Employer Utilization Management Tactics Place Healthcare Benefits Cost Before Patient Care, Survey Finds – PR Newswire

When employers base health insurance decisions on cost alone, their employees suffer the consequences

NEW YORK, April 13, 2022 /PRNewswire/ — Utilization management (UM) tools may be effective in controlling short-term organizational costs, but they are not as effective in controlling health care costs for employees and can even serve as barriers to treatment, according to a new survey of large employers by CancerCare, the leading national cancer support organization.

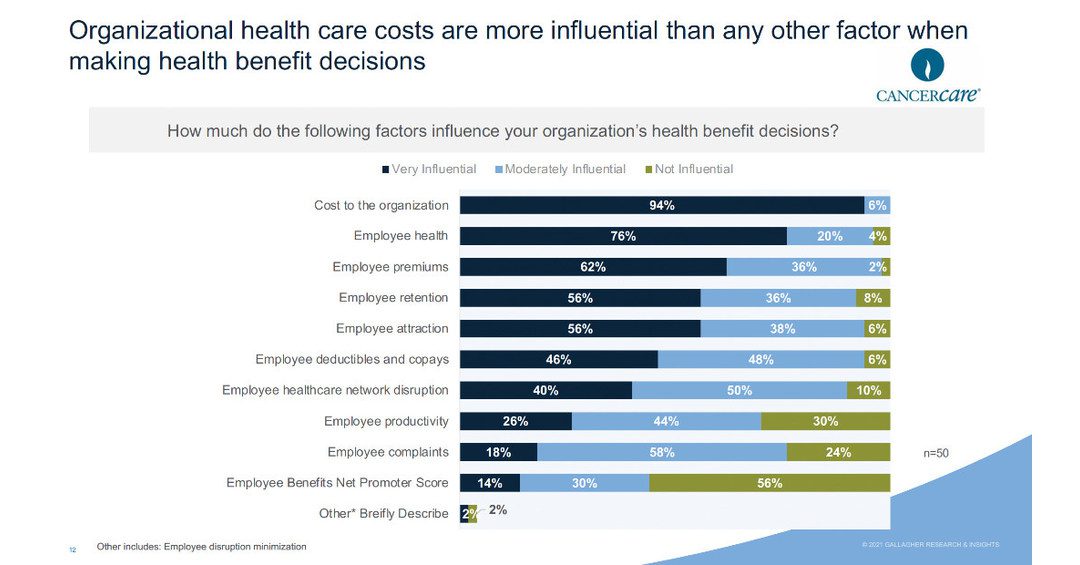

Organizational health care costs are more influential than any other factor when employers make health benefit decisions, according to the 2022 CancerCare Employer Market Survey.

Nearly all of the survey respondents (94%) said that employer organizational health care costs are more influential than any other factor when making health benefit decisions, including employee costs and issues. They overwhelmingly (98%) said that direct costs are the most important information source in their benefits decision making. As employers face escalating costs fueled by insurance premiums (up 47% between 2011 and 2021, according to a Commonwealth Fund study), they often use UM to keep healthcare spending in check.

Among the unintended consequences of UM are delaying, disrupting, or denying necessary and time-sensitive care, increasing out-of-pocket prescription costs which can drive treatment non-adherence, and costly administrative burdens for patients and healthcare providers.

“When cost is the dominant factor in guiding employers’ benefits decision making, employee health can pay the price,” said Patricia J. Goldsmith, Chief Executive Officer, CancerCare. “Employers must take care to balance cost savings with the real needs of their employees, especially those with serious or chronic illnesses.”

When prices – especially the cost for lifesaving medications – are unaffordable, patients take shortcuts. According to Kaiser Health News, 29% of all adults report not taking their medicines as prescribed because of the cost: 19% didn’t fill a prescription; 12% cut pills in half or skipped a dose; 30% of those who report not taking their medicines say their condition got worse as a result (8% of the public overall).

Cost saving measures that can compromise treatment and pose significant barriers to employees who need medical care include:

Pre-authorization (PA) – requires that certain medical services, treatments or prescriptions be approved by insurers before a patient can receive them. Nearly all (93%) of physicians recently surveyed by the American Medical Association reported that PA was linked to delays in patient care, and 34% reported serious adverse events due to PA delays.

Formulary design – the list of drugs approved by a health plan’s pharmacy benefits manager (PBM). Restrictive formularies can put needed drugs out of reach of patients.

Step therapy – a protocol that forces patients to try one or a series of PBM preferred drugs before being allowed the drug prescribed by their clinician. Step therapy can cause delays, increased costs, and adverse side effects or medical setbacks.

Specialty pharmacies – when patients are required to use specific – often PBM-owned – specialty pharmacies, it limits their choice as consumers and may result in difficulties receiving and refilling prescriptions.

Copay accumulator programs – exclude the dollar amount of financial copay assistance from deductibles and out-of-pocket totals, making it more difficult for patients to afford their medication while allowing health plans and pharmacy benefit managers to get paid twice.

“Employers and their benefits consultants must keep in mind that the goal of employer-provided health coverage is delivering access to swift and effective treatment,” Goldsmith said. “A strong benefit design can support productivity, help reduce long-term medical spending, attract and retain talented employees, and build satisfaction and loyalty, while meeting the needs of those with health problems.”

About the Survey

A total of 50 executives who are responsible for employee benefits, from 50 different large US employers, participated in the January 2022 CancerCare Employer Market Survey. Respondents’ companies employ over 250,000 employees.

Media Contact:

Beth Brody

[email protected]

908-295-0600

SOURCE CancerCare