Fidelis Insurance sees net income fall

Fidelis Insurance sees net income fall | Insurance Business America

Insurance News

Fidelis Insurance sees net income fall

CEO still remains positive on prospects for the rest of the year

Insurance News

By

Noel Sales Barcelona

Fidelis Insurance Group has released its second-quarter report for 2024, showing a steep decline in net income compared to the same period last year.

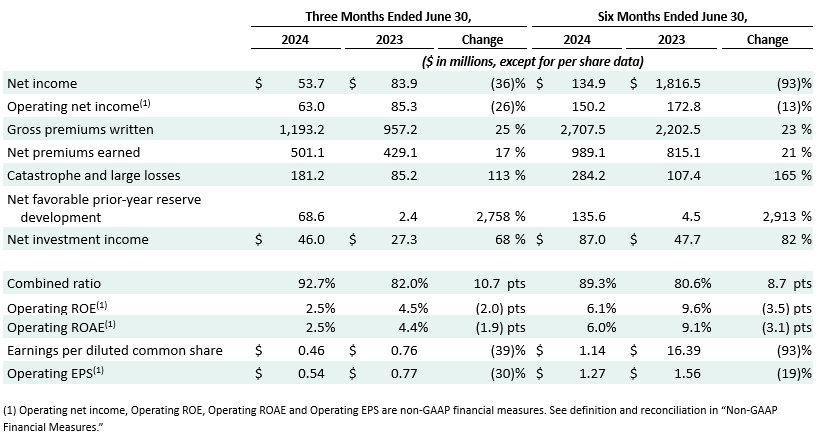

The company reported a net income, as of June 30, 2024, of $53.7 million from April to June this year, compared to $83.9 million recorded in the same period last year. This number equates to $0.46 per diluted common share and operating net income of $63.0 million, or $0.54 per diluted common share, the second quarter report stated. The company also recorded an income decline in the first quarter of this year.

However, gross premiums written were up by 24.7%, at $1.2 billion, compared to the second quarter of 2023. The company also reported a combined ratio of 92.7% for Q2 of this year.

Meanwhile, the company registered an annualized operating return on opening common equity (operating ROE) of 10.0% and an annualized operating return on average common equity (operating ROAE) of 10.0%.

The report also stated that its net favorable prior year loss reserve development for the second quarter of 2024 was $68.6 million compared to $2.4 million in the prior year period.

“Catastrophe and large losses for the second quarter of 2024 were $181.2 million compared to $85.2 million in the prior year period,” the report stated.

Nevertheless, the Fidelis Insurance Group Q2 results reported a net investment income for the second quarter of 2024 of $46.0 million compared to $27.3 million in the prior year period. Furthermore, the company reported it purchased $677.7 million of fixed-income securities at an average yield of 5.2% and had sales of $220.4 million at an average yield of 1.6%.

“For the three months ended June 30, 2024, our GPW increased – primarily driven by growth from new business and increased rates in our property and property D&F lines of business, partially offset by a decrease in our aviation and aerospace line of business,” the Fidelis Q2 report explained.

Fidelis CEO Dan Burrows (pictured) remained positive.

“As we mark our first anniversary as a public company, we are proud to have built a strong team, who are focused on realizing the value of our business. Our position as a market leader focused on short-tail specialty lines is enabling us to deliver attractive growth and create value for our shareholders,” he said. “We are well positioned to quickly respond to market conditions and continue to leverage our lead positioning to capitalize on attractive rates, terms, and conditions. In tandem with underwriting, active capital management remains a cornerstone of our strategy and to that end, we are pleased to announce our Board has approved a new share repurchase program of $200 million. In what remains one of the best markets we have seen in recent history, I am excited for the opportunities we see ahead.”

Have something to say about this story? Leave a comment below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!