Enhanced Medical Insurance Coverage for S Pass and Work Permit Holders in Singapore: Recent MOM Changes Explained

The Ministry of Manpower (MOM) in Singapore has recently implemented enhanced medical insurance requirements for Work Permit and S Pass holders, aimed at providing greater protection for workers and alleviating financial burdens on employers due to rising medical costs.

The enhanced MI requirements are compulsory for all new and existing S Pass and Work Permit (including Migrant Domestic Workers) holders and apply for all MI policies, renewals, and extensions starting from July 1, 2023, for Stage 1 requirements and July 1, 2025, for Stage 2 requirements.

Employers must understand these changes to provide adequate coverage. In this Pacific Prime Singapore article, we take a closer look at the latest developments and their implications.

Want to learn more about the three types of work passes in Singapore? Check out this guide to Singapore Work Permits, S Pass, and Employment Pass (Updated 2023).

Changes to Medical Insurance Coverage for Foreign Workers in Singapore

Effective July 1, 2023, Singapore’s MOM will implement new regulations to enhance the mandatory medical insurance (MI) for S Pass and Work Permit (including migrant domestic workers) holders. These changes aim to provide foreign workers with access to comprehensive medical treatment and care, with changes that include:

Increased coverage and co-payment requirements

Standardization of exclusions and direct reimbursement

Introduction of age-differentiated premiums

Increased Coverage and Co-payment

Under the new requirement, the minimum annual claim for medical insurance coverage has been raised to at least SGD $60,000, a significant increase from the previous limit of SGD $15,000.

This higher coverage ensures that S Pass and Work Permit holders have access to adequate financial protection, allowing them to receive medical treatment, surgeries, and other healthcare services as needed without worrying about hefty medical bills.

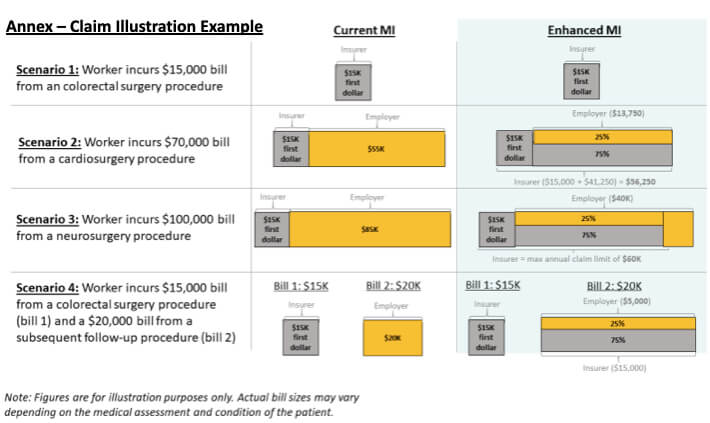

Employers will also be required to co-pay 25% of claim amounts exceeding the initial SGD $15,000. This means that if a worker incurs a medical bill of SGD $60,000, the employer will have to contribute SGD $11,250 (25% of SGD $45,000), while the insurer will cover the remaining SGD $48,750.

The image below illustrates four scenarios provided by the MOM, comparing the co-payment between employers and insurers for current and enhanced MI.

Source: MOM

The co-payment system ensures that employers and insurers share responsibility, reducing the financial burden on both parties.

Standardization of Exclusions and Direct Reimbursement

Starting from July 1, 2025, the MOM is introducing further changes to enhance the efficiency and transparency of medical insurance processes for S Pass and Work Permit holders.

The standardization of allowance exclusion clauses will provide clarity to employers and workers, ensuring both parties have a clear understanding of medical expenses coverage and eligible claims.

Direct reimbursement will also be introduced from July 1, 2025, which means insurers will have to reimburse hospitals directly upon the admissibility of the claim. Likewise, employers won’t have to pay upfront and seek reimbursement later.

Direct reimbursement will not only help simplify the claims process and reduce administrative burdens but also ensure that foreign workers can access healthcare services without delay.

Age-differentiated Premiums

Effective from July 1, 2025, insurers in Singapore are required to offer age-differentiated premiums for workers aged 50 and below, as well as those above 50. This change ensures affordability for younger workers, who make up the majority of the migrant workforce.

Along with giving younger workers access to essential medical insurance without excessive financial burden, age-differentiated premiums also benefit older workers by taking their specific health needs and risks into account. This allows them to secure adequate medical coverage without facing high costs due to their age.

Understanding the Implications for Employers in Singapore

The MOM’s regulatory change increases the minimum coverage limit for medical insurance from SGD $15,000 to SGD $60,000. Adhering to this revision is imperative for employers to avoid regulatory non-compliance.

It’s important to note that these changes apply to employees holding S Pass and Work Permits, while those with an employee pass are not affected. Consequently, employers should re-evaluate their existing inpatient and day surgery medical benefit limits for S Pass and Work Permit holders to ensure compliance with the new regulatory requirements.

The aforementioned changes apply to all policies, renewals, or extensions that have a start date effective on or after July 1, 2023. However, if the policy renewal date falls before July 1, 2023, changes can be made at the next renewal date on June 30, 2024.

The impact on employers and group medical plans is significant as it helps them in managing costs, especially in the event of large medical bills where they are responsible for bearing the costs. Higher medical benefit limits also mean employers are better protected as employers partially cover larger medical bills.

How Pacific Prime Singapore Can Help

Understanding and complying with the new requirements while navigating insurance policies can be complex for employers and HR professionals. Fortunately, a reputable insurance broker like Pacific Prime Singapore can provide valuable assistance.

Our team of insurance experts can evaluate existing policies, offer suitable recommendations, compare health insurance options, provide tailored solutions, and more to help you secure the right group health insurance plan.

Contact Pacific Prime Singapore today to ensure you have the right coverage in place and meet the regulatory requirements.

![]() Jantra Jacobs is a Senior Content Creator at Pacific Prime with over 10 years of writing and editing experience. She writes and edits a diverse variety of online and offline copy, including sales and marketing materials ranging from articles and advertising copy to reports, guides, RFPs, and more.

Jantra Jacobs is a Senior Content Creator at Pacific Prime with over 10 years of writing and editing experience. She writes and edits a diverse variety of online and offline copy, including sales and marketing materials ranging from articles and advertising copy to reports, guides, RFPs, and more.

Jantra curates and reports on the results of Pacific Prime’s monthly newsletters, as well as manages Pacific Prime’s Deputy Global CEO’s LinkedIn posts. Complemented by her background in business writing, Jantra’s passion for health, insurance, and employee benefits helps her create engaging content – no matter how complex the subject is.

Growing up as a third-culture kid has given her a multicultural perspective that helps her relate to expats and their families while 8 years of working remotely have given her unique insight into hybrid work arrangements and enthusiasm for employee benefits.

![]() Latest posts by Jantra Jacobs (see all)

Latest posts by Jantra Jacobs (see all)