Dental insurance in Canada: why you need it

When it comes to dental and oral care, Canadians are mostly responsible for finding ways to finance different treatments and services. Here are four ways you can do so:

Through third-party insurance or coverage that you get from your employer

Through private dental insurance or coverage that you have taken out on your own

By paying for treatments and services directly out of pocket

Through government-subsidized programs, if you meet eligibility requirements

The reason is that general oral and dental health care is not covered under the Canada Health Act (CHA).

Here’s how coverage works in these four types of financing:

1. Employer-sponsored dental insurance

Most businesses have a deal in place with insurance providers, which charge them a set premium for each worker. This means that if you’re gainfully employed, you can likely access dental coverage through your employer.

Company-sponsored dental insurance often follows a fee-for-service model, where your employer pays for a portion – sometimes even all – of the cost, with you being responsible for covering the rest.

The payment process is also pretty straightforward:

First, you inform the dental employee of your insurer’s name.

Then, the staff checks to see how much your employer covers.

Lastly, you pay for the portion not covered by your dental insurance.

You can also set up a payment schedule if you cannot settle the remaining bill directly.

2. Private dental insurance

In private dental coverage, the amount you pay often depends on the type of plan you have. Most policies follow an 80:20 copayment system, also referred to as coinsurance. This is where the dental plan pays for 80% of the bill, with you covering the rest. Some policies, however, follow this system mostly for basic preventive care such as teeth cleanings and x-rays. For more complex restorative treatments – including bridges and crowns – the split is usually 50:50.

Copayment, coinsurance. You may have to deal with a lot of buzzwords when taking out dental insurance. Don’t worry. You can find the meaning behind common industry jargon in this glossary of insurance terms that Insurance Business prepared.

Another thing you need to take note of is that Canada has strict rules about copayments. According to the Canadian Dental Association (CDA), the waiving of copayments is considered insurance fraud, which is a federal crime. Dentists who are found to be doing so face hefty fines and risk having their licenses revoked.

To prevent this from happening, you and your dentist are required to sign a claim form, stating the type of services provided and how much these cost. The insurer will then verify the expenses and pay for their portion of the cost, with the expectation that you will cover yours.

3. Direct pay

If dental insurance is not for you, you can choose not to take out coverage and instead only pay for treatments and services when the need arises. You can just set aside a portion of your income in your dental emergency fund, which you can withdraw from when you need to visit your dentist.

We will discuss how much different dental procedures cost in Canada in one of the sections below.

4. Government-subsidized dental programs

Some dental services are covered through government-sponsored dental programs. The eligibility requirements and the types of services, however, vary depending on the province. If you want to know if you are qualified for these programs and what services are offered, you may want to talk to your local public health unit or visit their websites through the links below:

Last December, the Canadian government also opened applications for the Canada Dental Benefit program, an initiative aimed at providing free dental care for children aged 12-years old and below. Coverage applies to treatments and procedures taking place between October 1, 2022 and June 30, 2023.

This comes as part of the NDP’s push for nationalized dental care in Canada, with this being a first step towards a nationalized dental system for all if Canadians push for it. The compromise, for now, with the Liberal government was for it to cover children up to 12.

Different dental insurance policies in Canada offer varying levels of coverage. Most basic plans pay out for preventative dental care services, which includes the following:

Check-ups

Cleaning or scaling

Dental examinations and diagnosis

Fillings

Simple extractions

X-rays

Other laboratory tests

More extensive plans also cover restorative dental treatments such as:

Bridges

Crowns

Dentures

Endodontics (dental pulp)

Inlays/onlays

Oral surgery

Periodontics (gums)

Root canals

Most comprehensive dental insurance plans also cover orthodontic procedures, which include braces and other corrective dental treatments. But just like many restorative services, copayments for orthodontic procedures follows a 50:50 model, meaning you will need to pay for half of the bill.

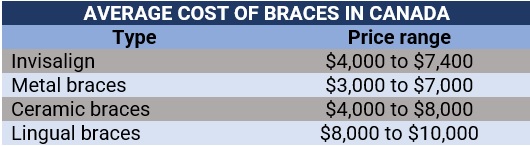

Getting braces in Canada can be expensive as well. This is often the main reason why many Canadians are hesitant to get them even if the need arises. The cost primarily depends on the kind of braces you choose, with the average price ranging between $3,000 and $10,000. The table below details how much the different types of braces can cost you.

