Eclipse Re issues $12.5m in notes, private cat bonds near $400m in 2024 so far

Two more series of private catastrophe bond notes have been issued by the Artex Capital Solutions managed Eclipse Re Ltd. vehicle, with these new deals amounting to almost $12.5 million in risk capital, taking total private catastrophe bond issuance for 2024 so far to nearly $400 million, according to Artemis’ data on the cat bond market.

It takes the number of private cat bond, or cat bond lite, issuances by the Eclipse Re Ltd. structure to seven for 2024, for a total risk capital issued of almost $179.4 million at this time.

Including these two new series of cat bond lite notes Eclipse Re has issued, with seven series coming to market in 2024 so far it also makes the structure the busiest of those we are able to track.

Although remember, we can only track the notes that list on the Bermuda Stock Exchange (BSX), or where the information comes available to us, so there are likely many more of these Rule 4(2), Regulation D and Regulation S type ILS and cat bond securities in the market.

Eclipse Re Ltd. is a Bermuda registered special purpose insurance (SPI) company and segregated account platform, that is owned and managed by insurance-linked securities (ILS) market facilitator and service provider Artex Capital Solutions.

Eclipse Re typically acts as a risk transformation structure, operating on behalf of ILS fund managers and investors, converting collateralized reinsurance or retrocession arrangements into investable notes with features that are more akin to a catastrophe bond, so fully-securitized and with secondary transferability as an option.

In this case, Eclipse Re Ltd. has issued a just slightly under $5 million tranche of Eclipse Re Ltd. (Series 2024-3A) notes and a $7.5 million tranche of Eclipse Re Ltd. (Series 2024-4A) notes.

These two issues, being the sixth and seventh to come to light from Eclipse Re, fill in the gaps in series numbering, with now 2024-1A to 2024-7A all listed in our extensive cat bond Deal Directory.

As ever with these private ILS deals having limited information, we make the assumption they will both provide coverage for property catastrophe reinsurance or retrocessional risks for unknown cedents.

The just below $5 million of Series 2024-3A notes have been issued on behalf of Eclipse Re’s Segregated Account EC63, with these notes having a final maturity date of May 31st 2025.

The $7.5 million of Series 2024-4A notes have been issued on behalf of Eclipse Re’s Segregated Account EC64, with these notes also having a final maturity date of May 31st 2025.

As a result, given the maturity dates for these private cat bonds is for the end of May 2025, we expect they represent the securitization of a one year or less duration reinsurance or retrocession arrangement, likely from the mid-year renewals.

Both series of notes issued by Eclipse Re have been privately placed with qualified investors.

We make the assumption that they feature reinsurance or retrocession arrangements that has been transformed using the Eclipse Re structure, to create and issue a series of investable, securitized catastrophe bond notes, typically for an ILS fund manager or investor portfolio.

We don’t know the underlying trigger(s) or peril(s) for these private catastrophe bonds, but assume they will be some kind of property catastrophe related risk.

The proceeds from the sale of the almost $12.5 million of private cat bond notes across these two series issued by Eclipse Re will have been used to collateralize a related reinsurance or retrocession contract, with funds held in a trust, enabling the risk transfer and the creation of investable catastrophe-linked securities.

As we said, with these sixth and seventh Eclipse Re deal’s of the year included, private catastrophe bond issuance from that structure that has been tracked by Artemis has now reached almost $180 million for 2024, so far.

In total, private catastrophe bond issuance across all structures tracked year-to-date by Artemis now stands just shy of $400 million, at almost $397.2 million.

Which means Eclipse Re is currently responsible for just over 45% of 2024 private catastrophe bond issuance so far.

