Eclipse Re issues $25m Series 2024-2A private catastrophe bond

The Artex Capital Solutions managed Eclipse Re Ltd. structure has issued a new private catastrophe bond transaction, a $25 million Eclipse Re Ltd. (Series 2024-2A) deal.

This is the second private catastrophe bond issuance, or cat bond lite, from the Eclipse Re platform in 2024.

Back in January we reported on the first of the year, a $100 million Eclipse Re Ltd. (Series 2024-1A) issuance.

Last year, for full-year 2023, the Eclipse Re platform issued just under $210 million of private cat bond notes, maintaining its position as one of the most used structures for these listed private cat bond note issuances.

Eclipse Re Ltd. is a Bermuda domiciled special purpose insurance (SPI) company and segregated account platform, that is owned and managed by insurance-linked securities (ILS) market facilitator and service provider Artex Capital Solutions.

Eclipse Re is normally acting as a risk transformation vehicle, working on behalf of ILS fund managers and investors, converting collateralized reinsurance or retrocession arrangements into investable notes with features more like a catastrophe bond, so fully securitized and with secondary transferability as an option.

We’ve learned today that Eclipse Re Ltd. has issued $25 million of Series 2024-2A notes, on behalf of Segregated Account EC62, with these notes having a final maturity date of March 31st 2025.

The $25 million of Series 2024-2A notes issued by Eclipse Re have been privately placed with qualified investors and admitted for listing on the Bermuda Stock Exchange (BSX) as insurance-linked securities.

As ever, we make the assumption that this latest private cat bond issuance features a reinsurance or retrocession transaction that has been transformed utilising the Eclipse Re structure, in order to create and issue a series of investable, securitized catastrophe bond notes, typically for an ILS fund manager or investor portfolio.

We don’t know the underlying trigger or peril(s) for this private catastrophe bond deal, but assume they will be some kind of property catastrophe reinsurance or retrocession risk.

The proceeds from the sale of this $25 million of Series 2024-2A private cat bond notes issued by Eclipse Re will have been used to collateralize the related reinsurance or retrocession contract, held in a trust, enabling the risk transfer and the creation of investable catastrophe-linked securities.

Given the maturity date of this private cat bond is for the end of March 2025, it is likely this deal represents the securitization of a one year or less duration reinsurance or retrocession arrangement.

