Getting to the Prize: A Primer on Insurance Channel Options

Trivia question. Which well-known brand managed to place its name into a popular song that is sung by hundreds of thousands of people across the country, nearly every day, except in the winter? Keep reading!

Since 1908, during every seventh-inning stretch at every MLB ballpark, fans scream out the words “Take Me Out to the Ballgame,” and they ask someone to buy them some peanuts and Cracker Jack. This is product marketing placed conspicuously within a common everyday event. You can’t sing the song without singing the Cracker Jack brand. How fitting it is that it’s Cracker Jack, the product that for 104 years included a free prize, “embedded” in every box! That is ingenious marketing.

There’s a bit of marketing ingenuity in insurers as well. We have a history of innovative marketing. Gerber Life’s start with ties to healthy baby food, MetLife and the Peanuts characters, and Geico’s gecko are just a few of the standouts. Yet the most profitable innovations in marketing were also tied to marketing channel expansion, such as Homesite, Progressive, and Esurance’s first-mover status with B2B, B2C, and partnership channels.

Today’s insurers, however, are faced with a puzzle. How do they market their products to become well-known, trusted, and valued best-sellers, yet, at the same time, place some products where they can be purchased through other partners or channels, even if they are unknown? This kind of brainstorming and network building is part of insurance’s new methods for innovation. Partnerships are forming within and outside the insurance industry. Insurers are selling each other’s products, leveraging new marketplaces to expand reach, and strengthening the traditional agent/broker channel with new digital capabilities.

A powerful, new distribution ecosystem places insurance directly in the path of a customer’s life journey event, where insurance is relevant and needed. Ecosystems provide a greater impact on sales because they are an “outside” customer approach instead of an “inside” product/process approach. This is the shift from selling to buying that is so crucial to today’s insurer growth. It’s an approach that naturally reduces infrastructure, operational, and capital expenditures while at the same time bringing in more business. It’s a “high touch” for the customer and often a “low touch” for the insurer.

Majesco and PIMA will soon release a jointly authored report based on primary research with PIMA members, Expanding Channels for Insurance: A Spectrum from Traditional to Affinity and Embedded. In it, you will find a comprehensive look at today’s insurance channel options, and you will see how these channels are developing. It is excellent conversation material for your next strategy meeting. The results are eye-opening and valuable because the channel spectrum is wider than you think and there are great “white space” opportunities for growth.

In today’s blog, we provide a short review of insurance’s channel spectrum.

The Channel Spectrum

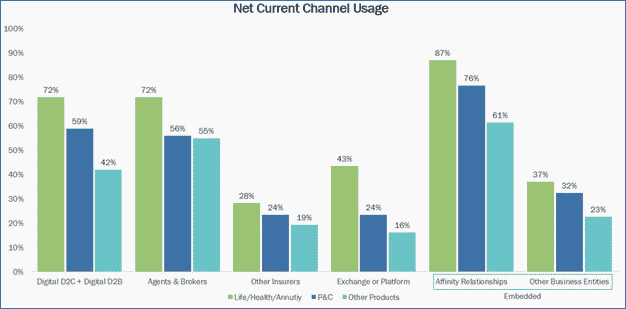

Distribution options fall across a spectrum of channels, including direct to the customer (B2C and B2B), agent/broker, other insurers, other financial entities, marketplace exchange or platform, and embedded as depicted in Figure 1 below. Embedded insurance is among the newest options and expands the traditional affinity model by leveraging technology and an ecosystem of new partnerships. Numerous interesting examples of partnerships between insurers and other industries are popping up on this end of the spectrum, including GM, Ford, Tesla, SoFi, Petco, Airbnb, Uber, Intuit, and more. Embedded insurance is offered through three different modes:

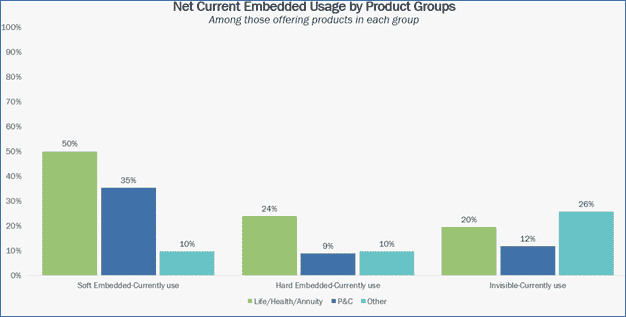

Soft Embedded: Coverage offered at the point of purchase that the customer must opt-in to buy.

