Emblem Portfolios in action – Asset allocation update, September 2021

Key takeaways:

Emblem Portfolios – Canadian: September 22, 2021

Emblem GIF Portfolios – Global: September 27, 2021

Incrementally less aggressive outlook/positioning towards risk assets

Deploying cash to realign select asset class exposures back to targets

![]()

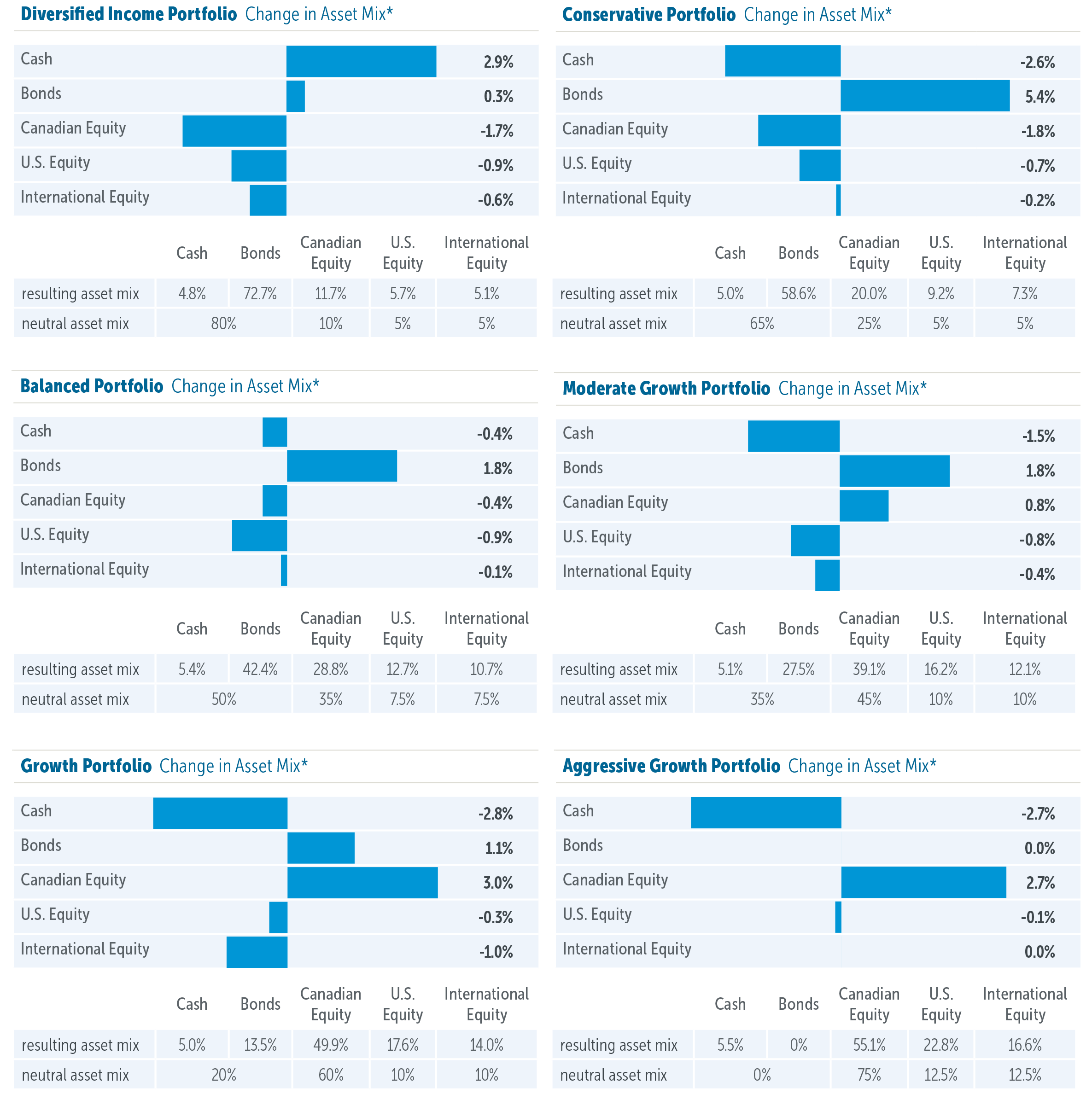

Moving to a slightly less aggressive posture given some reopening has played out, supply chain difficulties remain and valuations remain elevated.

We are also seeing some indications of slowing economic growth and we still don’t have a clear picture of just how transitory inflationary pressures will prove to be.

In light of all these factors we decided to make a modest change to a somewhat less aggressive positioning, while deploying cash in select portfolios to realign select asset class weights back to targets.

Empire Life Emblem Portfolios: Asset allocation update

*change in asset mix from September 17, 2021 to September 22, 2021

Empire Life Emblem Global Portfolios: Asset allocation update

*change in asset mix from September 23, 2021 to September 27, 2021

Empire Life Investments Inc. is the Portfolio Manager of the Empire Life segregated funds. Empire Life Investments Inc. is a wholly-owned subsidiary of The Empire Life Insurance Company.

Empire Life Emblem GIF Portfolios currently invest primarily in units of Empire Life Mutual Funds.

A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value. Policies are issued by The Empire Life Insurance Company.

Empire Life Investments Inc. is the Manager of the Empire Life Emblem Portfolios and Empire Life Mutual Funds (the “Portfolios” or “Funds”).

The units of the Portfolios and Funds are available only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such units.

This document includes forward-looking information that is based on the opinions and views of Empire Life Investments Inc. as of the date stated and is subject to change without notice. This information should not be considered a recommendation to buy or sell nor should they be relied upon as investment, tax or legal advice. Information contained in this report has been obtained from third party sources believed to be reliable, but accuracy cannot be guaranteed. Empire Life Investments Inc. and its affiliates does not warrant or make any representations regarding the use or the results of the information contained herein in terms of its correctness, accuracy, timeliness, reliability, or otherwise, and does not accept any responsibility for any loss or damage that results from its use.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated