Florida workers’ compensation rules for employers

Florida workers’ compensation rules for employers | Insurance Business America

Guides

Florida workers’ compensation rules for employers

Florida workers’ compensation rules for employers: what business owners need to know

Workers’ compensation is required by law in nearly all states, but the regulations regarding coverage vary. If you’re running a business with employees in the Sunshine State, there are certain Florida workers’ compensation rules for employers you need to be aware of.

In this article, Insurance Business delves deeper into the unique aspects of workers’ compensation laws in the state. We will discuss how this type of insurance works, including the different employer requirements and limitations.

If you want to gain a deeper understanding of this form of coverage, this Florida workers’ compensation guide can help. Read on and find out what you should do to keep your business compliant.

Workers’ compensation is an essential form of business insurance. It covers the cost of medical care and a part of lost income if an employee becomes sick or injured while doing their jobs. If a worker succumbs to their injuries, this form of coverage also pays a death benefit.

Just like in other states, workers’ compensation in Florida follows a no-fault system. This means that the benefit your staff receives isn’t affected by their or the company’s negligence.

As an employer, you’re responsible for shouldering the entire cost of the insurance coverage. It’s against the law to require your staff to contribute to the premiums.

Most businesses operating in Florida are legally required to get workers’ compensation coverage. The requirements differ based on three main factors:

the industry the business is in

the number of employees

the business structure

The Bureau of Compliance (BOC) enforces Florida workers’ compensation rules. The department ensures that all businesses are compliant with the state’s coverage requirements:

Construction businesses

The state requires construction companies with at least one employee to get workers’ compensation coverage. This is regardless of whether they are employed full-time or on a contractual basis. Corporate officers and limited liability company (LLC) members are considered employees, thus also requiring insurance coverage.

Section 69L-6.021 of the Florida Administrative Code lists the different trades that are considered a part of the construction industry.

Agricultural businesses

Businesses involved in agricultural activities need to take out workers’ compensation insurance if they have at least:

six full-time employees

12 seasonal staff who work for more than 30 days in a season but not more than 45 days in a calendar year

Non-construction businesses

For businesses not operating under the construction and agricultural sectors, coverage is required if they have at least four employees. These include corporate officers and LLC members.

Sole proprietors and partners in a partnership business aren’t considered employees. Because of this, they are also not required to get workers’ compensation insurance unless they want to. If they do, they need to fill in a DWC-251 form, also called notice of election of coverage, and submit it to the Division of Workers’ Compensation.

Contractors

If you’re a contractor, you must ensure that all subcontractors have workers’ compensation coverage before doing business with them. Once a project starts, subcontractors are treated as your employees. This means that if they get sick or injured on the job, you will be responsible for paying for the benefits if they are uninsured.

Section 69L-6.032 of the Florida Administrative Code lists the documents that subcontractors need to submit before entering into a contract.

Out-of-state businesses

Construction and non-construction businesses based outside Florida but have workers in the state are required to purchase coverage from state-approved providers. The coverage requirements are the same as those for local businesses.

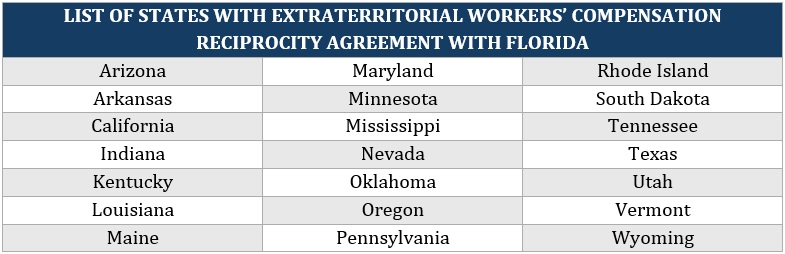

Some states also have an extraterritorial reciprocity agreement with Florida. This allows employers based there to use their home state’s workers’ compensation coverage for employees temporarily working in the state. Florida workers’ compensation rules define temporary as “no more than 10 consecutive days with a maximum of 25 total days in a calendar year.”

These are the states that Florida has extraterritorial reciprocity agreements with:

There are several aspects of Florida workers’ compensation laws that you, as an employer, need to take note of. These include where you can get coverage, who is exempt from taking out insurance, and what happens if your business isn’t compliant.

Here are the answers to some of the most common questions employers have about workers’ compensation in Florida:

Where can you get workers’ compensation coverage?

Employers can only get coverage through private insurers licensed by the Florida Office of Insurance Regulation (FLOIR). There are more than 250 providers of workers’ compensation insurance across the state.

