General Liability Insurance for Florida Contractors: Essential Information

The Essential Guide to General Liability Insurance for Contractors in Florida

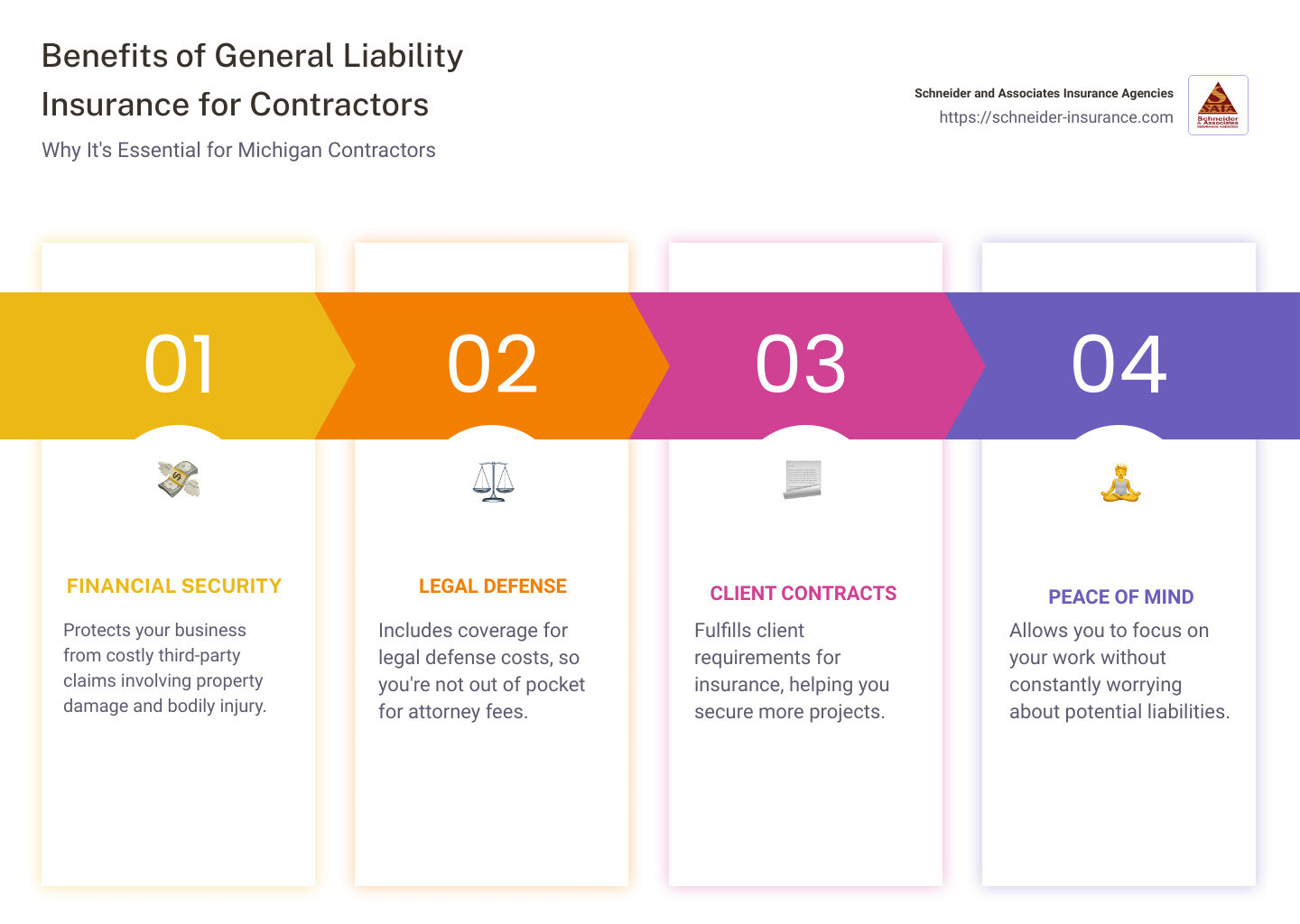

General liability insurance for contractors in Florida is crucial. This type of insurance provides protection against unexpected financial losses due to third-party claims, such as property damage or bodily injury. It’s designed to cover legal defense costs and other expenses that could otherwise hurt your business financially.

