Dividend Recognition is Going to Get Interesting

Podcast: Play in new window | Download

Dividend recognition dictates the policy a life insurance company has regarding what it does in the event a policyholder takes a loan out against his/her whole life policy. If the company practices non-direct recognition then it does not adjust the dividend in the event there is a loan against the policy. The company pays the exact same dividend rate to all policies regardless of the outstanding loan. If the company practices direct recognition, then the company makes an adjustment to the policy due to the outstanding loan.

For years, certain marketers claimed that non-direct recognition was the superior policy because it ensured a certain arbitrage that greatly benefited policyholders. A sort of magic so special that it served as the underpinnings of such fantastical ideas as Bank on Yourself® and other self-financing-through-life insurance schemes.

From experience, I can tell you it’s a heck of a lot easier to explain–so long as you don’t have someone who wants to dive into how a company can afford to continue to pay a dividend on money it doesn’t technically have anymore. But we’ve long held the position that dividend recognition is a tertiary at best consideration when selecting the right whole life policy for one’s specific needs.

And for good reason, while direct recognition policy companies outnumber the non-direct recognition companies by a good margin, there are still several that practice the much older non-direct recognition policy, and not all of them manufacture stellar policies. If you bought MetLife or Ohio National whole life policies during the past 10 years because they were non-direct recognition, you’re ruing that decision, aren’t you?

So while some marketers claimed that non-direct recognition was the silver bullet to financial success, we expressed our dubiousness and supplied numerous accounts of where it failed to produce the superior wealth creation many claimed it would.

And now, I suspect things are about to get interesting.

Interest Rates are Going Up!

Oh happy day for the life insurance industry, interest rates are on the rise. This means their primary investment tool–corporate debt–is about to produce much higher returns. This of course means that we can anticipate higher dividends in the near-ish future. But there is a small functional problem that might unfold soon and it’s not good news for your non-direct recognition contract.

Robbing Peter to Pay Paul

Non-direct recognition insurance companies do not possess magical powers. In order to pay everyone the same dividend regardless of loan status, they must take the money from somewhere to accomplish this feat. Somewhere, is the other policyholders who don’t take loans out against their policies.

The last time we saw inflation this high, and then experienced interest rate levels necessary to combat it, non-direct recognition caused a big problem for the life insurance industry.

At the time, it was the only dividend policy life insurers used. And it posed a serious threat to their financial stability. Insurers had a problem to manage. How do we balance the loan interest we collect from policy loans with the pressure to pay higher dividends in general? This created a spread that was way too far apart for insurers to manage, and so they kept dividend rates low–much to the chagrin of policyholders. They also faced a problem with policyholders borrowing at one–much lower rate–and using the loans to buy things like CD’s at considerably higher rates. The disintermediation that ensued was quite troubling.

And out of necessity comes innovation…

Direct Recognition, the Answer to the Problem

Direct recognition first came on scene as a mechanism to combat the above-mentioned problem. It coupled loan and dividend rates for a certain component of the policy–the portion pledged as collateral for a loan. This led to two things happening.

First, it allowed insurers to raise dividend rates because they were no longer worried about managing the spread between dividend rates and loan rates.

Second, it created a strong disincentive for policyholders to take loans as their cash value performed better inside the whole life policy.

Today, further innovation has come along to minimize the negative consequences realized by the second point mentioned. And the adoption of direct recognition has put a lot of insurance companies in a much strong position to equitably return value to policyholders.

Despite this being the case, some insurers still insist on committing to non-direct recognition. Many of them choose this due to the perceived marketability of non-direct recognition. On its face, it sounds like a magic bullet, and the marketing angle of this dividend policy is too good to pass up.

Will Rising Rates be a Problem for Non-Direct Recognition

The short and semi-correct answer is probably. There are a few reasons.

First, life insurers will appear slow to adopt the new interest rate environment. This isn’t because they’re lazy, nor is it because they want to hold back and keep the profits for themselves. Companies that provide dividend-paying whole life insurance to the general public are mutual or mutual-holdings companies and they operate in the best interest of their policyholder.

Insurance companies are kind of like aircraft carriers, they are huge and they manage a lot of assets. It will take time for them to cycle assets and begin to achieve increased yields to the degree necessary to pay higher dividends. I suspect dividend recognition aside, we’re probably 18-24 months away from announcing increased dividend rates.

