplies in China,” Niron Senior Director Tom Grainger said.

The deal comes despite GM’s 2021 agreement to buy rare-earth magnets from MP Materials. MP has struggled to refine its own rare earths in California, but has been building a magnet facility in Texas.