Quick facts at a glance:

– Protects against third-party claims: Covers property damage, bodily injury, and more.

– Includes legal defense coverage: Helps with legal fees if you face a lawsuit.

– Essential for contractors: Safeguards against financial devastation from accidents or injuries.

In the construction industry, accidents and unforeseen events are almost inevitable. Having comprehensive insurance ensures contractors can focus on their work without constantly worrying about potential liabilities. Without proper coverage, you could be held personally responsible for expensive claims, which could end your business.

My name is Paul Schneider. With years of experience running independent insurance agencies in Florida, I specialize in providing tailored insurance solutions, including general liability insurance for contractors in Florida. My expertise ensures you get the right protection to keep your business secure.

What is General Liability Insurance?

General Liability Insurance is a type of insurance coverage designed to protect businesses from a variety of risks. For contractors in Florida, this insurance is particularly important as it provides financial protection against common incidents that can occur during business operations.

Definition

General liability insurance, often referred to as commercial general liability (CGL), covers the costs associated with third-party claims of bodily injury, property damage, and personal injury, such as libel or slander. This insurance is essential for contractors who interact with clients, work on different properties, or engage in activities that could potentially cause harm to others.

Coverage

General liability insurance for contractors in Florida typically includes:

Bodily Injury: Covers medical expenses and legal fees if someone gets injured on your job site.Property Damage: Pays for repairs or replacements if your work damages someone else’s property.Personal Injury: Protects against claims of libel, slander, or copyright infringement.Legal Defense Costs: Covers the costs of defending your business in court if you’re sued for a covered claim.

Common Risks

Contractors face numerous risks in their daily operations. Here are a few common scenarios where general liability insurance can provide protection:

Slip-and-Fall Injuries: Imagine a scenario where a client trips over your equipment and gets injured. General liability insurance can cover their medical bills and any legal costs if they decide to sue.Property Damage: Suppose you’re a snow plower in Lansing, and you accidentally damage a client’s driveway. This insurance can help cover the repair costs.Accusations of Libel or Slander: If a client claims that your marketing materials defamed them, general liability insurance can help cover the legal costs of defending against such accusations.

Financial Protection

Having general liability insurance is crucial for financial security. Without it, you could be personally responsible for paying out of pocket for damages, medical costs, and legal fees. This can be financially devastating, especially for small businesses.

For example, a Grand Rapids carpet cleaner accidentally dislodges a corner of a carpet, causing the client to trip and get injured. General liability insurance could cover the emergency medical treatment costs, ensuring the business doesn’t suffer a significant financial hit.

In summary, general liability insurance for contractors in Florida is a vital safety net. It allows you to focus on your work without the constant worry of potential liabilities that could arise from everyday business operations. This coverage not only protects your finances but also enhances your credibility with clients and landlords who may require proof of insurance before working with you.

Why Florida Contractors Need General Liability Insurance

Legal Requirements

While general liability insurance for contractors in Florida is not mandated by state law, it is crucial to understand that some local jurisdictions may have their own requirements. For instance, cities like Battle Creek require vendors to carry general liability insurance to obtain a business license. Checking with your city clerk’s office can help you confirm the specific requirements in your area.

Client Contracts

Many clients, especially in the construction industry, require contractors to have general liability insurance before agreeing to work with them. This requirement is often written into contracts to ensure that both parties are protected in case of accidents or damages. For example, if a contractor in Grand Rapids accidentally causes damage while working on a project, having general liability insurance can cover the repair costs, thus maintaining a good relationship with the client.

Commercial Leases

If you plan to lease commercial space for your contracting business, landlords may require proof of general liability insurance. This is to ensure that any potential damage to the property or injuries that occur on the premises are covered. Without this insurance, property managers may refuse to rent out space to you, limiting your business opportunities.

Financial Security

Accidents and unexpected events can happen at any time, and the financial implications can be devastating. General liability insurance provides a safety net that can cover costs related to property damage, bodily injury, and legal fees. For instance, if a customer slips and falls at your construction site, the medical expenses and any legal fees could be covered by your insurance policy. This financial protection allows you to focus on growing your business without the constant worry of potential liabilities.

In summary, general liability insurance for contractors in Florida is not just a legal formality but a crucial part of running a secure and reputable business. From meeting client and landlord requirements to ensuring financial stability, this insurance is an essential investment for any contractor.

