Gallagher Re on the ‘big picture’ in the reinsurance market

Gallagher Re on the ‘big picture’ in the reinsurance market | Insurance Business Asia

Reinsurance

Gallagher Re on the ‘big picture’ in the reinsurance market

Head shares insights into recent report into the sector

Reinsurance

By

Mia Wallace

With so many intricacies and niches, it can be easy to lose focus on the ‘big picture’ when it comes to the reinsurance sector and how it’s faring. It is with this in mind that Gallagher Re published its latest ‘Reinsurance Market Report’, offering a snapshot of how the market fared for the full-year 2023.

Discussing some of the key takeaways of the report, Michael van Wegen (pictured), head of client & market insights, international, global strategic advisory at Gallagher Re, underscored how capital is rebuilding “quite nicely”. Global reinsurance dedicated capital hit US$729 billion for the 12 month period, up 12% from the restated full-year 2022 base.

“What is interesting is that the growth of capital is very much driven by increased capital build from profits,” van Wegen said. “In the traditional segments, that is the traditional reinsurance companies, we’re seeing very little new capital being invested. Capital inflow there is very limited at only $2 billion.

“Meanwhile, combined ratios – the key metric for underwriting profit for the industry – are improving very noticeably. At a headline level, we see 5.7 percentage points of improvement to 88.9% for the full-year: the best level we’ve seen in a decade.”

Beyond the headline figures and looking at an underlying level, he said, correcting for the fact that natural catastrophe impacts can be above or below normal and for things like reserve releases, the underlying combined ratio at 96.0% shows a 2.5 percentage points improvement compared to 2022. Gallagher Re has been running its flagship reinsurance report since 2013, and again this figure is at the best level it has been in 10 years.

van Wegen highlighted that the accounting change in the insurance industry represented by IFRS 17 being introduced for the first time in 2023, was reflected in the reinsurance broking giant’s restatement of the 2022 figures on an IFRS 17 basis for the relevant companies. As a result, the figures in the 2023 report do reflect a like-for-like basis when compared with the 2022 figures reported.

Within that combined ratio improvement, there’s the underlying improvement, which is a pure reflection of the better rates that the reinsurers have been able to obtain – but there’s also lower impact from nat-cats, he said.

“Looking at the companies where we have the most granular data available, their share of the overall insured losses from nat cat activity has come down to about seven percentage points, versus nine percentage points two years ago,” he said. “I think that is a reflection of the change in attachment points and terms & conditions that we’ve seen, particularly with 2023 January renewals.

“But it is also a reflection of the difference in the type of nat-cat events that we experienced in 2023, where there were fewer hurricane losses than we had in previous years, but more convective storm losses.”

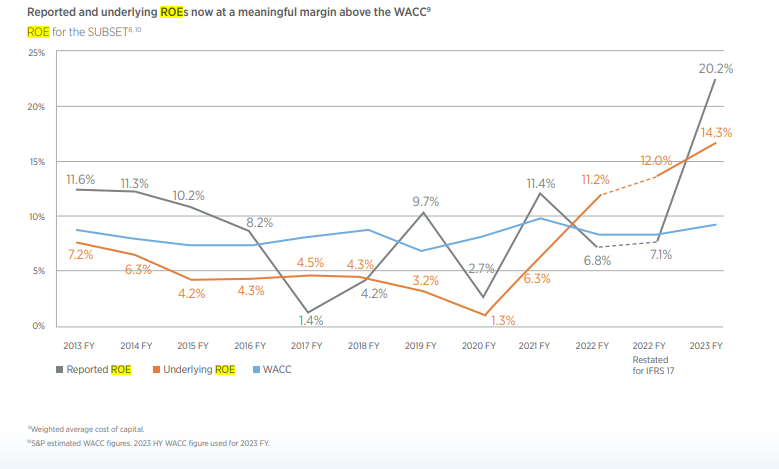

Another trend worth noting is the return on equity (ROE) recorded in 2023, he said, which is, of course, a key metric for most companies and certainly companies listed on stock markets. ROE improved very substantially at a headline level, at 20.2% in 2023 versus 7.1% in 2022. A big factor in 2022’s results was that these were hampered by the volatility in the financial markets while 2023 had more positive bearings.

Figure 1 Gallagher Re Reported and Underlying ROE

There’s also the additional aspect of low nat-cat activity in 2023, he said, as well as a very strong underlying improvement. The underlying ROE improved to 14.3%, from 12% in 2022, as seen in the graph directly above. The fact that the underlying ROE is well above the cost of capital for the industry reflects that the sector is making a genuine economic gain – for only the second year in more than a decade.

“This means that the industry now really makes tangible money beyond the hurdle rates that they should target for,” he said. “If you look at the headline ROE, the 20.2% [the grey line], you can see that it has been pretty volatile. As a result of the strong 2023, the industry has now made a profit beyond the cost of capital for the 2017-2023 period, on aggregate. So, they recouped the underperformance from the 2017 to 2020 period, because of that very strong 23 year. This is a very important takeaway as to where the industry currently sits.”

Keep up with the latest news and events

Join our mailing list, it’s free!