Hard Embedded: Coverage included at the point of purchase that the customer must opt out of if they do not wish to buy.

Invisible Embedded: Coverage that is automatically included with the purchase and cannot be removed/opted out.

[Figure 1. The insurance channel spectrum.]

Do insurers belong “in this space?”

Of course, any insurer must look at its overall strategy to help determine whether or not it should expand and how expansion should occur. If an insurer isn’t including a wider spectrum of channels, in its strategy, it is missing a key component that is crucial for growth and market relevance. Why? Here are just a few reasons:

Buyer Expectations – Today’s buyers do not necessarily associate with traditional channels and they will look to buy insurance through other channels or entities.

Trusted & Loyal Relationships – Entities like Gig Economy groups, health, and fitness organizations, large retailers, and auto manufacturers have strong relationships with buyers. Embedding makes sense since it ties to what they are buying from them.

Multi-Channel Ease of Buying – If distribution channels are easy to use with products that are easy to understand, then insurance has an opportunity to grow through a friction-free multi-channel distribution. The less traditional options on the channel spectrum may also require far less traditional marketing to gain far greater results.

PIMA Community Distribution Spectrum Use

In the survey of PIMA members, the PIMA Community uses more options across the channel spectrum to offer L&AH products as compared to P&C products and other products & services.[1] In many ways this is not surprising, given the L&AH segment has been operating in a multi-channel world for decades – B2C, Agents, Broker/Dealers, Banks, BGAs, and more. As seen in Figure 2, among those offering L&AH products, 72% are using D2C/B2B, which is 13% more than P&C products, and 30% more than other products and services. The largest gaps are in the use of an Exchange or Platform, where L&AH leads by 19% and 27% over P&C and Other products and services.

PIMA Affinity Relationships, which are part of the Embedded category, are heavily used for all products and viewed as a target-rich area. Each of the three product groups (L&AH, P&C, Other Products & Services) have the highest percentage of offerings through Affinity relationships, reflecting a vital distribution role. Once again, L&AH products lead in leveraging this channel.

Digital and agent/broker channels are also widely used. In particular, digital channels reflect a similar approach as embedded, using digital technology to get in front of customers at the moment they want to buy. Interestingly, partnerships with other insurers are under-utilized with less than 30% usage, offering an opportunity to retain and own the customer relationship, by offering products not manufactured, as well as revenue growth. With more customers seeking a simplified and more holistic approach to buying insurance, insurers must seek new partnerships to meet these expectations if they do not offer specific products wanted by customers.

Figure 2: Net current channel usage by companies offering L&AH, P&C or Other Products & Services

Overall, L&AH substantially leads in the use of embedded. Of the three embedded options, Soft Embedded is the most widely used for L&AH (50%) and P&C products (35%), as the “opt-in” strategy is similar to traditional affinity marketing (Figure 3). Interestingly, Invisible Embedded is the second most used option for P&C, but the most used for other products which is not surprising given products like roadside assistance and financial planning have been included with other insurance products for years. Hard Embedded, with the exception of L&AH, lags behind both embedded options.

Figure 3: Net current embedded usage by companies offering L&AH, P&C or Other Products & Service

Substantial growth in the use of groups and organizations

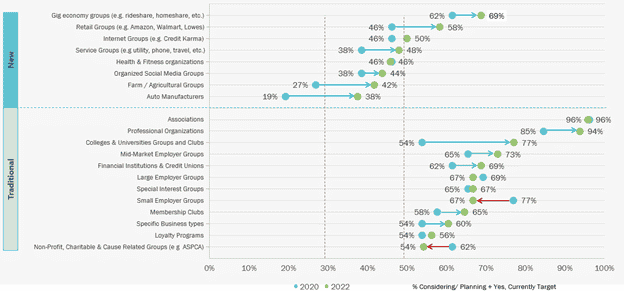

A key finding in this year’s research is the significant acceleration in the use of a larger array of groups or organizations, particularly new relationships as compared to the 2020 survey, as seen in Figure 4. New relationships standing out with growth are Auto Manufacturers (+19%), Farm/Agricultural Groups (+15%), Retail Groups (+12%), and Service Groups (+10%). These increases reflect growing partnerships with companies like GM, Petco, Ford, Amazon, IKEA, and more who are working with insurers to offer insurance at the point of purchase of their products. Also of note is a 7% increase with Gig economy groups, reflecting the continued growth in this segment.