Next, we’ll delve into the different types of coverage included in general liability insurance.

Types of Coverage Included in General Liability Insurance

When it comes to general liability insurance for contractors in Florida, understanding the types of coverage included is crucial. This insurance isn’t just a safety net; it’s a comprehensive shield against various risks your business might face. Here are the main types of coverage:

Property Damage

Property damage coverage helps pay for repairs or replacements if you accidentally damage someone else’s property during your work.

Imagine you’re a contractor in Lansing, and while installing new windows, one of your tools slips and shatters a client’s expensive glass table. General liability insurance would cover the cost of replacing the table. This protection ensures that unexpected accidents don’t become financial burdens.

Bodily Injury

Bodily injury coverage is essential for any contractor. It covers medical expenses if someone gets hurt because of your business operations.

For instance, if a client trips over your equipment at a job site and breaks their arm, this coverage would help pay for their medical bills. In a state like Florida, where icy conditions can increase the risk of slips and falls, having this coverage is particularly important.

Personal Injury

Personal injury coverage protects against non-physical injuries, such as libel, slander, or copyright infringement.

Consider a scenario where a competitor accuses you of making defamatory statements about their business. General liability insurance can help cover the legal costs associated with defending yourself against these claims. This coverage is vital for protecting your business’s reputation and financial health.

Legal Defense Costs

Legal battles can be costly, even if you’re not at fault. Legal defense cost coverage helps pay for attorney fees, court costs, and settlements or judgments if someone sues your business.

For example, if you face a lawsuit claiming that your work caused property damage or injury, this coverage ensures you have the financial resources to defend yourself. Without it, legal expenses could quickly drain your business’s finances.

Understanding these coverage types can help you see why general liability insurance for contractors in Florida is a smart investment. Next, we’ll explore additional insurance policies that can further protect your business.

Additional Insurance Policies for Florida Contractors

While general liability insurance for contractors in Florida is crucial, other insurance policies can provide extra protection for your business. Here are some additional policies to consider:

Workers’ Compensation Insurance

In Florida, if you have employees, you must carry workers’ compensation insurance. This covers medical expenses and lost wages for employees injured on the job. It also provides death benefits to families of employees who are killed in workplace accidents.

Commercial Auto Insurance

If your business uses vehicles, commercial auto insurance is essential. It covers damages or injuries resulting from vehicle accidents. This includes vehicles owned, leased, or rented by your business.

Builder’s Risk Insurance

Builder’s risk insurance protects structures under construction. It covers the project’s assets from natural disasters, theft, vandalism, and even major weather events.

Inland Marine Insurance

This insurance covers equipment, goods, and materials transported over land or temporarily housed by a third party. It’s crucial for protecting items not covered under standard property insurance.

Commercial Umbrella Insurance

Commercial umbrella insurance provides an extra layer of protection. It kicks in when the limits of your other liability policies are exceeded.

Professional Liability Insurance

Also known as errors and omissions insurance, this covers claims of negligence, mistakes, or failure to deliver services as promised.

Surety Bonds

Surety bonds are not insurance but a guarantee that your business will fulfill its contractual obligations. They are often required for certain projects and can help you win contracts.

Cost of General Liability Insurance for Contractors in Florida

Factors Affecting Cost

The cost of general liability insurance for contractors in Florida can vary based on several key factors:

Type of Work: The nature of your contracting work significantly impacts the cost. High-risk activities like roofing or heavy construction typically result in higher premiums compared to lower-risk tasks such as painting or carpentry.Number of Employees: More employees usually mean higher premiums due to the increased risk of accidents and claims.Business Location: Urban areas may have higher premiums due to increased risk of property damage and liability claims compared to rural areas.Past Insurance Claims: A history of frequent claims can lead to higher premiums as insurers view your business as higher risk.Policy Limits: Higher coverage limits generally result in higher premiums. However, they also provide greater protection.Deductibles: Choosing a higher deductible can lower your premium, but it means you’ll pay more out-of-pocket if a claim arises.

Median Costs

Based on internal data, the median annual cost of a Business Owner’s Policy (BOP) for general contractors in v is $1,900. This is significantly higher than the national median of $1,000. A BOP typically combines general liability insurance with commercial property insurance, offering comprehensive coverage.

For workers’ compensation insurance, Florida contractors benefit from relatively lower costs. The median annual premium is $1,974, which is considerably less than the national median of $3,682.

Comparison with National Averages

When comparing Florida’s insurance costs with national averages, it’s clear that some policies are more expensive while others are more affordable:

Business Owner’s Policy (BOP): Florida contractors pay more, with a median cost of $1,900 compared to the national median of $1,000.Workers’ Compensation: Florida contractors enjoy lower costs, with a median premium of $1,974 versus the national median of $3,682.

Understanding these cost differences can help you budget effectively and ensure you’re getting the best value for your insurance needs.

How to Choose the Right General Liability Insurance Policy

Choosing the right general liability insurance for contractors in Florida can seem overwhelming, but breaking it down into simple steps can make the process easier. Here’s how you can do it:

Assessing Risks

First, understand the specific risks your business faces. For example, a Grand Rapids carpet cleaner might worry about clients tripping over loose carpet edges, while a Lansing snow plower might be concerned about damaging driveways. Identifying these risks helps you choose the right coverage.

Comparing Quotes

Next, compare quotes from different insurance providers. This can help you find the best coverage at the most affordable price. Use online tools to get instant quotes and compare policies. Always ensure you’re comparing similar coverage levels to get a fair comparison.

Working with Brokers

Consider working with an insurance broker. Brokers can help you navigate the complexities of insurance policies and find the best deal. They have access to multiple insurance companies and can provide expert advice tailored to your business needs.

Policy Limits

Finally, pay attention to policy limits. This is the maximum amount your insurance will pay for a covered claim. Ensure your policy limits are high enough to cover potential claims. For example, if a client sues you for $100,000 but your policy limit is only $50,000, you’ll have to pay the difference out of pocket.

Next, we’ll answer some frequently asked questions about general liability insurance for contractors in Florida.

Frequently Asked Questions about General Liability Insurance for Contractors in Florida

Is General Liability Insurance Required by Law in Florida?

No, general liability insurance is not required by Florida state law. However, some local municipalities may have their own requirements. For example, the city of Battle Creek mandates that vendors carry general liability insurance to obtain a business license.

Even if it’s not legally required, having general liability insurance is a smart move. It can protect you financially and make your business more attractive to potential clients who may require proof of insurance.

What is the Difference Between General Liability and Contractor’s Protective Liability?

General liability insurance covers a wide range of risks that businesses face, such as property damage, bodily injury, and personal injury claims. This coverage is broad and applies to your overall business operations.

Contractor’s protective liability insurance, on the other hand, is project-specific. It provides coverage for liabilities that arise directly from work performed by subcontractors on a particular project. This type of insurance is often required for large construction projects and can be essential for ensuring all parties are protected.

What are the Liability Limits in Florida?

While Florida does not set specific liability limits for general liability insurance, it’s crucial to choose a policy with sufficient coverage.

Most policies have limits that range from $100,000 to $1 million per occurrence. Higher limits are available and may be necessary depending on the size and scope of your projects.

For example, a Lansing snow plower might opt for a $1 million policy to cover potential damages to client properties during winter storms. Always consider the potential risks and choose a limit that offers adequate protection.

Next, we’ll discuss additional insurance policies that Florida contractors should consider.

Conclusion

In conclusion, general liability insurance for contractors in Florida is essential for protecting your business from unexpected financial losses. Whether it’s covering medical expenses for a customer who slips on your site or legal fees from a lawsuit, this insurance provides a safety net that can save your business from devastating costs.

At Schneider and Associates Insurance Agencies, we understand the unique risks that Florida contractors face. Our team of experts is here to help you find the right coverage to ensure you have the peace of mind you deserve. With our tailored insurance packages, you can focus on growing your business without worrying about financial setbacks.

Proper coverage is not just a legal requirement or a contract stipulation—it’s a crucial investment in your business’s future. By securing the right insurance, you safeguard your financial stability and reputation, allowing you to operate confidently and securely.

Having the right general liability insurance is not just about compliance; it’s about protecting your livelihood. Let us help you navigate the complexities of insurance so you can concentrate on what you do best—building and creating.

Feel free to reach out to us for any questions or to get started on a policy that fits your needs. Protect your business today and ensure a secure tomorrow with Schneider and Associates Insurance Agencies.