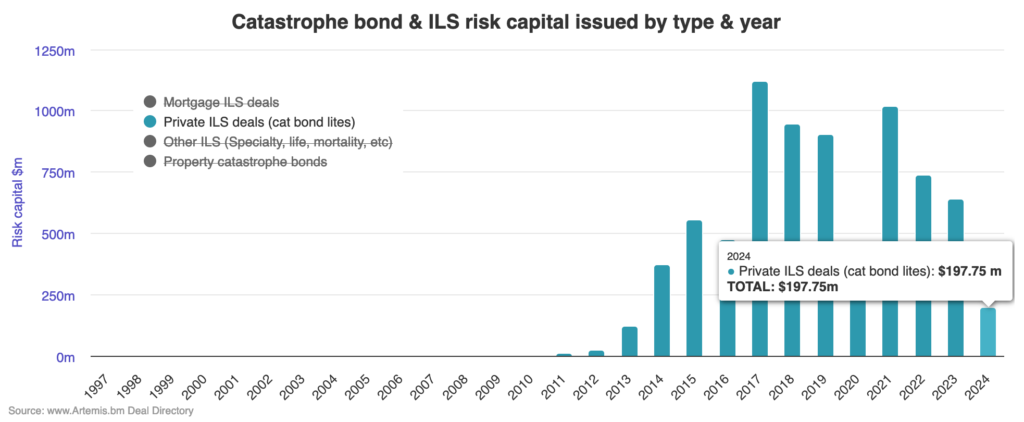

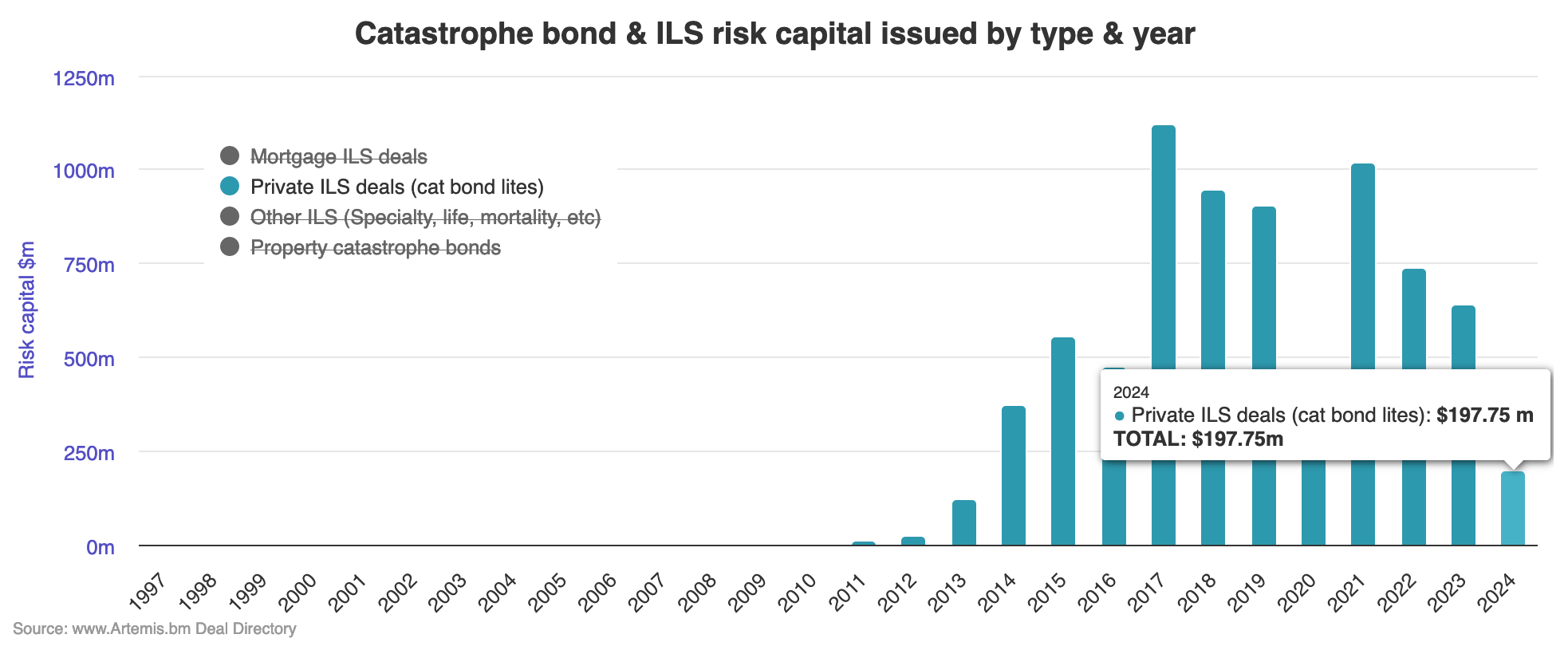

This new Eclipse Re deal takes private catastrophe bond issuance tracked by Artemis to $197.75 million for 2024, so far.

You can analyse private cat bond issuance by year through accessing this chart, where you can split our tracked catastrophe bond and related ILS issuance by type of arrangement, using the key.

Private cat bonds remain a structure that is supportive of cat bond market growth, helping cedents try out the market, either at lower-cost, or with fewer investors, while also providing a mechanism for ILS managers to securitize excess-of-loss risks for their funds.

Analyse private catastrophe bond issuance by year using our interactive chart.

You can view details of every private cat bond we’ve tracked by filtering our Deal Directory to see private ILS transactions only.