Figure 4: Changes in distribution through groups and organizations, 2022 vs. 2020

Of note, however, “traditional” relationships saw little to no movement and in some cases had declines, such as Non-Profits (-8%) and Small Employer Groups (-10%). The one exception with strong growth was through Colleges & Universities Groups with an increase of 23%. This lack of growth suggests these partnerships lack growth and may not be as valuable with a new generation of insurance buyers as compared to previous generations.

We established “zones of adoption” based on use or considering/planning on using the various partner options which further reflects market opportunities for growth. Anything 50% or higher is Table Stakes, 30%-49% is Approaching Table Stakes, and less than 30% is considered Incubating. Based on these zones, all Traditional relationships continue as table stakes, even with the limited or declining growth. In contrast, three New relationships moved to Table Stakes: Gig economy, Retail groups, and Internet groups.

More importantly is the remaining New relationship options are all in the Approaching Table Stakes zone, reflecting the rapid growth in these options which reflect potentially diminishing options for insurers not considering these partnerships.

The timeframe is closing for these partnerships, potentially putting those not actively engaged out of the game, limiting market reach and growth, particularly for the new generation of buyers who value these relationships.

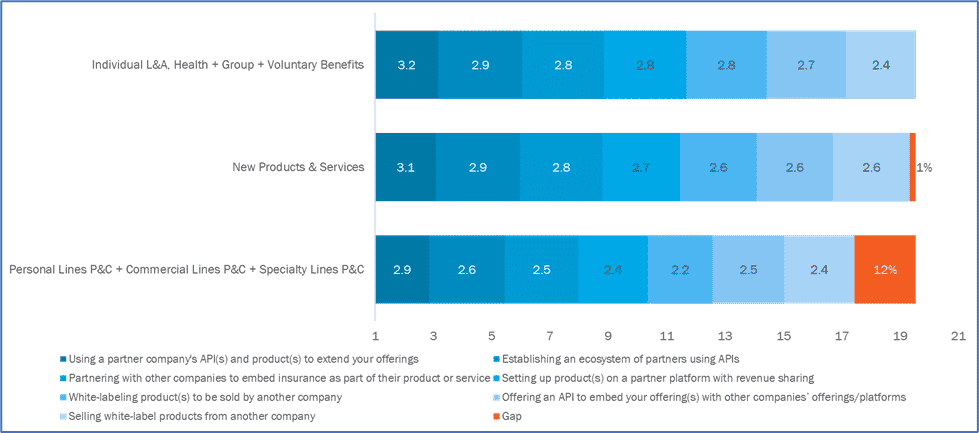

In Majesco’s 2022 Strategic Priorities research, significant gaps between Leaders and Followers (19%) and Laggards (27%) in their use of partnerships and ecosystems were identified. While this view was product agnostic, when looking through the lens of the three products in this research, those offering L&AH products stand out as the leaders in using partnerships and ecosystems, as seen in Figure 5. While the gaps are much smaller, the results are directionally consistent.

Figure 5: Use of partnerships and ecosystems by companies offering L&AH, P&C or New Products & Services

Innovation: Where to begin?

When it comes to channel spectrum options, it can be helpful to look at companies, both InsurTechs, and Traditional insurers, that are already using these various channels successfully. In the upcoming report, you’ll find lists of example companies that fit into each channel category across the spectrum. You can then compare their products and concepts to the possibilities you’ve considered for your organization.

For today, however, it may be helpful to revisit the channel spectrum diagram above and think a bit about each channel. What is your strategy to reach both today’s and tomorrow’s buyers? Would one or more of these channel options fit your organization’s goals for market growth? What combination of products and channels offer better growth opportunities? Which ones, in particular, might be easier to implement with your current technologies, and which might be easier to implement with the help of an agile, cloud-based system?

Where can you be positioned that your insurance products become the prize that waits inside someone else’s Cracker Jack box? What kind of SaaS, digital, platform solutions will make you a marketing contender with customers, meeting them when and where they want to buy?

For a preview of the upcoming report and an in-depth discussion surrounding the distribution channel landscape, tune in to Majesco’s latest webinar, Finding the White Spaces in the Product/Distribution Channel Landscape, today.

[1] Includes: Caregiving, Roadside Assistance, Legal Services, Discount Programs, Money management, Financial Planning/Financial Wellness, Absence Management, Risk Management, Risk Monitoring, Home Healthcare