Do you need extended care insurance?

Do you need extended care insurance? | Insurance Business America

Guides

Do you need extended care insurance?

Extended care insurance helps protect your retirement fund from the high cost of long-term care. Find out what other benefits this policy offers in this guide

Once you turn 65 years old, there’s roughly a 70% chance that you will eventually need long-term care support or services, according to the latest estimates from the Administration for Community Living (ACL). But the high cost of these services can easily deplete your retirement savings.

Unfortunately, your health insurance won’t cover this type of expense. To be protected, you will need to take out extended care insurance, more popularly known as long-term care insurance (LCTI).

Insurance Business discusses the pros and cons of this form of coverage in this article. We will also give you a walkthrough of the different factors to consider when searching for the right plan. If you’re planning for your own care or helping an older loved one, this guide can prove useful. Read on and find out the answers to the most pressing questions about extended care insurance.

Extended care insurance pays for the cost of long-term medical and non-medical services for seniors who have lost the ability to care for themselves due to age-related impairments. This type of care can be accessed in the following venues:

At home

Assisted living facilities

Nursing homes

Adult day care centers

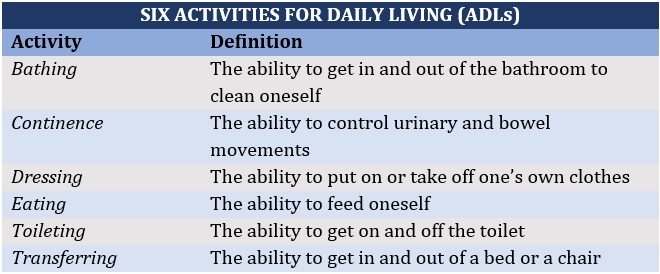

The eligibility requirements for long-term care benefits under this form of coverage vary from state to state. But generally, you will need certification from a reputable healthcare provider stating that you can no longer perform at least two of the six activities for daily living (ADLs) without “substantial assistance.” These ADLs, also called benefit triggers, are listed in the table below.

Once you make a claim against your policy, your insurance provider will assess your ability to perform these tasks. Only when your insurer confirms that you need assistance can you begin receiving payments.

Some elder care insurance policies may also provide coverage if you suffer from a debilitating condition, including:

Alzheimer’s disease

Amyotrophic lateral sclerosis (ALS) or Lou Gehrig’s disease

Dementia

Multiple sclerosis

Parkinson’s disease

Schizophrenia

In most instances, you will be required to pay for the cost of long-term care services out of pocket for a certain timeframe, called the elimination period. This often lasts between 30 and 90 days, after which your insurer starts the reimbursements. Extended care insurance plans pay out up to a daily limit until the policy reaches its lifetime maximum.

Some insurance providers offer married couples a shared care option. This type of plan allows couples to share the total coverage amount and draw from each other’s pool of benefits once one of the spouses reaches their policy’s limit.

Apart from a standard extended care insurance policy, you can access long-term care coverage through the following:

1. Purchasing an extended care insurance rider

If you have life insurance, you can also purchase a rider to access extended care coverage. This add-on allows you to use a portion of the policy’s death benefits to cover for your long-term care needs. You can find out more about how life insurance works in this guide.

2. Taking out a hybrid policy

Some insurers let you pair your extended care insurance policy with an annuity or your life insurance plan. Also called a linked-benefits or hybrid policy, this provides separate coverage for your long-term care needs, eliminating the need to tap into your death benefit.

ACL’s data above indicates a strong likelihood that you’ll be needing some form of long-term care support once you reach senior age. The agency, which is under the US Department of Health and Human Services, also reveals that women typically need extended care for an average of 3.7 years. Men, meanwhile, need it for around 2.2 years. A quarter of all seniors, regardless of their gender, may also require care services for more than five years.

Without proper coverage, you’ll have to pay for such expenses yourself – and these can prove costly.

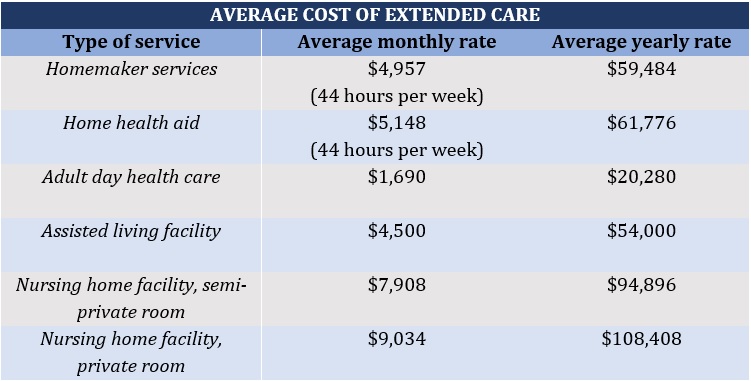

The table below shows the average costs of long-term care based on Genworth’s latest cost of care survey.

Given the costs, elder care services can eat into your retirement savings very quickly. Extended care insurance can help protect your retirement funds.

While you can get assistance through Medicaid, your choices are often limited to nursing home facilities that accept payments from the government program. You can also access Medicaid only if you’ve used up most of your savings. Despite this, it still won’t cover all your assisted living costs.

Purchasing long-term care coverage gives you more options for getting the best care possible.

Another benefit of an extended care plan is that the costs are deductible from your federal taxes.

