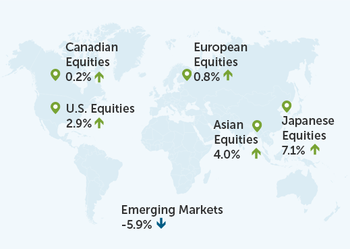

Financial markets at a glance – September 30, 2021

FINANCIAL MARKETS

AT A GLANCE

SEPTEMBER 30, 2021

Canadian equity sectors were mixed while U.S. equity sectors were generally positive last quarter. We saw

a steepening of the yield curve. As a result, government bonds trailed corporate bonds, while short term

bonds outperformed long term bonds. Here are the financial markets at a glance.

![]()

CANADIAN EQUITIES

US EQUITIES

Sector

7 of the 11 Canadian equity sectors ended the quarter in positive territory. Here are the best and worst performing sectors relative to last quarter.

Sector

9 of the 11 U.S. equity sectors ended the quarter

in positive territory. Here are the best and worst

performing sectors relative to last quarter.

WORST PERFORMERS

BEST PERFORMERS

Consumer

Staples

![]()

Energy

Industrials

4.2% ![]()

4.0% ![]()

3.5% ![]()

Materials

Consumer

Discretionary

Healthcare

-5.6% ![]()

-5.9% ![]()

-20.3% ![]()

Financials

Utilities

5.1% ![]()

4.1% ![]()

Materials

Industrials

-1.3% ![]()

-2.0% ![]()

Company size

Small companies underperformed medium and

large-sized companies.

Company size

Small and medium-sized companies underperformed large companies.

What’s working/What’s not working

From a style perspective, growth ended the quarter in negative territory with value coming in

slightly above the index.

Dividends were the big winner this quarter, with momentum and quality trailing.

What’s working/What’s not working

Growth continues to lead this quarter, outperforming the S&P 500 Index.

Momentum was the only factor to outperform the broader market, with dividends being the weakest over the quarter, but still positive.

GLOBAL EQUITIES

FIXED INCOME

Regional

Company size

Global small companies performed well but were

still outpaced by large companies.

![]()

![]()

![]()

![]()

Large

Companies

Small

Companies

What’s working/What’s not working

From a style perspective, growth outperformed value and the MSCI World Index.

Momentum and quality were the factors that outperformed the index, and while positive dividends underperformed.

We saw a steepening of the yield curve this quarter, with yields in the middle and long end moving higher.

Bond yields were up this quarter.

Yield on the Canada 2-year rose from 0.45% to 0.53%.

Canada 5-year rose from 0.97% to 1.11%.

Canada 10-year rose from 1.39% to 1.51%.

Canada long bond rose from 1.84% to 1.98%.

Source: Morningstar Research Inc., as of September 30, 2021

Segregated Fund contracts are issued by The Empire Life Insurance Company (“Empire Life”). A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value. Past performance is no guarantee of future results. Please read the information folder, contract and fund facts before investing.

This article includes forward-looking information that is based on the opinions and views of Empire Life as of the date stated and is subject to change without notice. The information contained herein is for general purposes only and is not intended to be comprehensive investment advice. We strongly recommend that investors seek professional advice prior to making any investment decisions. Empire Life and its affiliates assume no responsibility for any reliance on or misuse or omissions of the information contained herein.

November 2021