People are impatient. So if my whole life policy doesn’t appear to crush other fixed-income investments or the interest rate environment appears to lend itself to some other opportunity, I might as well figure out how to make use of that money elsewhere. This manifests at best as policy loans and at worst as complete policy surrender–watch for unscrupulous salespeople with competing products especially target whole life over the next several months due to this vulnerability.

This will likely lead to disintermediation that hits especially hard on the non-direct recognition companies because they will be forced to pay their current dividends despite money flowing out of the company. The good news is they will mostly earn returns on those loans that are near–potentially above–the yields they are achieving right now. The bad news is, potentially, they could be constrained when it comes to purchasing new bonds at higher rates than loan interest affords. Worse yet, this lending activity could cause a revision in planned loan activity–a big deal for non-direct recognition companies–and potentially lead to additional dividend rate reductions.

Second, given the need to carefully manage the spread between loan rates and dividend rates, non-direct recognition life insurers may have their hands tied with respect to announcing a higher dividend. The lower return they achieve on assets due to potential and real loan activity will impede their ability to pay a higher dividend to policyholders. This is exactly what played out last time we had a rapidly rising interest rate environment. Companies that adopted direct recognition were freed from the spread-watching necessity and announced much larger increases in their dividend rates throughout these years. Their dividend rates also fell much more slowly as rates came back down.

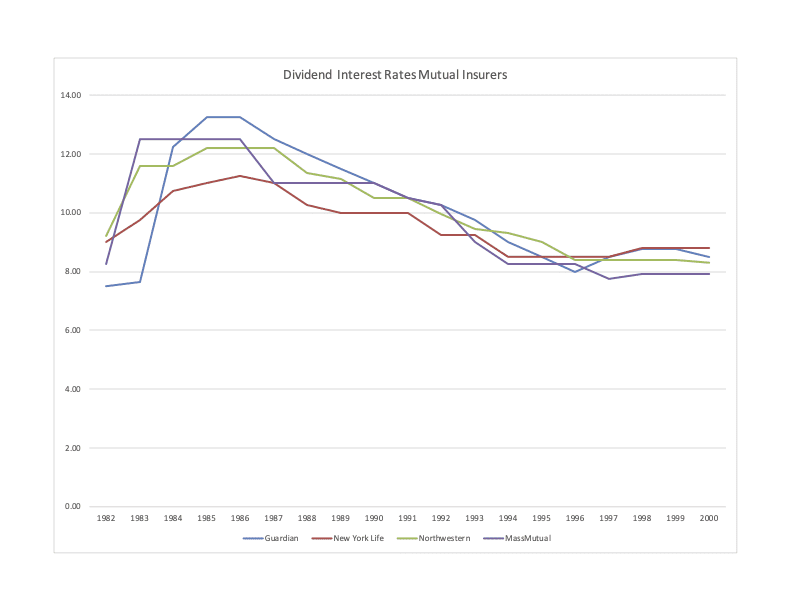

Here’s a chart that compares the four largest mutual life insurers–that remain mutual life insurers today–from 1982 through 2000:

Notice that the first adopter of direct recognition–Guardian–shoots up in the mid-’80s. Later adopter Northwestern Mutual also increases, while non-direct recognition policy companies MassMutual and New York Life experience smaller increases and quicker declines in their dividend interest rates throughout the period.

What to Do if you Own Non-Direct Recognition Whole Life Insurance

Step one is to remain calm. There is no reason to worry just yet. Also, keep in mind that you most likely bought your policy as a long-term wealth accumulation plan and what will unfold is likely temporary.

That said, this is a shining example of a major non-direct recognition weakness. And it should cause some pause for people who look to buy a whole life policy based purely on its non-direct recognition status.

The good news is this will likely force spreads at companies that practice non-direct recognition smaller. There are times that these companies abuse coincidentally high spreads to sell more life insurance. We warned about this possibility at MassMutual back in 2012 and watched that spread go from 200+ basis points to 100 basis points, which dramatically changes the way projected values and real results unfold. The good news for us is that we never forecasted results at MassMutual with a spread over 100 basis points.

Lastly, if you bought your whole life policy purely for its guaranteed death benefit, then the majority of this discussion is moot in your case. This situation significantly impacts people who sought whole life insurance as a wealth-building tool. For those who bought it looking at cash value as a coincidental component of whole life insurance ownership, what happens to the dividend over the next several years isn’t all that important. And the one thing I’m confident of is that none of these companies is going bankrupt because of this.