According to the Internal Revenue Service (IRS), qualified taxpayers are allowed to deduct a portion of their long-term care premiums on their tax returns as “unreimbursed medical expenses,” depending on their age. However, you must itemize these deductions, which must also not exceed the adjusted gross income (AGI) threshold.

Here are the latest deduction limits based on the data gathered by the American Association for Long-Term Care Insurance (AALTCI).

2023 extended care insurance tax-deduction limits

Attained age before close of taxable year

2023 limits

2022 limits

40 and under

$480

$450

Over 40 but under 50

$890

$850

Over 50 but under 60

$1,790

$1,690

Over 60 but under 70

$4,770

$4,510

Over 70

$5,960

$5,640

Long-term care insurance plans also come with tax-free benefits. This means that you will not be taxed for any benefits that you receive from your policy.

To sum up, here are the top reasons why you should take out extended care insurance, especially if you can afford to:

It helps protect your retirement fund.

It allows you to access the best care possible.

Premiums can be deducted from your federal taxes.

The benefits you receive are tax-free.

You can learn more about how long-term care insurance works in this guide.

Extended care insurance is often accessible only to those who can afford to pay the premiums. So, this may not be an option for low-income individuals.

But one of the biggest drawbacks of taking out this type of policy is the risk of losing all the premiums that you’ve paid over the years. If you end up not needing long-term care services, for instance, you generally can’t qualify for coverage. This means the money you’ve spent on premiums goes down the drain.

The AALTCI recently released its latest price index detailing how much policyholders of different ages, gender, and marital status can expect to pay in yearly premiums. The table below sums up the costs for an extended care insurance policy worth $165,000. The rates below are for “Select” health policies, which are more expensive than “Preferred” health plans.

AALTCI – Long-term care insurance price index

Purchase Age

Yearly premiums

Single male, 55

$900

Single male, 60

$1,200

Single male, 65

$1,700

Single female, 55

$1,500

Single female, 60

$1,960

Single female, 65

$2,700

Married couple, both 55

$2,080 combined

Married couple, both 60

$2,550 combined

Married couple, both 65

$3,750 combined

Just like other types of insurance policies, premiums for extended care insurance plans are calculated using a range of variables. These include:

Health status: If you put off buying insurance until you already have health issues, you can expect more expensive premiums, or worse, having coverage denied.

Age: You can expect lower rates if you choose to purchase your policy at a younger age. The main drawback to this is that you’ll be paying your premiums longer.

Gender: Women generally pay more than men. Statistically, they tend to have longer lifespans, increasing their likelihood of making a claim.

Marital status: Married couples typically get less expensive premiums than their single counterparts. Spouses also have the option of purchasing shared benefits.

Insurer: The rates vary between extended care insurance providers.

Level of coverage: Higher daily and lifetime limits, as well as additional features – such as inflation protection and shorter elimination periods – can push up your insurance costs.

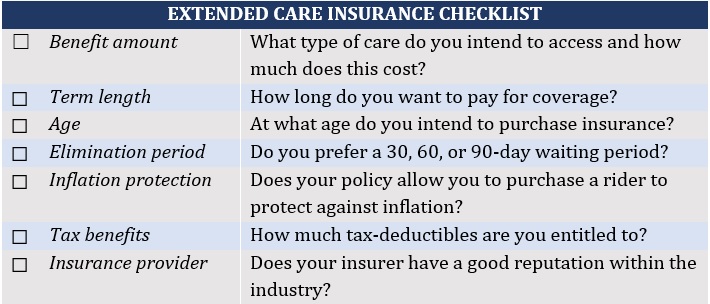

To find the coverage that matches your potential long-term care needs, there are several factors you need to consider. These include:

1. Benefit amount

This entails evaluating the type of elderly care services that you expect to receive and how much it will cost on a daily basis. One thing to consider is that long-term care expenses can vary significantly depending on where you live and where you intend to access care. Care services from a private nursing facility, for instance, are more expensive than those for at-home care.

2. Term length

Some insurers will let you choose how long you want to pay for the policy – usually ranging from two years to a lifetime. One major determining factor here is your medical history. If your family has a history of a debilitating illness that will require years of care, it may be advisable to opt for a longer benefit period.

3. Age

Industry experts recommend taking out an extended care insurance policy between your mid-50s and early 60s. Taking out coverage at a younger age can help reduce your premiums, although you will also need to make payments longer.

4. Waiting or elimination period

Insurance providers often impose waiting periods of 30, 60, or 90 days before you can start receiving benefits and reimbursements. This means you will need to pay for medical expenses out of pocket for a certain timeframe. A longer elimination period also decreases the premiums you pay.

5. Inflation protection

Medical costs have soared in the past several years due to inflation. Many insurers offer riders to protect against this. Such add-ons result in yearly increases in the daily benefits but also drive up your premiums.

6. Tax implications

Insurers often offer tax-qualified policies, which come with tax-free benefits and deductible premiums. The deduction amount, however, differs depending on how old a taxpayer is.

7. Company reputation

It is crucial for you to practice due diligence and choose an insurer that is both financially stable and committed to providing its policyholders with the best possible care.

Here’s a sample checklist of the factors you need to consider when taking out extended care insurance.

Another way to ensure that you’re getting the right coverage is to keep abreast of the latest industry developments in the long-term care insurance space. You can do this by bookmarking and regularly visiting our Life & Health News section. Here, you can find breaking news and the latest industry updates.

Do you think extended care insurance is a worthwhile investment? Feel free to share your thoughts in the comments section below.

Keep up with the latest news and events

Join our mailing list, it’s free!