Dedicated reinsurance capital may be up “significantly” by mid-year: Flandro

As macro-economic shifts continue, while confidence in the reinsurance sector among investors has also grown, and reinsurers are looking to maximise the hard market opportunity, it seems dedicated reinsurance capital is set to rise.

David Flandro, Head of Industry Analysis & Strategic Advisory at reinsurance broker Howden Tiger believes that the industry is “coming up on an inflection point.”

In a recent briefing, Flandro explained, “While capacity was largely impaired last year, we’re starting to see early signs of a recovery. It still hasn’t happened yet, but we can see capital constraints like, elevated cost of capital, limited capacity, and macro uncertainty, while persisting, starting to be offset by some new capital inflows.”

Saying that this signals, “A clear growth in appetite on the part of some carriers and possibly early signs of inflation easing.”

Looking at an analysis his team undertook on composite reinsurer capital, Flandro noted the sharp drop-off in 2022.

“This was very significant and it coincided with sharp changes in inflationary trends and interest rates,” he said. Adding, “But if you look closely, you can see capital beginning to recover in the first quarter.”

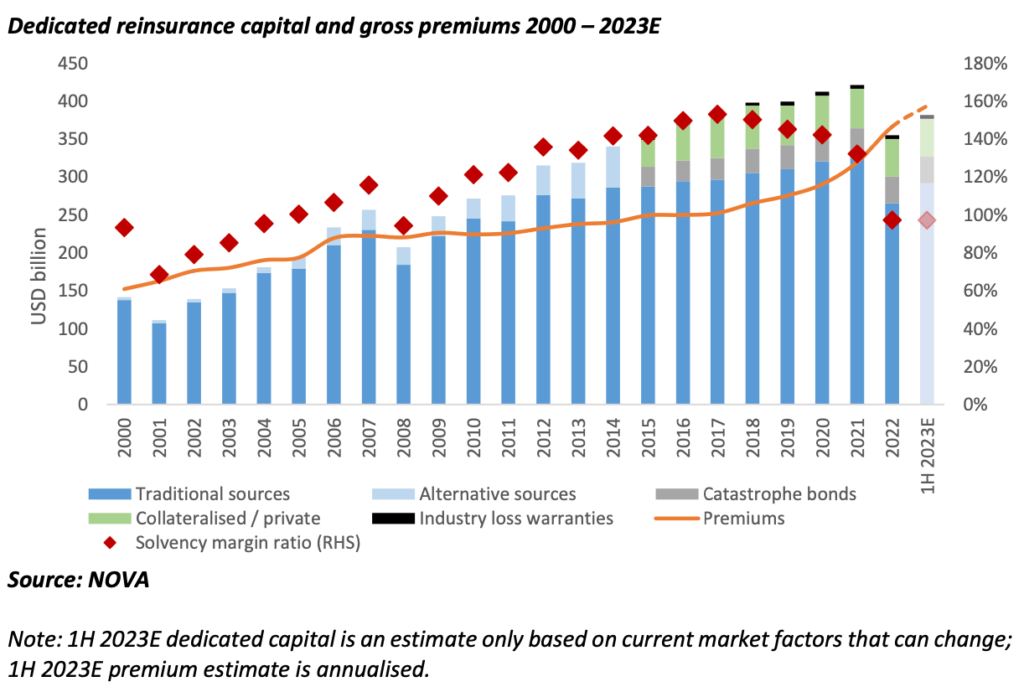

Then, looking at an analysis of dedicated reinsurance capital, Flandro noted the exact same drop-off trend last year.

“But it’s recovering in 2023 and we anticipate that by the end of the first half, it will have gone up significantly,” Flandro said.

Although qualified this by saying, “Still, risk and premiums have gone up significantly as well, meaning that the solvency margin ratio. that’s capital divided by premiums, remains below 100%. But this is changing.”

He also indicated that the increased reinsurance capital levels have offset some of the pressures anticipated for the June renewals, making for a more orderly season.

Also read: Property catastrophe rate-on-line hits record high at June 1st: Howden Tiger.