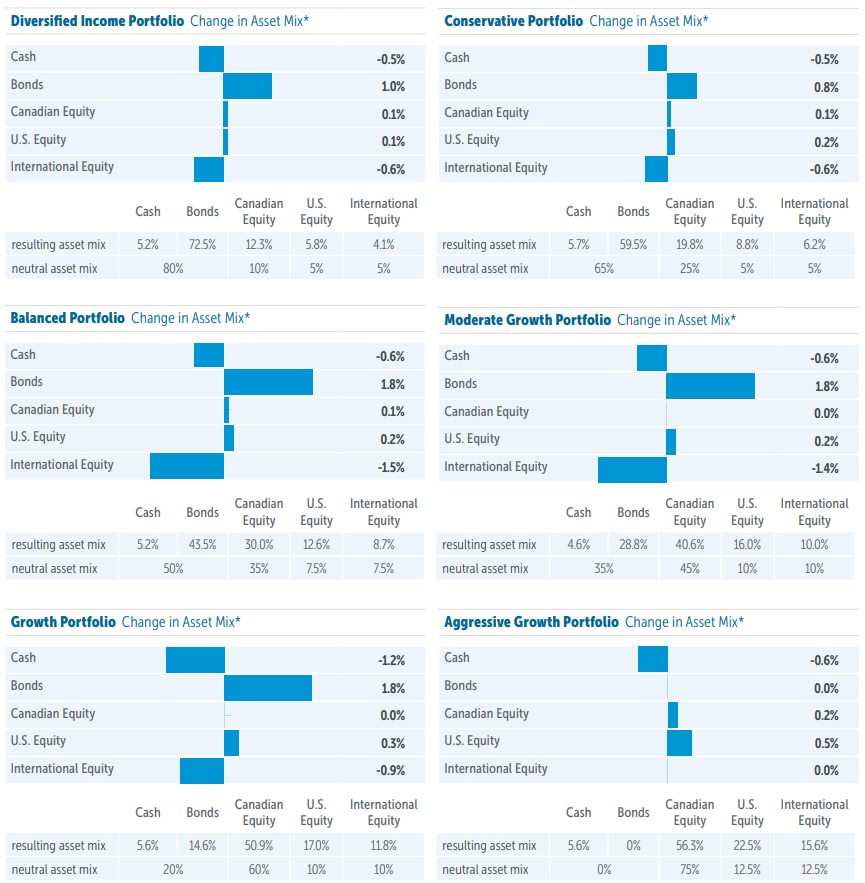

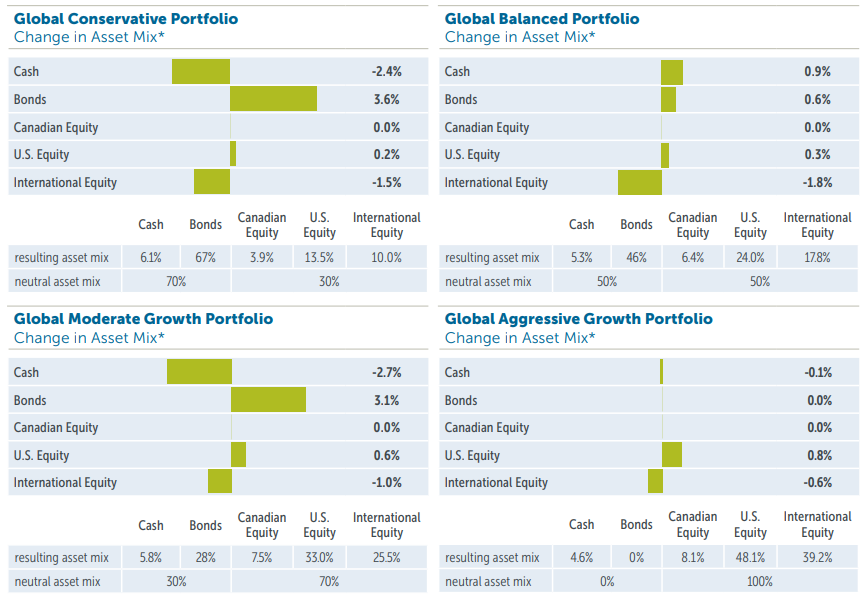

Emblem Portfolios in action – Asset allocation update, January 27, 2022

Key takeaways: Tactically increased bonds, decreased international equities*

Tactical update – January 27, 2022

We are taking a slightly more defensive posture by trimming international equities and adding to bonds. This is indeed a tactical, but measured decision. It is a move in a more conservative direction with an eye towards taking potential risk exposures incrementally lower.

This is related to a range of concerns we are seeing including the potential persistence of inflationary pressures, the pace and magnitude of interest rate hikes, geopolitical uncertainty and certain pockets of elevated valuation.

* Excludes Emblem Aggressive Growth, which has no allocation to bonds

![]()

Empire Life Emblem Portfolios: Asset allocation update

*Change in asset mix from January 26, 2022 to January 28, 2022

Empire Life Emblem Global Portfolios: Asset allocation update

*Change in asset mix from January 26, 2022 to January 28, 2022

Empire Life Investments Inc. is the Portfolio Manager of the Empire Life segregated funds. Empire Life Investments Inc. is a wholly-owned subsidiary of The Empire Life Insurance Company.

Empire Life Emblem GIF Portfolios currently invest primarily in units of Empire Life Mutual Funds.

A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value. Policies are issued by The Empire Life Insurance Company.

Empire Life Investments Inc. is the Manager of the Empire Life Emblem Portfolios and Empire Life Mutual Funds (the “Portfolios” or “Funds”).

The units of the Portfolios and Funds are available only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such units.

This document includes forward-looking information that is based on the opinions and views of Empire Life Investments Inc. as of the date stated and is subject to change without notice. This information should not be considered a recommendation to buy or sell nor should they be relied upon as investment, tax or legal advice. Information contained in this report has been obtained from third party sources believed to be reliable, but accuracy cannot be guaranteed. Empire Life Investments Inc. and its affiliates does not warrant or make any representations regarding the use or the results of the information contained herein in terms of its correctness, accuracy, timeliness, reliability, or otherwise, and does not accept any responsibility for any loss or damage that results from its use.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated