General Liability Certificate Of Insurance | ALLCHOICE Insurance

Estimated reading time: 5 minutes

Return To: General Liability Insurance – The Ultimate Guide

A Certificate of General Liability Insurance (COI) is an important document for any business or organization. It is a formal proof that a business has adequate liability insurance in place to protect you from potential legal problems.

The certificate provides evidence to a certificate holder that the company has taken steps to protect itself and its customers from financial losses related to lawsuits, accidents, third-party injuries, property damage, and more.

In this article, we will be able to answer the question, “What is a general liability certificate of insurance?” as we review the following:

What Is A General Liability Certificate Of Insurance?

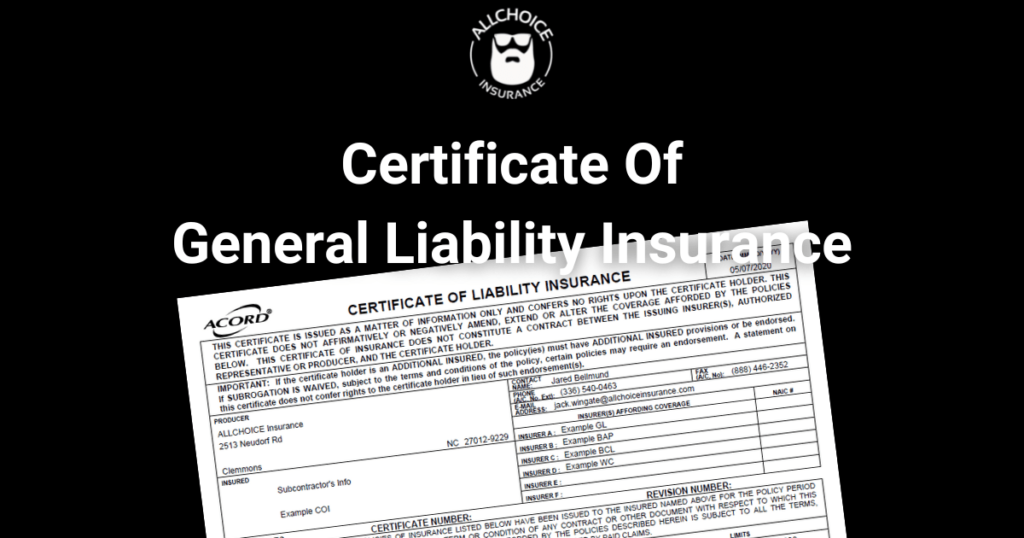

A General Liability Certificate Of Insurance is a document generated by an insurance company and insurance agencies that provides a summary of liability coverages for a business for a specified period of time.

Having a COI in place helps ensure that if an incident does occur that results in legal action against the company, they will be covered by their insurance policy up to the limits provided on their policy. Without this protection, companies face significant risks as they could be held liable for damages and medical expenses associated with any claims made against them.

What Information Is Included On The Certificate Of Insurance?

A certificate of insurance is a document that shows you have business insurance in case someone sues you or there is a legal claim. The certificate includes information about who is covered, what the policy covers, how much coverage there is, and when the coverage starts and ends.

The document also identifies who is providing coverage, including their address and contact information as well as who is receiving it (also known as the Certificate Holder). This makes sure that parties are aware of their respective roles in relation to the policy.

Common Information Included On A Liability Insurance Certificate

Business Name and address of the Named Insured

Issuing Insurance Company Name & NAIC Code

Name Of The Certificate Holder

The Types Of Liability Coverage(s) Included

The Policy Number(s)

Insurance Form

The Effective Date and Expiration Date Of Coverage

Policy Limits

Additional Insured Endorsements

Waiver Of Subrogation

Special Cancellation Status

Common Liability Coverage Types Included On A Certificate Of Liability Insurance

Commercial General Liability Insurance

Business Auto Liability Insurance

Commercial Umbrella Liability Insurance

Workers Compensation & Employers Liability Insurance

What Is The Purpose Of A Certificate Of Insurance?

A certificate of insurance is a legal document from an insurance company that shows you carry a general liability insurance policy. The certificate has information about the small business with liability insurance coverage, the insurance company, and how much liability insurance an insurance company will pay.

In addition, certificates are used to identify details such as who is being insured, what types of risks are covered, and any exclusions within the policy. This ensures full disclosure between both parties before any transactions take place and also helps ensure compliance with local laws and regulations.

This document provides certificate holders proof when additional liability coverage is present like:

Professional Liability Insurance

Additional Insureds

Errors & Omissions Insurance

Primary And Non-Contributory Coverage

Special Notices Of Cancellation

Finally, certificates can also serve as evidence should a dispute arise between two parties regarding their obligations under an agreement. They can serve as valuable legal documents when seeking compensation from an insurance provider after experiencing a loss due to covered risks or liabilities under their policy.

Additionally, forms accompanying certificates can help protect both parties’ interests by detailing relevant information such as contact information and deadlines for filing claims should they be required in future disputes.

In summary, certificates of insurance serve many important functions including providing proof of business insurance for certain risks or liabilities while also helping ensure compliance with local laws and regulations, offering additional security when engaging in high-risk activities such as construction work, and providing evidence should disputes arise between two parties regarding their obligations under an agreement.

For these reasons it is essential that businesses have up-to-date certificates issued by reliable providers at all times so they remain protected against potential losses or damages due to unforeseen events.

Why Do Companies Request A Certificate Of Liability Insurance?

A General Liability Insurance Certificate is a document that provides certain policy details of an insurance policy and details the coverage limits and duration of the active insurance policy. The purpose of the certificate is to provide proof to companies, customers, or suppliers that an organization has adequate insurance coverage for its operations.

The insurance certificate proves an insurance policy exists and outlines the type and amount of insurance coverage the organization has purchased and any limitations on what types of activities are covered. It also includes details about deductible amounts, coverage exclusions, and claims procedures. Additionally, it specifies the policy period and if any additional endorsements have been added to customize the policy.

For businesses looking to protect their assets from potential legal battles, a certificate of liability insurance can give them peace of mind knowing they are adequately covered should something go wrong. Certificates of liability insurance often come in handy when negotiating contracts with customers or vendors since they provide evidence that an organization has taken proper steps to protect itself financially should a situation arise where they become legally responsible for damages caused by its operations.

How Do You Request A Certificate Of Insurance?

Certificates of insurance are issued by an insurance carrier or their agents to confirm a policyholder has proper business insurance coverage for their needs. They act as an acknowledgment from the insurer that it will provide certain levels of financial protection in case of certain incidents or losses.

The General Liability Insurance Certificate provides a valuable summary of coverage to inform parties about the existence of a policy but also acts as evidence that all parties involved are aware of this agreement and its terms.

Regardless certificates are legally binding documents so it’s important for anyone requesting one to make sure that all relevant details are clearly established prior to signing off on them.

Final Verdict – Certificate Of General Liability Insurance

In conclusion, a Certificate of General Liability Insurance is an important document to have when running any business or organization. With this certificate in hand, you can be sure your company will not suffer from unexpected liabilities and expenses should something go wrong.

Having a General Liability Insurance Certificate also demonstrates your commitment to safety and responsibility within the industry as well as providing peace of mind for yourself and others involved with your organization.

All in all, it’s essential for businesses large or small to invest in obtaining such insurance coverage so they are able to operate safely without fear of facing serious financial repercussions down the line if something were ever to happen unexpectedly.