Democrat, Republican senators debate over cause of rising insurance premiums

Democrat, Republican senators debate over cause of rising insurance premiums | Insurance Business America

Catastrophe & Flood

Democrat, Republican senators debate over cause of rising insurance premiums

One group points to higher spending, inflation, while the other blames climate change

Catastrophe & Flood

By

Kenneth Araullo

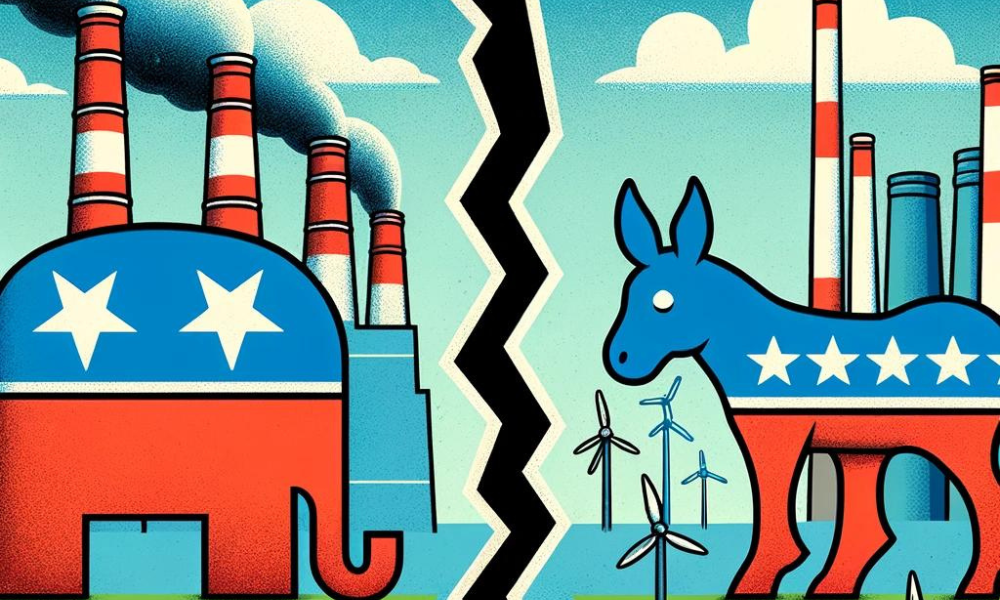

The US Senate Budget Committee held a hearing to discuss the insurance crisis affecting homeowners nationwide, with Democrats identifying climate change as the primary driver of rising premiums, while Republicans pointing to high government spending and inflation.

In his opening statement, Budget Committee chair Sen. Sheldon Whitehouse (D-R.I.) highlighted the situation with Florida’s state-backed insurer, Citizens. Florida faces increased threats from hurricanes, heat waves, and flooding, leading national insurers to either drop plans or raise prices in disaster-prone areas.

As a result, many residents turn to Citizens, which is backed by the state. Louisiana and California are experiencing similar issues.

A report from the Michigan Advance revealed that average homeowners insurance premiums in Florida are just over $4,000 a year, compared to the national average of about $2,700, according to a March report from Florida Today. Whitehouse warned that if Citizens’ payouts for damages exceed its reserves, it could lead to even higher premiums for policyholders.

Whitehouse also noted that the crisis is not limited to Florida. He cited a New York Times investigation showing that in 2023, insurance companies lost money on homeowners policy coverage in 18 states, including Illinois, Michigan, Utah, Washington, and Iowa.

Democratic senators and their witnesses attributed high-damage claims and rising premiums to climate change. Rade Musulin, an actuary for Finity Consulting, testified that Florida’s experience could be a warning for the rest of the country, predicting more extensive or extreme hurricanes and coastal flooding in the coming decades.

Sen. Jeff Merkley (D-Ore.) emphasized the importance of addressing climate resilience to solve the insurance crisis. He argued that fixing the insurance market without addressing the underlying causes would be irresponsible.

Not just a climate issue, Republicans say

Republicans on the committee, however, attributed the rise in insurance prices to government spending and inflation. Iowa Republican Chuck Grassley cited the increased costs of labor and materials and the migration to disaster-prone areas as contributing factors.

Republican witness EJ Antoni from the Heritage Foundation claimed that government action, inflation, and regulatory costs account for approximately 90% of the increase in insurance premiums over the past few years.

Sen. Mitt Romney (R-Utah) also acknowledged climate change as a factor but argued that solving the climate and insurance issues would require global action.

As the summer approaches, homeowners nationwide brace for extreme weather. The National Oceanic and Atmospheric Administration predicts an 85% chance of an above-normal hurricane season, with heat waves already affecting the West.

Whitehouse called on Congress to unite in finding a solution, stressing the importance of addressing climate risk to protect the federal budget and millions of Americans.

What are your thoughts on this story? Please feel free to share your comments below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!