First Protective & Frontline’s Astro Re cat bond marked lower on hurricane Ian exposure

According to sources, the $40 million Astro Re Pte. Ltd. (Series 2021-1) catastrophe bond, sponsored in 2021 by U.S. primary insurance group First Protective on behalf of itself and subsidiary Frontline Insurance, has been marked down in the secondary market, on concerns over exposure to rising losses from 2022’s hurricane Ian.

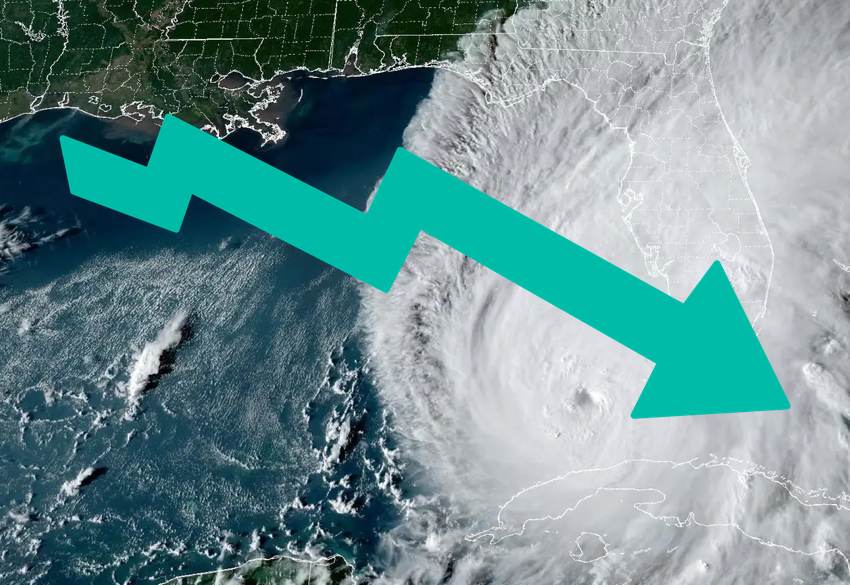

First Protective and Frontline Insurance underwrite property business in the state of Florida, as well as other coastal states, so naturally the Astro Re Pte. issuance was a catastrophe bond considered potentially at-risk as hurricane Ian approached the Gulf coast of that state in September 2022.

But now, approaching two year’s later, we are told that Frontline’s ultimate net losses from hurricane Ian have been rising and that as a result the Astro Re 2021-1 Class A catastrophe bond notes have now been marked down in broker secondary cat bond market pricing sheets.

Stepping back, right after hurricane Ian had struck Florida we analysed the catastrophe bonds that appeared most exposed to losses from the storm.

At that time, the Astro Re cat bond notes had been marked down heavily with cat bond funds and investors anticipating a significant loss of principal.

In fact, as we reported, the Astro Re cat bond notes were listed for bids on pricing sheets as low as just 1 cent on the dollar after Ian, implying the market felt it likely at the time that the Astro Re 2021-1 cat bond faced a total loss due to the hurricane.

Fast-forward to the end of 2023 and the Astro Re Pte. cat bond notes had recovered somewhat, but were still marked down to imply an expected 30% to 40% loss of principal at that time.

By March 2024, the Astro Re cat bond notes were marked in a relatively wide range across secondary cat bond broker pricing sheets, from as low as 65 cents on the dollar, to as high as 80 cents at that time.

At the end of May, some broker pricing sheets even had these notes marked a little higher, at 85 cents on the dollar.

Which is roughly where the bids stayed, on pricing sheets, ranging in bids from 65 to 85 cents on the dollar, indicating a wide uncertainty range over the eventual chance and quantum of losses cat bond investors might face.

But, earlier this month, around the second week of July 2024, we’re told that the notes had been marked down again, with sources suggesting that the reason is continued loss creep that has increased the estimate for hurricane Ian losses, for Astro Re sponsors First Protective and Frontline Insurance.

We’re now told the notes are marked down for bids as low as 25 on one pricing sheet, having fallen by over 50 cents in a week, so a quite meaningful mark-down.

Another cat bond broker pricing sheet has the Astro Re cat bond notes marked at 50, down by roughly 20 cents.

All of which suggests a market that is now discounting these notes by as much as 50% to 75%.

The Astro Re Pte. Series 2021-1 catastrophe bond notes are still on-risk, with maturity not due until July 2025.

But, with no other major Florida hurricanes having occurred since hurricane Ian, and Florida comprising almost 70% of the notes expected loss (they also cover named storms in Alabama, Georgia, South and North Carolina), it seems safe to assume it is hurricane Ian that continues to threaten the holders of these notes with losses.

Details of catastrophe bonds facing losses, deemed at risk, or already paid out, can be found in our cat bond losses Deal Directory here.

You can read all about the Astro Re Pte. Ltd. (Series 2021-1) catastrophe bond from Frontline and every other cat bond ever issued in our Artemis Deal Directory.