While most health and dental insurance plans do not cover pre-existing conditions – including dental issues – there are some insurance providers that offer guaranteed acceptance plans that cover medical and dental conditions you may have before taking out the policy. These plans, however, may come with higher premiums.

If you’re searching for dental insurance that can provide cover to your pre-existing dental issues and don’t know where to look, an experienced insurance agent or broker can help steer you in the right direction.

Many dental insurance plans cover treatments and procedures deemed necessary by either a dentist or other medical professionals. This means cosmetic procedures such as teeth whitening and composite or tooth-colored fillings are excluded from coverage. Some policies also do not cover pre-existing conditions.

As mentioned, basic dental insurance plans limit coverage to preventative care, meaning you will need to pay for the full costs of restorative and orthodontic procedures.

Apart from exclusions, most dental insurance policies come with restrictions. Some plans limit access to preventative dental care services to once or twice a year. Others implement a sliding scale for reimbursement, which increases after the first year. For example:

60% reimbursement for the first 12 months since the policy was taken

70% reimbursement from the 13th to 24th months

80% reimbursement after two years or more

Waiting periods also apply, usually ranging from three months for basic dental care to 24 months for restorative and orthodontic treatments. Insurance companies impose these wait times to discourage customers from taking out policies just to cover impending procedures.

One thing to remember is that the exclusions and restrictions vary between insurers, so it is still advisable for you to check your coverage limits with your dental insurance provider.

Standalone dental insurance plans can start at around $40 per month for individual coverage, $80 for couple’s policies, and $140 for family plans. These are equivalent to $480, $960, and $1,680, respectively, every year.

However, there are other out-of-pocket costs that you need to consider such as insurance deductibles, which can reach up to 25% of the dentist’s bill.

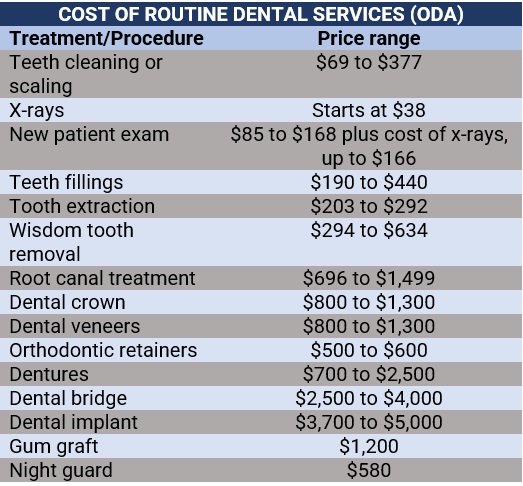

Dental care costs vary across Canada. To help dental professionals provide fair and equitable fees for routine dental services, some provincial industry associations release annual fee guides detailing how much different treatments and procedures should cost. The table below shows the latest costing done by the Ontario Dental Association (ODA) on common dental care services.

Because not all Canadians have access to government-subsidized dental coverage, it may be beneficial for certain individuals to take out dental insurance – but it all depends on one’s personal circumstances and oral health needs.

If you have the benefit of employee-sponsored coverage, then you may not need to purchase a separate dental insurance plan. The same goes if your pearly whites are in good condition, and you only need to visit your dentist for your annual check-up.

But if you need to see your dentist regularly and expect to undergo several dental procedures, getting a private dental insurance policy may be a worthwhile investment. You must bear in mind, however, that not everything is covered by dental insurance. Each policy has different inclusions and exclusions, so it is always best to carefully read your policy document to know what you are covered for.

In addition, dental insurance plans have annual limits, so even if a procedure is covered, you may need to pay for the cost if the amount exceeds the policy’s maximum. There are also several out-of-pocket costs that you need to consider such as copayments and deductibles. In the end, the key to getting the right coverage is finding a dental insurance plan that suits your oral health needs and budget.

Dental insurance works slightly differently south of the border. If you plan on moving to the US and were wondering how your dental care needs will be covered, you can check out our guide to dental insurance in the US.

Do you think dental insurance is something Canadians should invest in, or is it an unnecessary expense? Are you in favour of the NDP’s recent push for nationalized dental care for all? Key in your thoughts in the comment box below.