FOXO Technologies Stock: Investing in Longevity Insurance – Nanalyze

Getting life insurance is one of those things that responsible adults are supposed to do, like work the same job for 45 years and retire with a gold watch. Who does that anymore? Similarly, the number of people buying into life insurance policies is dropping. Over the last decade, life insurance market penetration decreased by 11 percentage points, with barely over half of U.S. adults (52%) covered today. While not the oldest industry (wink, wink) in the world, the concept of covering costs for funeral expenses and providing for loved ones dates back to at least the Roman empire and so-called burial clubs. Like many respectable institutions, modern life insurance began with the British, with the first policy offered in 1706 by the Amicable Society for a Perpetual Assurance Office.

They don’t make names like they used to, but most insurance companies still pretty much rely on the same statistical models developed in the 18th century for the calculations behind their products. Over the years, we’ve highlighted the different ways insurtech companies are trying to shake up the game, especially by taking advantage of big data and artificial intelligence. Indeed, a report from McKinsey and Company outlined how technology will play an outsized role in changing the paradigm for underwriting life insurance from a pretty static model to one that evolves with the health of the policyholder.

The future of life insurance. Credit: McKinsey and Company

It’s another riff on the whole personalized health concept. In this case, life insurance companies become yet another player in providing customers personalized health and lifestyle recommendations and reminders based on nontraditional data sources like wearables and social media that AI algorithms have crunched. Now a company called FOXO Technologies, which is potentially merging with a special purpose acquisition company (SPAC) to go public later this year, believes it can revolutionize the insurance industry by pinpointing changes in how genes are expressed – a science known as epigenetics.

What is Epigenetics?

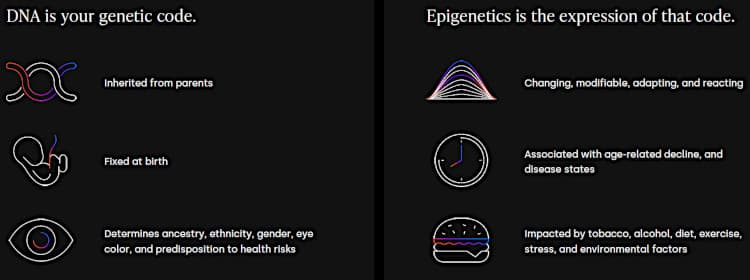

Before we dive into the specifics of the business, let’s try to understand a bit about the science at a level that even an MBA can comprehend. Most of us are probably familiar to some degree with genetics, which is the study of genes and gene function. These are characteristics we inherit from our parents, from the color of our eyes to our risk for breast cancer. Genetic tests like 23andMe (ME) can tell you the percentage of Neanderthal DNA or your risk for type 2 diabetes. You might then might make better life choices based on genetics testing, such as shaving your back or using a low-glycemic sugar replacement. Just like your family, there’s not much you can do about your genetics.

Credit: FOXO Technologies

Credit: FOXO Technologies

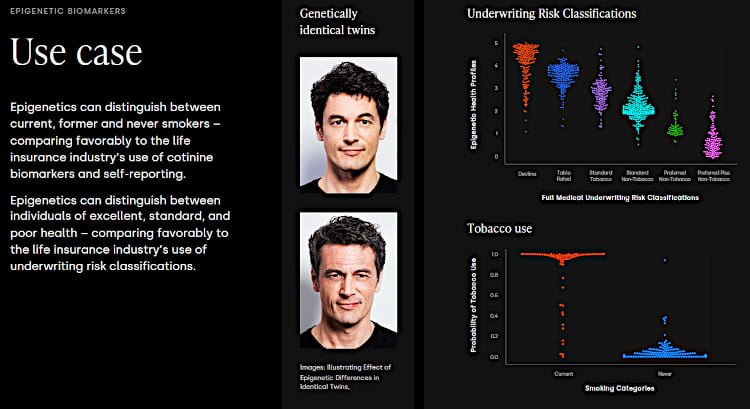

On the other hand, epigenetics is the study of how your environment and behaviors can cause changes that affect the way your genes work. So, living next to a leaky nuclear power plant or being a two-pack-a-day smoker may influence what’s called gene expression, or what genes are turned on or off. Epigenetic changes can affect gene expression in several ways, but the one we’re interested in here is a chemical modification called DNA methylation. For example, smokers tend to have less DNA methylation than non-smokers at certain genes. However, unlike genetics, epigenetic changes are reversible and variable. In other words, an epigenetic test could ID the Marlboro man versus a Millennial who only smoked the occasional clove with avocado toast. In effect, DNA methylation is a biomarker for smoking – and much more.

About FOXO Technologies Stock

That brings us back to Minneapolis, Minnesota-based FOXO Technologies, a company founded about a half-dozen years ago. The startup claims to have raised about $40 million to date before announcing this month that it would merge with Delwinds Insurance Acquisition Corp. (DWIN) at a valuation of $563 million, based on a promised gross cash prize of up to $224 million if all goes as planned. We’ll talk more about that later.

FOXO Technologies is one of those companies that wants to serve the yet-to-emerge longevity industry, a high-reward but high-risk venture to capitalize on our ability to extend human life. This is more than just the biotech companies that will somehow help us live longer than Moses, whether through draining the blood of the young or regenerating skin tissue. A long-lived populace will require a host of updated services to meet their needs, opening up new opportunities in everything from health services to retirement and (of course) life insurance.

