Disability insurance: What is it and how does it work?

In this article, Insurance Business gives you a rundown of what disability insurance covers, how the different types of policies work, and which demographic needs this type of coverage the most. If you’re looking for a plan that will best protect you financially if circumstances take away your ability to work, this piece can serve as a useful guide. For the insurance professionals who typically read our website, use this as a guide for clients who have questions about disability insurance.

Disability insurance is a type of policy that pays out a portion of your income if an unexpected illness or injury prevents you from working and earning a living. Coverage may be available through your employer, the government, or private insurers.

There are two main types of disability insurance policies, according to the Insurance Information Institute (Triple-I). These are:

Short-term disability insurance: Provides immediate protection after an incident, with waiting periods between zero to 14 days and maximum benefit period of two years.

Long-term disability insurance: Offers financial protection for disabilities that can last for more than two years, but with longer waiting periods, usually ranging from several weeks or several months. Some policies provide coverage until retirement age.

Plans that combine short-term and long-term benefits are also available. In this type of policy, long-term coverage takes effect after short-term disability insurance runs out. If you plan on taking out a long-term policy, you can customize your plan and access additional benefits in the form of riders. These add-ons, however, have a corresponding impact on premiums.

Similarly, you can use other types of policies:

Group disability insurance: Mostly offered through work, employers typically cover a portion or the entire cost of premiums.

Individual disability insurance: Suits those who do not receive disability cover from their employers and high-income earners looking for additional coverage. This can also be carried over even if you switch jobs.

Supplemental disability insurance: Offers additional coverages that traditional short-term and policies do not provide.

Disability insurance serves as a partial replacement for your income if you’re unable to work due to sudden illness or injury. It can help pay for your daily living expenses. These include:

Groceries

Clothing

Utilities

Children’s education

Mortgage repayments

Car loan repayments

Medical and dental costs

Recreational expenses

If you’re in the US, you can also access two types of federal disability programs under the Social Security Administration (SSA):

Social Security Disability Insurance (SSDI): Designed for people who became disabled after earning enough Social Security work credits within a certain timeframe. Spouses and children may also be eligible for SSDI benefits.

Supplemental Security Income (SSI): Offers financial protection for those with disabilities aged 65 or older who have little to no income and resources.

These programs, however, often have strict eligibility requirements. These include providing proof that:

Your disability is so severe that it prevents you from performing any type of meaningful work at all.

Your disability is expected to last for at least 12 months or that it is expected to result in death.

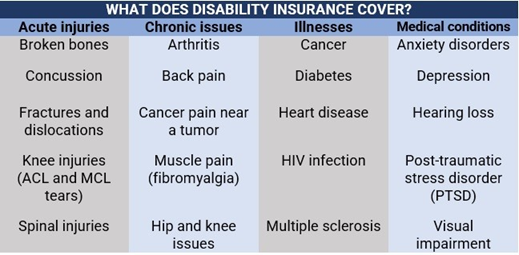

Disability insurance covers most injuries and illnesses, even those that are not covered by workers’ compensation insurance. Some people, however, have a skewed perception of what a disability is, believing that it only applies to severe conditions such as paralysis from an accident or stroke. In reality, many types of disabilities are caused by common health conditions. These include:

Back pain

Digestive disorders

Mental health issues such as anxiety and depression

Pregnancy

The table below lists several examples of medical conditions that disability insurance typically covers.

Although disability insurance covers a range of medical and health conditions, there are certain exceptions that are not covered:

Self-inflicted injuries and illnesses

Injuries sustained while committing a criminal offence

One thing to take note of is that different policies have varying coverages and exclusions, so it pays for you to carefully read your policy document to understand what you are covered for.

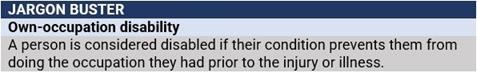

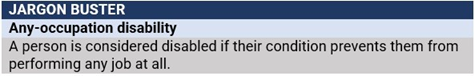

Each insurer defines a disability differently, so they also impose varying requirements that a policyholder must meet before coverage kicks in. Here are the two most common definitions used by disability insurance providers.

If you’re struggling to make sense of different insurance buzzwords, our glossary of insurance terms can help you.

Most of the time, when we think of instances that lead to disability, we picture devastating accidents that cause serious bodily harm. But in reality, most long-term disabilities that force people to miss significant time from work are due to common illnesses – and they happen far more often than you think.

The latest data from the SSA reveals that about a quarter of young people are likely to experience a disabling event at some point in their careers that will cause them to miss work for at least a year. Not having a stable source of income during that period can put families in dire straits.

This figure shows that disability insurance is not just essential for people who work in dangerous professions. Here are the types of individuals who need disability insurance the most:

Breadwinners or sole providers

Professionals in physically demanding occupations

Parents with minor dependents

Individuals with recurring injuries

Just like in other types of policies, premium prices for disability insurance are determined by a range of factors. These include:

Your age: The younger you are and the more financial leverage, the lower the premiums you have to pay.

Your medical history: Depending on your family’s history of certain illnesses, your rates can go up or down.

Benefit amount: This is based on how much income you earn and has a corresponding effect on premiums.

Benefit period: The length of time the insurer needs to pay out your benefit has an impact on premiums.

Waiting period: Also called the elimination period, this is the period between the time you became disabled and when you start to receive the benefits. The longer the waiting period, the lower the premiums and vice versa.

Curious about how insurance premiums work in different policies? Check out our comprehensive insurance premium guide.

Most disability insurance providers give you access to income protection calculators to help you work out how much coverage you need. Some insurers also offer different figures ranging from 40% to 80% of your after-tax income.

Ultimately, however, you will have to strike a balance between what you can afford to pay and the amount you will need to receive to meet daily living expenses should you become disabled.

According to Triple-I, there are two protection features in disability insurance plans that you as a policyholder needs to understand. These are:

Non-cancelable coverage: Insurers cannot cancel this type of policy unless you fail to pay premiums. You can also renew this policy every year without any premium increases or reductions in benefits.

Guaranteed renewable coverage: This works the same as non-cancelable plans. The only difference is that the insurer can raise premium prices as long as it does for all policyholders in the same rating class.

Here are some other options that you need to consider when buying disability insurance.

Additional purchase options: Allows you to purchase additional coverage later.

Coordination of benefits: The policy specifies a target amount from all the benefits you are set to receive because of the disability and the policy will pay out the difference not covered by other policies.

Cost-of-living adjustment (COLA): Adjusts the benefits amount over time based on the cost of living calculated by the Consumer Price Index. This feature pushes up premiums.

Residual or partial disability rider: Allows you to return to work part-time and still receive a partial disability payment.

Return of premium: Requires the insurer to refund part of your premium if no claims are made for a specific period stated in the policy.

Waiver of premium: Allows you to waive premium payments, so you can maintain coverage without a reduction to the benefit amount.

If you have people depending on you financially, purchasing disability insurance can be worth it. Accidents and illnesses strike when you least expect them, and these can adversely impact your ability to earn a living. Having disability coverage can ease some of the financial strain of not being able to receive your normal paycheck until you are physically able to perform your job again.

Disability insurance also works best with the right health insurance plan. If you’re searching for health plans within your budget, you can find everything you need to know about affordable health insurance in this Insurance Business guide.

Which jobs do you think need disability insurance the most? Talk to us in the comments section below.