Global insured catastrophe losses hit $22bn in Q1 2023: Gallagher Re

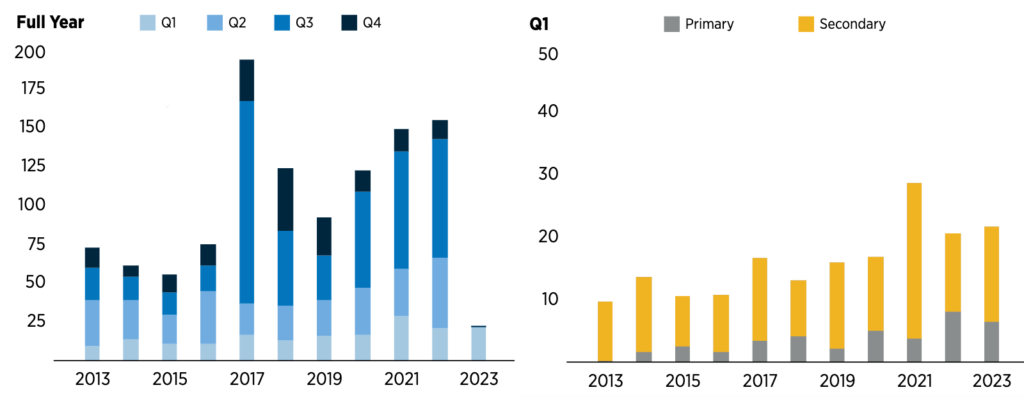

Global catastrophe losses that will be paid by public or private insurance and reinsurance capital are estimated to have reached $22 billion in the first-quarter of 2023, Gallagher Re has said.

The reinsurance broker points out that a “significant protection gap” was evident in the first-quarter, as global economic losses from catastrophes reached $77 billion.

Excluding the massive Turkey and Syria earthquake loss, which is estimated as an economic loss of $45 billion and insured of $5 billion, the toll for climate and weather related catastrophe losses is a more close to the average $31 billion economic, $17 billion insured.

The severe convective storm (SCS) peril is seen as the largest contributor to global insurance and reinsurance market losses from catastrophe events, at more than $10 billion for the quarter, Gallagher Re said.

Gallagher Re said that the total insured loss was 38% higher than the decadal average and 47% higher than the decadal median for Q1.

The reinsurance broker also highlights that secondary perils drove the largest contribution of catastrophe insured losses in the first-quarter of 2023.

“The Turkey earthquake sequence was a difficult reminder of the significant vulnerabilities that exist to life and property from seismic events,” explained Gallagher Re Chief Science Officer Steve Bowen.

“As the private and public sectors work together to develop a more resilient and adaptive society to current and future climate change risk, it is imperative that all natural hazard types, and not just weather or climate perils, are considered in the planning discussions.”

Bowen added, “The high-dollar loss costs observed in Q1 2023, including those from notable thunderstorm and flood-related events, were marked by notable gaps in insurance coverage across both developed and emerging economic territories. This highlights the continued opportunity to develop tools and products that not only identify or quantify risk, but to make meaningful strides to ensure equitable protection for communities around the world.”