Life Insurance for a Long Life

This longevity life insurance company wants to replace today’s crude biological sampling using blood or urine for underwriting with a saliva-based epigenetic test. The platform combines microarray technology from Illumina (ILMN) for detecting epigenetic biomarkers and machine learning technology supplied by a well-funded startup called DataRobot. Algorithms look for patterns of DNA methylation across 800,000 sites along the epigenome that correlate to measures of health and wellness. All of these insights can be rolled up into an epigenetic clock that provides a biological age, which can differ drastically from the chronological one, depending on how much drugs, alcohol, and free love one has enjoyed over a lifetime. It’s just like that movie Twins with Arnold Schwarzenegger and Danny DeVito:

By this calculation, our MBAs are about 150 years old on average. Credit: FOXO Technologies

By this calculation, our MBAs are about 150 years old on average. Credit: FOXO Technologies

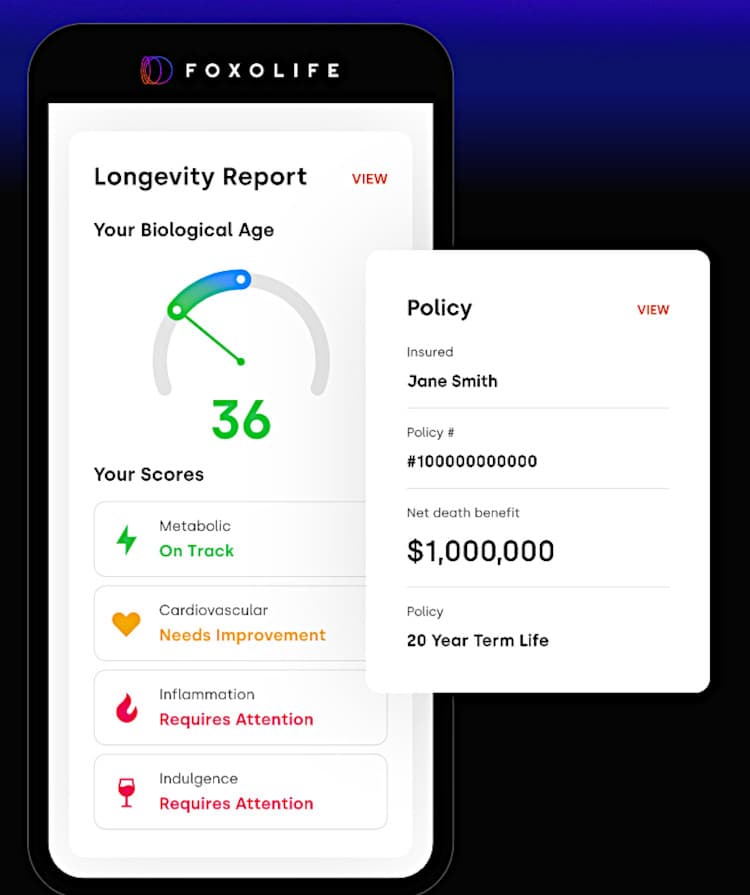

One of the main products the company hopes to commercialize is the FOXO Longevity Report, which provides consumers with insights into rates of biological aging based on the epigenetic clock concept. The report includes “proprietary epigenetic-based wellness measures to inform and support consumer health and longevity.” The idea is to sell the platform globally as a service to life insurance companies to “personalize their customers’ experience and interact with them at an individual level to support health and longevity.”

Credit: FOXO Technologies

Credit: FOXO Technologies

In addition, FOXO will offer its own life insurance product after acquiring the Memorial Life Insurance Company of America last year, probably as more of a proof of concept to attract major insurers to the idea. Most of the work is being outsourced to a reinsurer called SCOR Global Life USA, which uses its own AI engine called Velogica for automated underwriting. The plan is to eventually incorporate the saliva-based epigenetic biomarkers into the underwriting process.

The tagline is “Life Insurance Designed to Keep you Alive.” And, yes, some marketing guru thought that was brilliant enough to trademark.

Should You Buy FOXO Technologies Stock?

This all sounds very cool and cutting-edge. It also sounds like something we wouldn’t invest in during our less-than-Biblical-long lives. FOXO Technologies is a pre-revenue company with a projected market cap of less than $1 billion. For those reasons alone, we would pass. However, it’s unclear if FOXO even has a working product at this time, given that it is basically using another’s company’s AI to underwrite insurance policies. It all sounds very pie-in-the-sky to us.

Another thing retail investors should note is that many SPAC deals are being pushed through even when most of the money from the proposed merger disappears because institutional investors pull their cash out at the last minute. Indeed, the deal between Delwinds and FOXO says the agreement “includes no minimum cash closing requirement.” There is a consolation prize should all of the investors decide to redeem their money from the SPAC trust: FOXO will get at least $10 million from the Delwinds CEO and The Gray Insurance Company, which is also providing an additional $22.5 million. And apparently there’s another $40 million otherwise secured in a different financial deal that we’re not too inclined to dig into at this time. It all adds up to a lot of risk with little chance of reward in our lifetime.

Conclusion

For a while, we were pretty hot and heavy on the longevity theme based on reader interest. But, frankly, there’s a lot of snake oil being peddled and a large number of incestuous relationships in this industry that make us highly skeptical of any offering. While we do believe there is good science being done by legitimate companies – and FOXO could be one of those, though most of its tech seems outsourced – the overall vibe is very OTC right now. If the deal does go through, FOXO Technologies stock will trade on the NYSE under the ticker symbol FOXO.

Tech investing is extremely risky. Minimize your risk with our stock research, investment tools, and portfolios, and find out which tech stocks you should avoid. Become a Nanalyze Premium member and find out today!