De-Risk Your Portfolio with Whole Life Insurance

Podcast: Play in new window | Download

We had a really good run with the stock market over the past 10+ years. It seemed like the market was on a non-stop race to higher and higher levels. In fact, many hobbyist investors made unimaginable fortunes by launching blogs and doling out investment advice that largely parroted the long-standing ethos of the now late Jack Bogle. And they looked like geniuses until very recently.

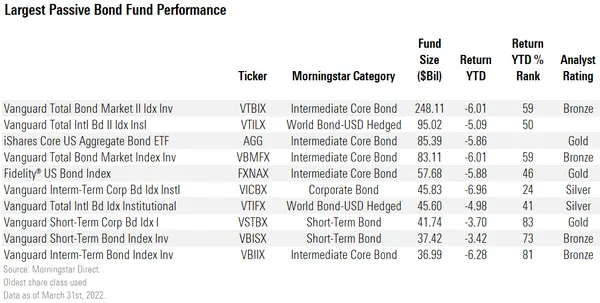

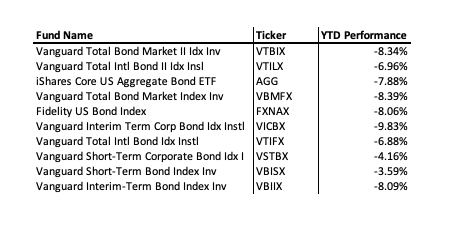

Now everyone is looking to diversify risk and find assets that will shield them from market volatility that won’t go away. Bonds aren’t working. According to Morngingstar, the 10 largest bond funds lost an average of 5.42% in the first quarter of 2022.

And if we look at this same collection of funds, we find that performance worsened since Q1 of this year:

YTD figures are January 1 through August 26 of 2022 using data gathered from the Portfolio Visualizer.

YTD figures are January 1 through August 26 of 2022 using data gathered from the Portfolio Visualizer.

Now the average nominal decline among all the funds is -7.22%. It does remain true that bonds appear safer than the overall stock market. Using the S&P500 Index as our measuring stick, it’s down around 12.62% YTD.

Life Insurance, the Real Flight to Safety

Using either whole life insurance or indexed universal life insurance as a buffer against volatility is something we’ve been doing for a few decades. I’m not looking to make an “us vs. them” argument that seeks to convince anyone that they should immediately sell all of their stocks/bonds and buy up as much life insurance as that will allow. That’s idiotic and has never been the position we take here at The Insurance Pro Blog.

What I do want to argue today is that you can use life insurance as a strategy to de-risk your portfolio with great success if you follow the right path.

First, let me point out that life insurance (excluding variable life insurance products) is a very low or zero volatility product concerning year-over-year account values. It’s engineered to guarantee against losses, and there is a multitude of benefits this affords you. Today isn’t the day we can detail every single one of those benefits, but I want you to hold on to that idea as we unpack the rest of this discussion.

And because it’s extremely difficult to truly grasp what a financial product of any type has to offer when discussed purely in the theoretical sense, I will instead use some examples to more explicitly call out what exactly life insurance has to offer.

De-Risking Your Portfolio with Whole Life Insurance by Moving Assets to Life Insurance

Let’s look at the following situation. Male, age 50 who has accumulated a couple million dollars in assets. He’s on the right track regarding retirement preparedness, but he worries about losses bringing his accumulated assets down. He understands that just because he’s achieved a certain balance up to now, stocks and bonds cannot guarantee that his portfolio will always be worth what it is today or more.

