Gallagher Re pegs global insured catastrophe losses at $123bn for 2023

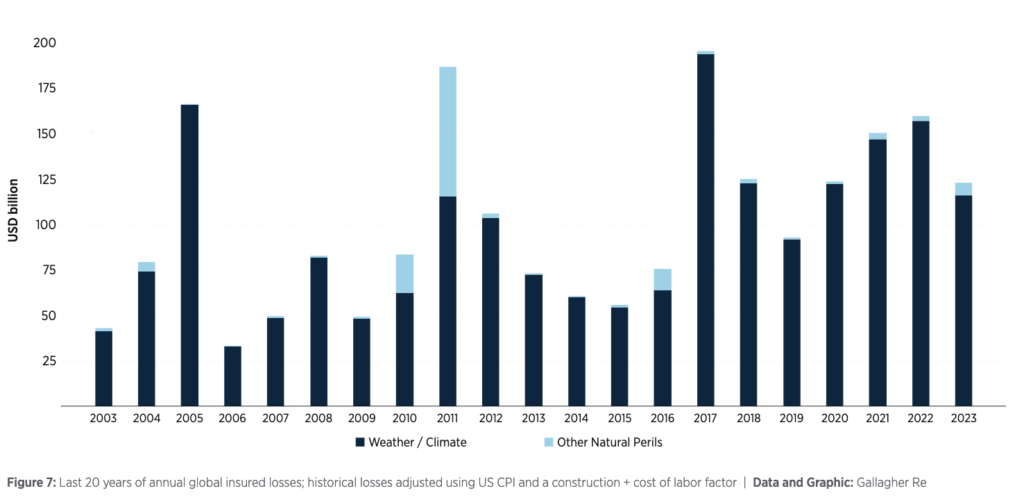

According to reinsurance broker Gallagher Re, global insured catastrophe losses reached $123 billion in 2023, the fourth year in a row where they surpassed the $100 billion level.

Gallagher Re’s estimate is above the others we’ve seen to-date.

Back in December, Swiss Re had estimated overall insured natural catastrophe losses at $100 billion which is the most comparable figure to Gallagher Re’s.

Meanwhile, in January, reinsurance firm Munich Re said that global natural disasters and severe weather are estimated to have caused the insurance and reinsurance industry losses of US $95 billion in 2023.

Gallagher Re’s methodology is clearly different and we believe captures more of the smaller severe weather catastrophes that occur around the globe, while the broker also includes public insurance entity losses as well as the private market.

In 2023, Gallagher Re said that six of the ten most costly insured catastrophe loss events were US severe convective storms.

In total there were 34 individual billion-dollar insured loss events in 2023, which has set a new annual record for events above this cost for the insurance and reinsurance industry.

Of the total, Gallagher Re explained that private insurers covered $110 billion and public insurance entities, $13 billion of the catastrophe loss burden.

Gallagher Re also estimates that the global economic loss across all natural perils reached $357 billion in 2023, which is the eighth consecutive year global losses have surpassed $300 billion.

Breaking it down to look solely at climate and weather events, so excluding losses from earthquakes and other non-atmospheric-driven events, insured losses are estimated at $116 billion, while the economic loss is estimated at $301 billion.

Gallagher Re’s Chief Science Officer Steve Bowen said: “We continue to witness an increase in the severity and high-impact frequency of natural catastrophe events. These effects bring multifaceted and complex challenges to the (re)insurance industry, as the importance of blending today’s view of risk with the anticipated downstream implications of tomorrow grows more critical.”

Severe convective storm events drove the bulk of insured losses in the year, with an estimated 58% of global insured losses from this peril.

Gallagher Re said that this translates to a record-setting $71 billion of convective storm losses globally in 2023, of which the US accounted for $60 billion.

Bowen commented, “‘Peak’ perils are still anticipated to drive the highest individual event losses. However, the continued growth of damage from ‘non-peak/secondary’ perils, such as SCS, is changing the way we view and plan for natural catastrophe risk. It also increases the importance of analytics and catastrophe modeling to properly gauge how a combination of climate change-influenced event behavior and socioeconomic parameters are leading to higher loss potentials.”