George Town Re silver jubilee – $135bn of catastrophe bonds tracked

This December marks the 25th anniversary, or silver jubilee, of the issuance of a landmark catastrophe bond transaction, the George Town Re Ltd. deal, since when Artemis has tracked almost $135 billion of cat bond issuance.

The George Town Re Ltd. catastrophe bond, which came to market in December 1996, is often considered the first true, widely syndicated, cat bond transaction, so features heavily in the memories of many of those involved in the insurance-linked securities (ILS) market since its inception.

While Artemis did not actually exist at the time the George Town Re cat bond was issued, the Artemis Deal Directory did, but as a single page of another insurance and reinsurance market focused web portal that I managed at the time.

There, I began to collect data on and details of every catastrophe bond issuance I could glean information on, with that single page becoming the basis for Artemis’ launch in early 1999.

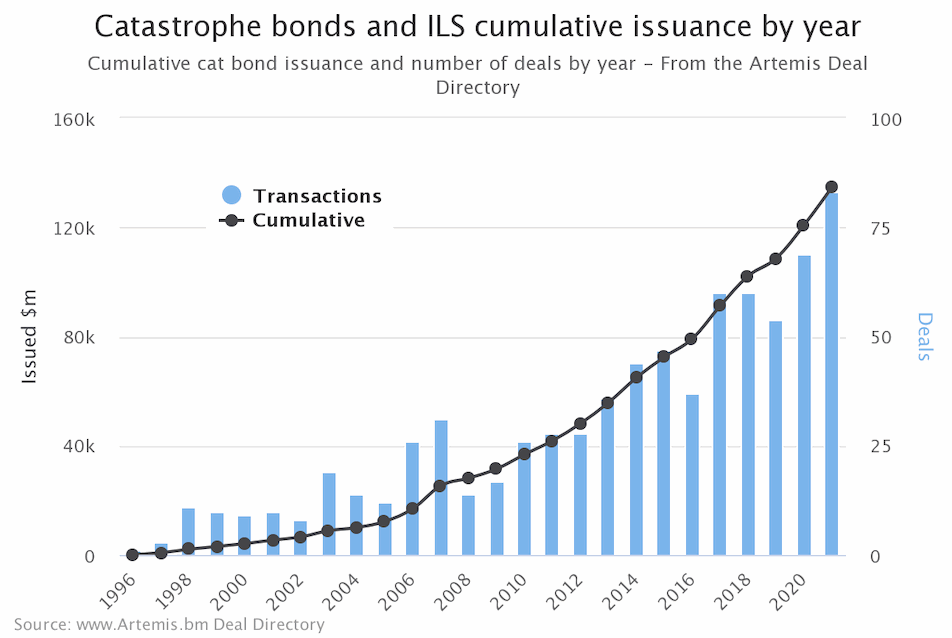

Twenty-five years after I began this collection of ILS market data, cumulative issuance of catastrophe bonds (including Rule 144A property cat bonds and cat bonds covering life, health, specialty, or other lines of insurance and reinsurance business, as well as some private cat bonds), has now reached an incredible almost $135 billion.

The George Town Re cat bond did not have the easiest ride over the life of its coverage and in the end a small, less than $1 million payout was made to its sponsor St Paul Re, after a range of catastrophe events caused the deal to be triggered.

The triggering of George Town Re came about after 1999’s Hurricane Floyd, as well as European Windstorms Anatol, Lothar and Martin, as well as impacts from the 2000 UK Floods, and the 2001 attack on the World Trade Centre.

George Town Re was not typical of catastrophe bonds seen today, given its quota share nature of the underlying reinsurance, plus its structure and lack of what we’d call a coupon today.

But, as the very first cat bond listed in the Artemis Deal Directory and one we tracked through to issuance at the time in 1996, it’s certainly memorable for us and for those others active in the insurance-linked securities (ILS) space at the time.

In total we’ve tracked the issuance of more than 800 catastrophe bonds and similarly structured ILS transactions in our Deal Directory over the twenty-five year period, of which around 760 make up the $135 billion of cumulative issuance detailed in our chart (as it excludes mortgage ILS and a few other reinsurance securitization transactions).

With catastrophe bond issuance again setting records in 2021 and the market looking forward to a busy 2022 as well, it’s entirely possible cumulative issuance could near the $150 billion mark by the end of next year.

The George Town Re catastrophe bond started a fascination with the use of financial market technology to enable the transfer of insurance and reinsurance related risks to capital market investors in a form that could be assumed more easily by their funds and mandates.

While issuance of $135 billion over the twenty-five year’s since George Town Re is impressive, we still believe that as technology improves, issuance costs come down and financial market securitization becomes more readily achievable, that the next twenty-five could see a far higher volume of issuance.

Happy Christmas everybody and best wishes for the New Year ahead!

Access all of our charts breaking down the catastrophe bond and related insurance-linked securities (ILS) market here.