To make your search for the right coverage easier, FLOIR recommends enlisting the services of an experienced insurance agent from the following industry associations:

Florida Association of Insurance Agents

Latin American Association of Insurance Agents

Professional Insurance Agents of Florida

If getting standard workers’ compensation for your business isn’t possible, your agent can get coverage through the Florida Workers’ Compensation Joint Underwriting Association. The rates, however, will be higher than those for coverage from the standard market.

Some other ways for you to get workers’ compensation coverage include:

joining a commercial self-insurance fund where the members pool resources and spread liabilities

qualifying as an individual self-insured

entering into an employee leasing arrangement with a professional employer organization that has secured workers’ compensation coverage on behalf of its client

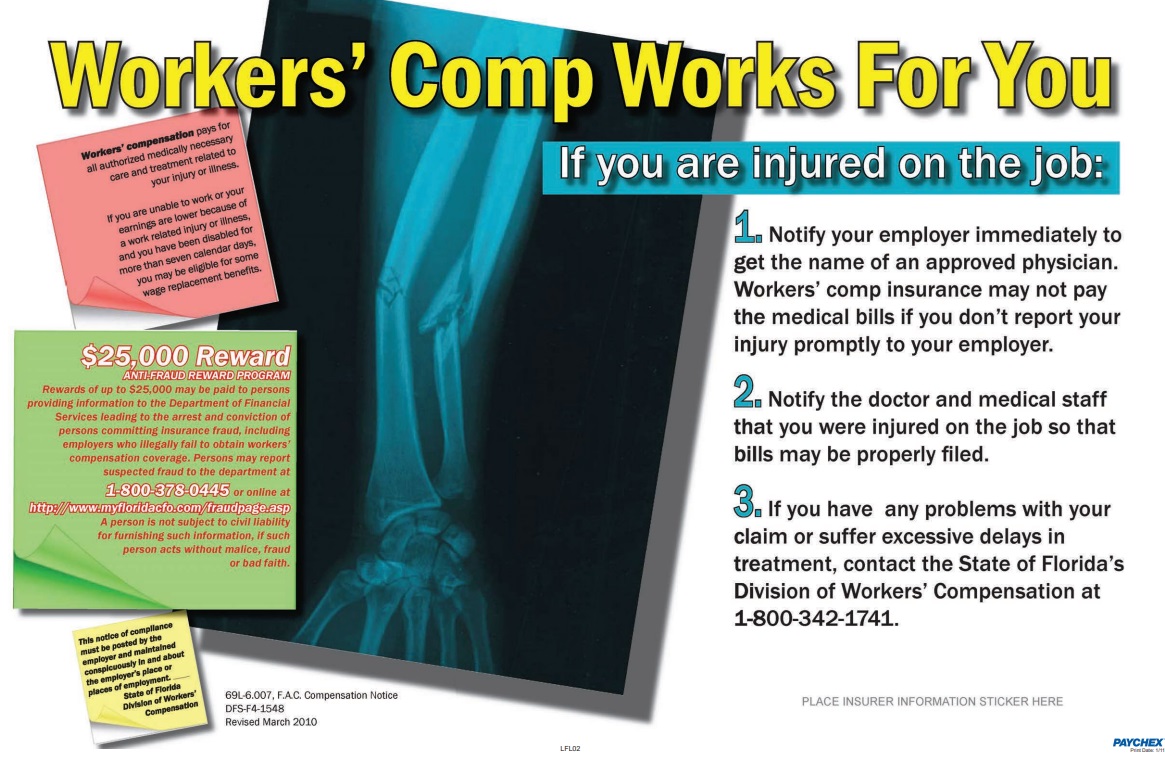

Once you have coverage, you will be given the “Broken Arm” poster. You’re required to display this in your office where your staff can easily see it. The poster contains the name and contact number of your insurance provider.

Caption: All in One Broken Arm poster. Source: State of Florida

How many employees can you have without workers compensation in Florida?

Florida workers’ compensation rules set the same coverage requirements for all businesses outside the construction and agricultural sectors. Employers aren’t required to take out coverage if they have fewer than four employees.

If your business doesn’t meet the coverage requirements, it doesn’t mean you cannot obtain workers’ compensation.

“As a business, you are still able to purchase workers’ compensation coverage for your employees,” said Jeff Sandy, vice-president of workers’ compensation brokerage for Jencap Insurance Services. “It can be through the State Fund or private insurers that don’t have minimum employee requirements.”

State laws do allow exemptions for workers’ compensation coverage. Corporate officers and LLC members can apply for an exemption online through the Division of Workers’ Compensation website of the Florida Department of Financial Services (FLDFS).

