Fitting Life Insurance into Your Budget

A life insurance policy won’t do you or your loved ones any good if you can’t afford it.

But most people overestimate the cost of life insurance. In a survey by LIMRA, millennials, on average, guessed that a $250,000 term policy for a 30-year-old cost $1,000 per year. It really only costs $160 per year on average.

Term life insurance is the best option for families because it’s very customizable and affordable. Whatever your budget, Quotacy can help you get life insurance coverage so you can protect your family.

» Compare: Term life insurance quotes

How to Fit Life Insurance into Your Budget

There are two different types of life insurance: term life insurance and permanent life insurance.

» Learn more: Term vs Whole Life Insurance

Term life insurance is the most affordable. If you have a tight budget, a term policy is the way to go.

Term life insurance provides coverage for a specific period of time. It’s designed to end when you’re nearing retirement and no longer have as many financial responsibilities, such as dependent children.

Example:

Jim and Julie are 35 years old. They have two children aged 4 and 5.

Jim and Julie each buy a 30-year $500,000 term life insurance policy.

This policy provides financial protection during the next 30 years as Jim and Julie raise their children, save for retirement, and pay down their mortgage.

If either Jim or Julie die prior to age 65, the death benefit of $500,000 is paid out so the family won’t struggle financially when they lose that source of income.

Once the 30 year term is over, the coverage simply terminates.

As a safeguard, most term life insurance policies include a conversion and renewal option. Should you find yourself still needing coverage yet you’ve become uninsurable (maybe you’ve been diagnosed with a serious illness) these options keep you insured for a price.

Choosing Your Life Insurance Coverage

Because you can choose the coverage amount and term length—and there are many options—term life insurance premiums are relatively easy to fit into a budget.

Term coverage choices range from $50,000 up to $25,000,000+. Term length choices range from 10 years up to 40 years. These options can vary by your age and financial need.

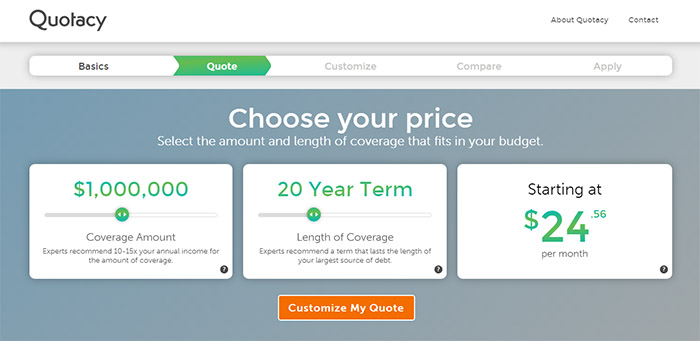

Typically, the more coverage you want, the more the policy will cost. But sometimes the premium difference is minimal compared to the change in coverage amount. Consider the screenshots below.

These screenshots show term insurance quotes for a 30-year-old healthy female. The monthly premium difference between a $750,000 term life insurance policy and a $1,000,000 term life insurance policy is only $5 per month.

For an extra $5 each month you can get $250,000 more coverage for your loved ones. If you have a mortgage and more than one child, that extra $250,000 could be extremely beneficial if you died unexpectedly.

Let’s pretend you’re that 30-year-old mother. What in your daily life could you cut back on to fit $25 into your monthly budget to be able to afford a $1,000,000 life insurance policy to protect your children?

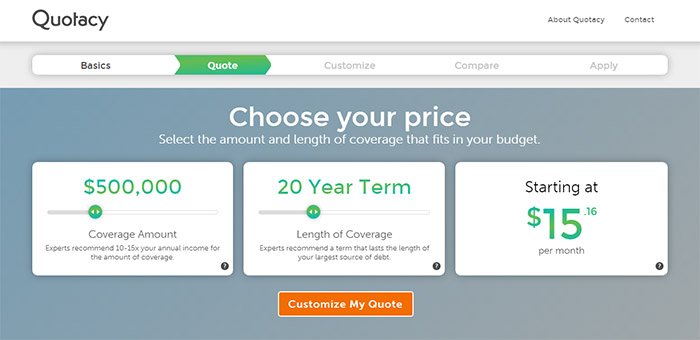

Or maybe you have a strict budget and can only afford to spend $15 per month for coverage. Using the sliders on our term life insurance quoting tool, you can see dropping the coverage amount to $500,000 also drops your estimated life insurance premium to about $15.

$500,000 is still a very good coverage amount.

Even if you can only comfortably afford a $100,000 term life insurance policy, a little bit of life insurance is better than none at all.