GAM gets ~$500m of H1 ILS inflows, takes cat bond AuM to ~$4.88bn

GAM Holding AG, the parent company to global asset manager GAM Investments, reported an impressive roughly US $500 million of net inflows to its catastrophe bond strategies in the first-half of 2022, including the funds managed by specialist Fermat Capital Management.

GAM Holding has once again cited its catastrophe bond investment fund strategies as a bright spot through the first-half of 2022 and the asset class has in fact been the main driver of positive flows for the asset manager

The company said that while investment markets have been challenged and client flows have been exiting some asset classes, others, particularly those that offer something defensive, diversifying, or lacking in correlation to the broader markets, have benefited.

“Clients are allocating to a number of our high conviction strategies designed to help them navigate this challenging environment,” GAM Holding explained.

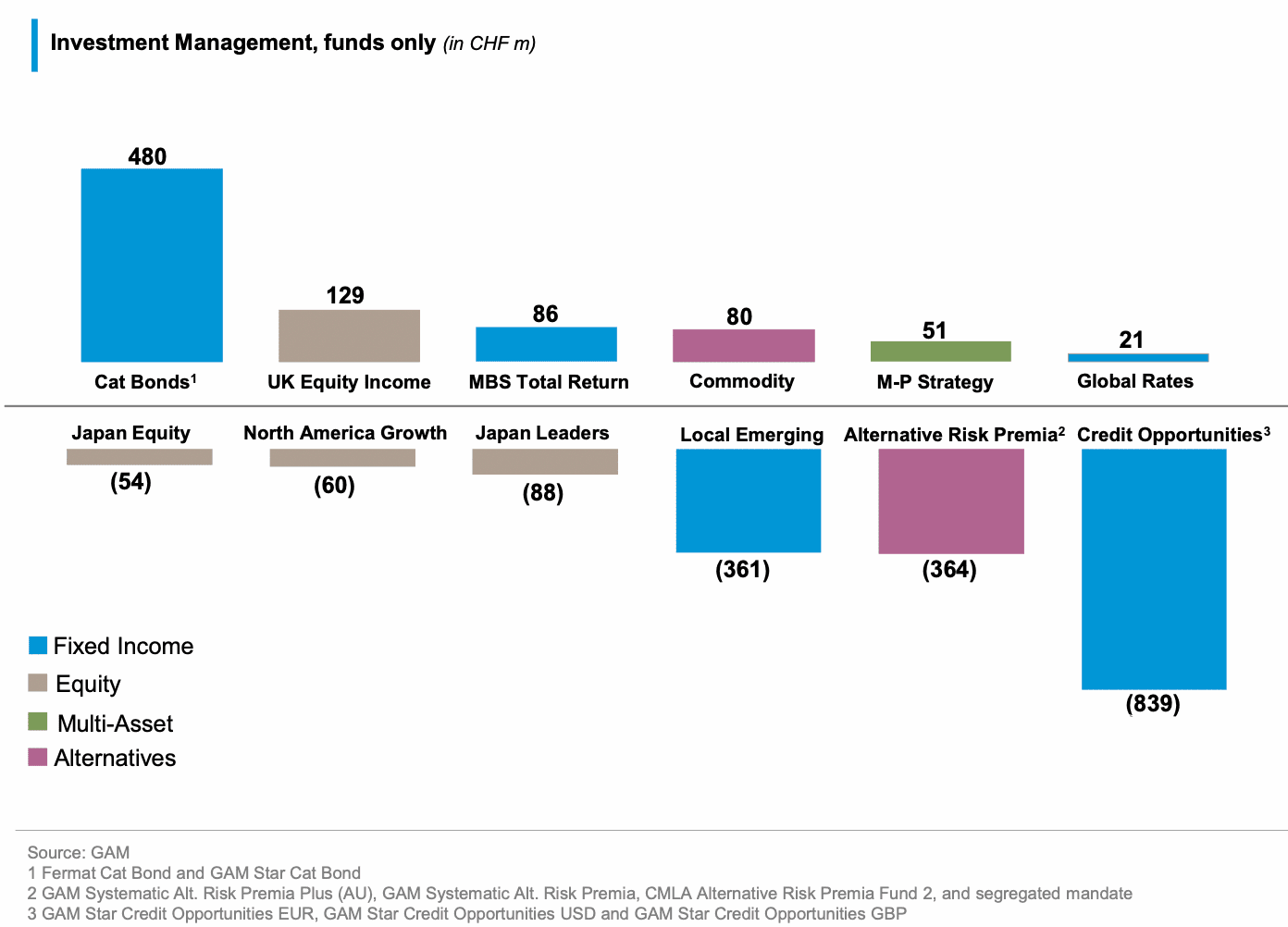

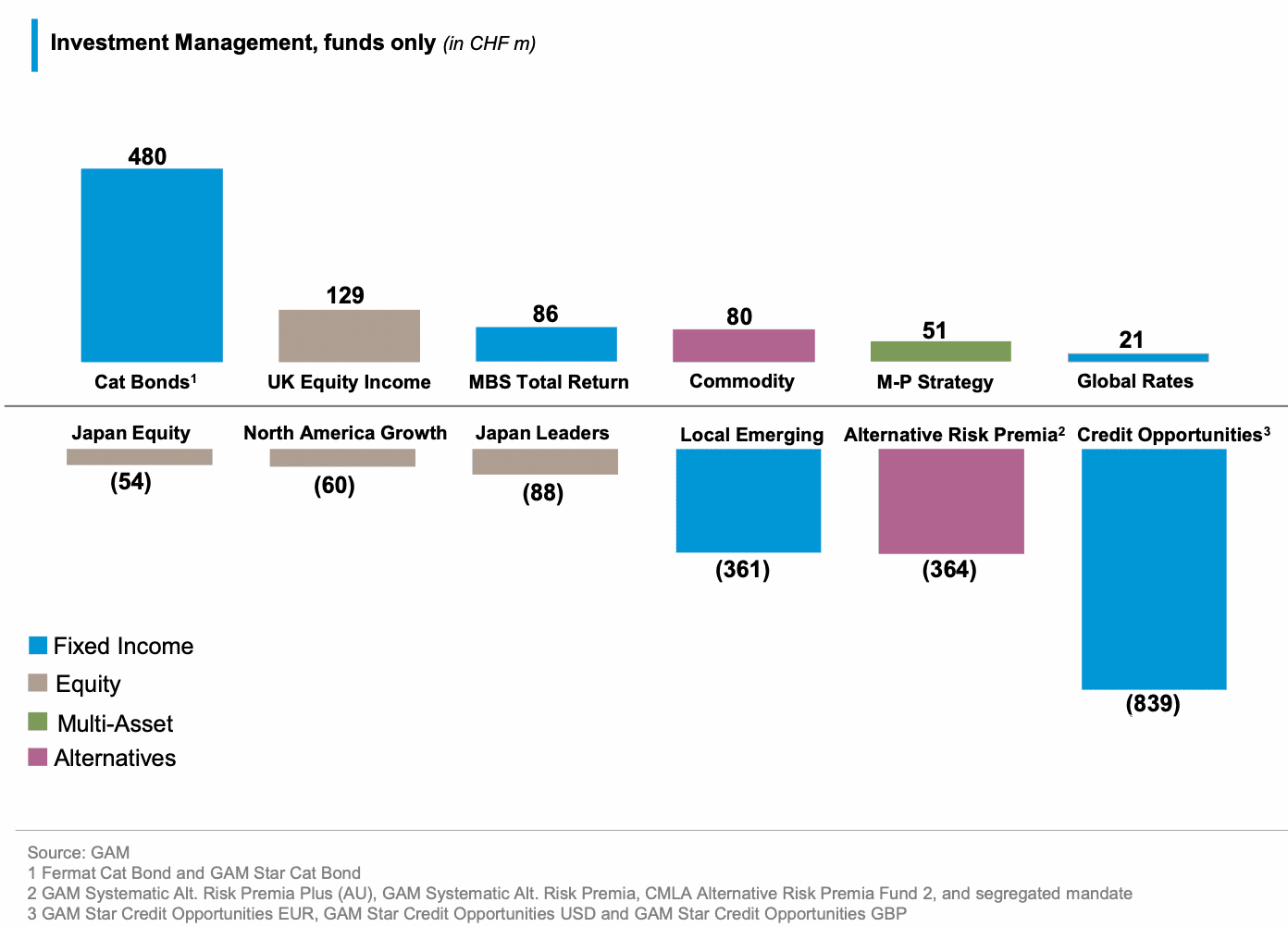

Explaining that, “Amongst those strategies seeing net inflows during the first half were,” its cat bond funds, which benefited from this investor attention and saw CHF 480 million (~$500m) of positive net flows.

While fixed income in general saw outflows from clients, GAM explained that, “We saw strong net inflows into our Cat bond strategies which now amount to CHF 4.7 billion of AuM.”

That new AuM disclosure equates to roughly US $4.88 billion across the GAM operated catastrophe bond fund strategies that it offers.

These include the Fermat Capital Management managed GAM Star UCITS Cat Bond fund, which as we’ve reported before has been experiencing solid growth through recent quarters, as has the entire UCITS cat bond fund sector.