For non-construction LLCs, applicants must have at least 10% ownership of the company. Each LLC can only be granted exemptions for not more than 10 members.

Corporations don’t face such restrictions if the applicants are listed as officers in the records of the Division of Corporations of the Florida State Department. Non-construction businesses also aren’t charged an application fee.

For construction businesses, the requirements are almost the same. The main differences are the $50 application fee charged per LLC member and the limit of three members per LLC.

These exemptions, however, are granted to the individual officers and members, not the business. If an officer or LLC member wants to be exempt for multiple businesses, they must file a separate application for each. Exemptions are valid for two years, after which they must be renewed.

What happens if a business doesn’t have workers’ compensation insurance in Florida?

Since workers’ compensation is required by law for most businesses in Florida, getting caught without one can lead to serious legal and financial consequences.

“Depending on the state, certain business owners could face fines, or even jail time,” Sandy said. “If an employee is injured at work, that employee could sue the employer, which can lead to additional cost to the business.”

Businesses found without workers’ compensation coverage may also be issued a stop-work order. This forces them to shut down operations until they can get insurance and pay the fine. The penalty is equal to twice the amount the employer would have paid in annual premiums for the period they were without coverage.

If a business is found to have falsely declared employees to be independent contractors, a $5,000 fine is assessed for each worker.

A stop-work order may also be issued if a business tries to avoid paying the right workers’ compensation premiums by providing false information.

The following instances are also against the law and may result in criminal charges from the Division of Investigative & Forensic Services (DIFS):

continuing operations after a stop-work order has been issued

failing to report an injury to the insurance provider

deducting premiums from employees’ salaries

misclassifying workers as independent contractors

making false statements when getting coverage to cut insurance premiums

terminating or threatening to terminate an employee for filing or attempting to file a workers’ compensation claim

Denying an employee the right benefits can also lead to costly settlements. Check out this list of the most expensive workers’ compensation settlement cases in the US that the Insurance Business research team compiled.

As a Florida employer, you have up to seven days to submit a report of a workplace injury to your workers’ compensation insurance provider. This deadline applies to accidents that require offsite medical treatment. Failure to do so can lead to fines of up to $500, according to Chapter 440 of the Florida Statutes.

If your worker, however, suffered an injury that only needed onsite treatment, also referred to as a “first-aid case,” you’re not required to report the incident to your insurance company.

Once an injury has been reported to your carrier, they will send the injured employee a notice containing their rights and responsibilities. The notice also includes a fraud statement that the injured worker must sign. The notice must be sent back to the insurer before any indemnity benefits are paid.

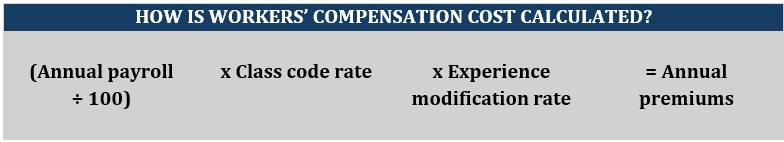

The cost of workers’ compensation coverage in Florida is based on three factors:

total payroll, consisting of the salaries and benefits of all employees, including full-time, part-time, seasonal, and temporary staff

job classification codes, also called class codes, which show the riskiness of the work a business does

experience modifiers, which track the previous workers’ compensation claims of a business

Just like in other states, the cost of Florida workers’ compensation insurance is calculated using this standard formula:

Even with all the necessary safety precautions in place, accidents can still happen in the workplace. But while most incidents lead only to minor injuries without long-term effects on employees’ lives, catastrophic injuries do occur. When they do, these can prove costly to both your business and the injured worker.

“It’s important for employers to have workers’ compensation insurance for their employees because it allows both sides to have peace of mind in knowing that if someone gets injured, they are covered,” Sandy said.

Workers’ compensation insurance also frees businesses from the financial liability of shouldering the cost of medical care and treatment for an employee injured at work.

“It can reduce the employers’ out of pocket expenses and cover the employees for an extended time no matter what or who is at fault,” he added.

“In the state of Florida, employers should be alert to the rules that the state has set when it comes to workers’ compensation. This includes coverage requirements, reporting obligations, and who they can buy insurance from.”

If you’re searching for dependable and trusted workers’ compensation insurance providers, our Best in Insurance Special Reports page is the place to go. The insurers featured in our special reports have been nominated by their peers and vetted by our panel of experts as respected market leaders.

Do you find Florida workers’ compensation rules for employers fair? Let us know in the comments.

Keep up with the latest news and events

Join our mailing list, it’s free!