Financial markets at a glance – March 31, 2022

FINANCIAL MARKETS

AT A GLANCE

MARCH 31, 2022

Canadian equities were mixed, while U.S equities were mostly negative. We saw a steepening of the yield curve. As a result, corporate bonds outperformed government bonds, and subsequently shorter term bonds outperformed long term bonds. Here are the financial markets at a glance.

![]()

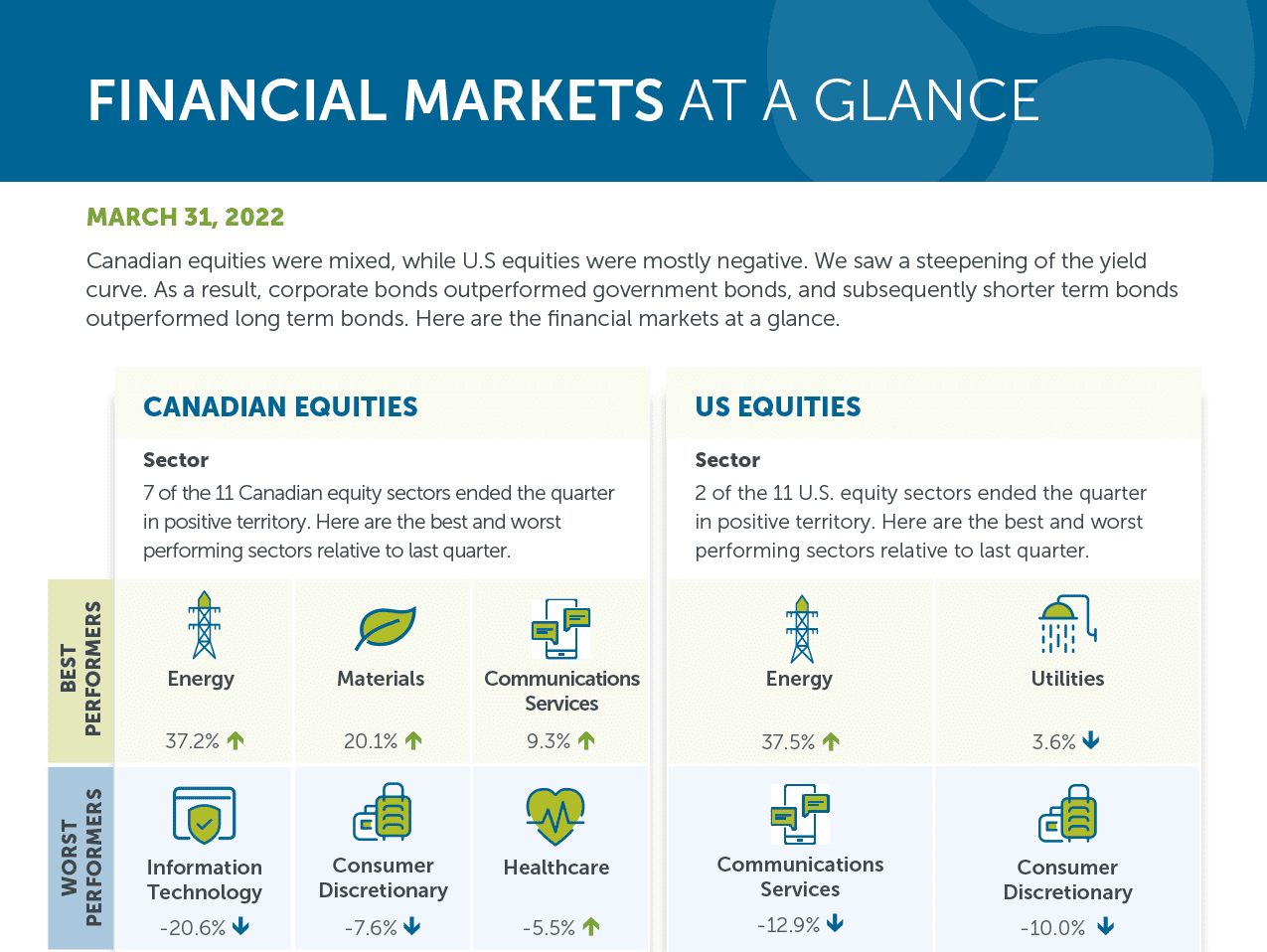

CANADIAN EQUITIES

US EQUITIES

Sector

7 of the 11 Canadian equity sectors ended the quarter in positive territory. Here are the best and worst performing sectors relative to last quarter.

Sector

2 of the 11 U.S. equity sectors ended the quarter in positive territory. Here are the best and worst performing sectors relative to last quarter.

WORST PERFORMERS

BEST PERFORMERS

![]()

Energy

Materials

Communications

Services

37.2% ![]()

20.1% ![]()

9.3% ![]()

Information

Technology

Consumer Discretionary

![]()

Healthcare

-20.6% ![]()

-7.6% ![]()

-5.5% ![]()

![]()

Energy

Utilities

37.5% ![]()

3.6% ![]()

Communications

Services

-12.9% ![]()

-10.0% ![]()

Company size performance comparison

Though medium and large companies were

positive over the quarter, they underperformed small-sized companies.

Company size performance comparison

Small, medium and large companies were

negative over the quarter, with small companies underperforming the most.

What’s working/What’s not working

From a style perspective, value was positive but growth was negative and underperformed the index.

Momentum and dividends were the top performing factors this quarter, while quality trailed all other factors.

What’s working/What’s not working

Value and growth were both negative this quarter, but growth underperformed the index.

All factors were negative this quarter, but dividends and low volatility outperformed the index.

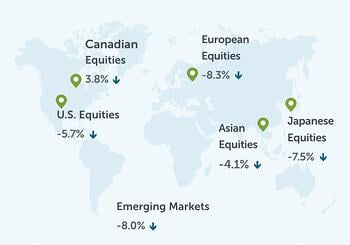

GLOBAL EQUITIES

FIXED INCOME

Regional

Company size performance comparison

Global small and large companies were

negative over the quarter with small companies underperforming the most.

![]()

![]()

![]()

![]()

Small Companies

Large Companies

What’s working/What’s not working

From a style perspective, value outperformed growth and the MSCI World Index. However, both ended the quarter in negative territory.

Dividends and low volatility were the factors that outperformed the index, but all factors and the index were negative.

We saw a steepening of the yield curve this quarter, with yields in the short, middle and long end moving higher as interest rates and inflation rose.

Bond performance

Bond yield

Bond yields were up with both shorter and longer date bond yields increasing over the quarter.

Yield on the Canada 2-year rose from 0.95% to 2.27%.

Canada 5-year rose from 1.25% to 2.39%.

Canada 10-year rose from 1.42% to 2.40%.

Canada long bond rose from 1.68% to 2.37%.

Source: Morningstar Research Inc. as of March 31, 2022. © 2022 Morningstar Research Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Segregated Fund contracts are issued by The Empire Life Insurance Company (“Empire Life”). A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value. Past performance is no guarantee of future results. Please read the information folder, contract and fund facts before investing.

This article includes forward-looking information that is based on the opinions and views of Empire Life as of the date stated and is subject to change without notice. The information contained herein is for general purposes only and is not intended to be comprehensive investment advice. We strongly recommend that investors seek professional advice prior to making any investment decisions. Empire Life and its affiliates assume no responsibility for any reliance on or misuse or omissions of the information contained herein.

March 2022