Peter Sanderson, Group Chief Executive Officer at GAM Holding, explained the allocation trends being seen, “Despite clients being cautious in the face of market volatility, we are encouraged to see them allocating to a number of our diverse, high conviction strategies designed to help them navigate the risks and opportunities during this challenging period. As a result, investment management saw an improving trajectory of flows.”

Impressively, the chart below from GAM’s earnings presentation shows that the cat bond fund strategies have been the source of most of its inflows in its investment management business over the first-half of this year.

GAM has been able to capitalise on investor interest in the catastrophe bond asset class through the first-half of 2022, providing a home for assets that have been exiting other investment sectors.

This, of course, has benefited the Fermat Capital Management insurance-linked securities (ILS) investment management business as well, helping Fermat raise its own ILS assets under management to a new high of $8.9 billion by July of this year.

This makes Fermat Capital Management the largest manager in the ILS market, in terms of AuM.

The Fermat Capital managed GAM Star Cat Bond Fund remains the largest UCITS cat bond fund strategy, at over $2.6 billion in assets, having added 5% over the first-half.

GAM also counts cat bond assets via the GAM Fermat Cat Bond Fund, which is a more privately marketed and solely institution focused investment strategy, we understand.

Analyse UCITS catastrophe bond fund asset growth using our charts here.

——————————————————————— Tickets are selling fast for Artemis London 2022, our first ILS conference in London. Sept 6th, 2022.

Tickets are selling fast for Artemis London 2022, our first ILS conference in London. Sept 6th, 2022.

Register soon to ensure you can attend.

Secure your place at the event here!

—————————————