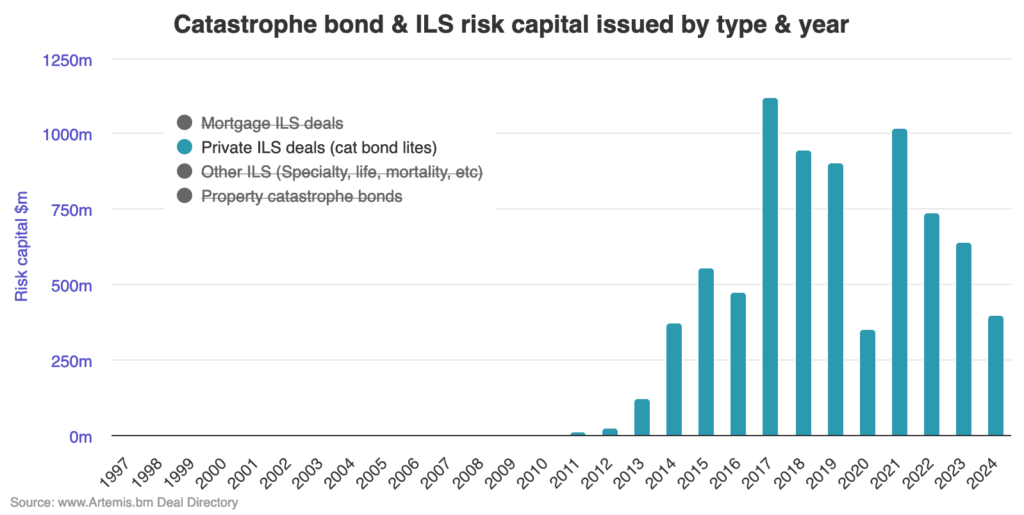

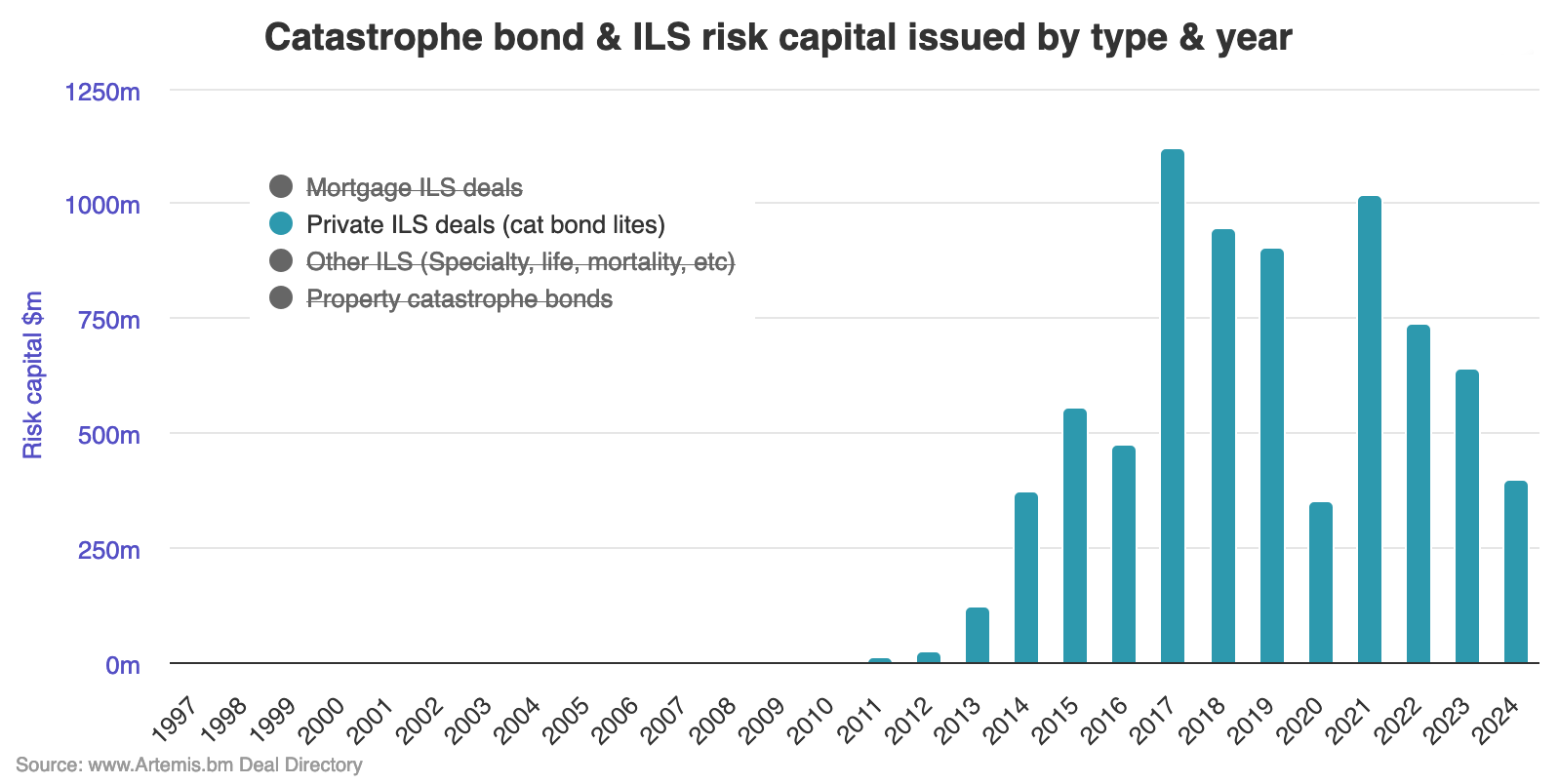

You can analyse private cat bond issuance by year through accessing this chart, where you can split our tracked catastrophe bond and related ILS issuance by type of arrangement, using the key.

Analyse private catastrophe bond issuance by year using our interactive chart.

You can view details of every private cat bond we’ve tracked by filtering our Deal Directory to see private ILS transactions only.