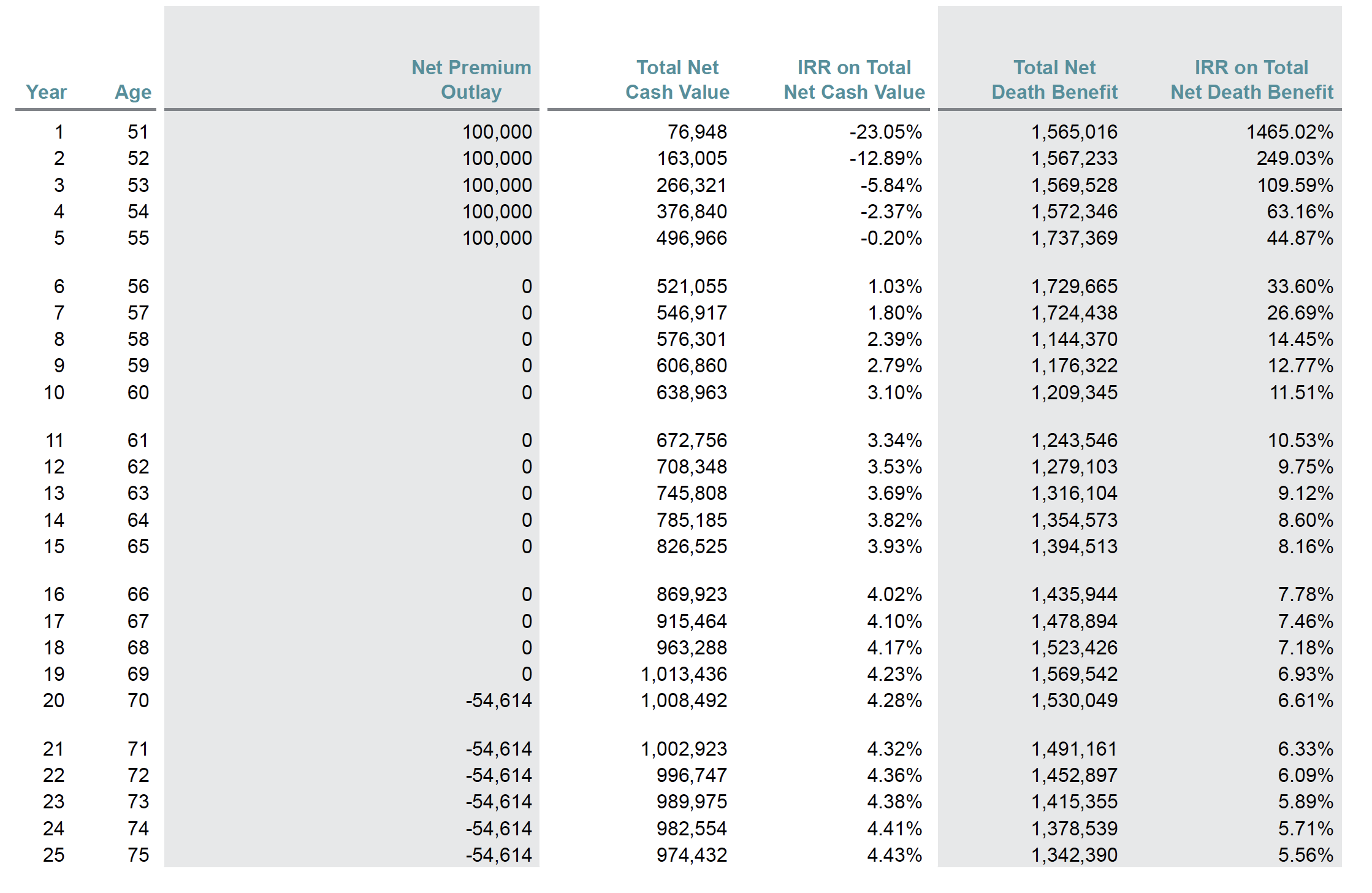

He will sell $500,000 worth of assets and move it to a whole life insurance policy. This policy uses several advanced design tweaks to ensure that it offers the highest possible level of cash value accumulation while minimizing less important offerings from the insurance company (namely death benefit).

Here’s a ledger that projects what he will achieve with this move:

Notice that by 10 years out, he has achieved a 3.10% return on his money. That’s a very attractive result for an asset with a zero chance of turning negative. This result gets even better come year 20 when the result is 4.28%. But the rate of return is an often misleading figure and it means nothing generally speaking when looking to use the money for day-to-day living expenses.

At year 20, he can take an income of almost 5.5% of the account balance, and sustain this income all the way to age 100 (not pictured in the ledger above). This income is free of income taxes, not subject to Modified Adjusted Gross Income calculations, and completely flexible. When I say flexible, I mean he’s not forced to take any specific amount under any specific timeframe–like an annuity benefit or dividend investment might require.

The ability to take an income against this asset that is quite a bit higher than the traditional 4% recommendation comes from the lack of volatility in the asset. The fact that this policy will never experience a year where the rate of return on cash value is negative affords the owner greater withdrawal power. The rate of accumulation might vary, but that has a significantly lesser impact on distributable income than the timing of negative returns.

Remember that he still owns over a million dollars worth of stocks that will hopefully grow at a rate commensurate with normal stock market returns. The whole life insurance play merely locks in a certain amount of asset value to bring peace of mind against future volatility in the stock segment of the portfolio.

Also, it’s important to note that this is all scalable in either direction. If he had more assets and wanted a larger amount going to life insurance or if he had fewer assets and put less into life insurance, the relative results are very similar. I simply bring this up to point out that if your situation is different, that doesn’t exclude you as a candidate for such a strategy.

But there is a different approach that could be the better option for many people.

Setting the Stage to De-Risk in the Future

Now let’s take a look at a different scenario. 40-year-old who is starting to worry about what risks he might face as he draws nearer to retirement. He has saved a decent amount to this point, but he’s wondering if he should tweak his approach to address future risks proactively. He’d rather leave the assets he does have in the market and take advantage of what that will likely produce over the next couple of decades.

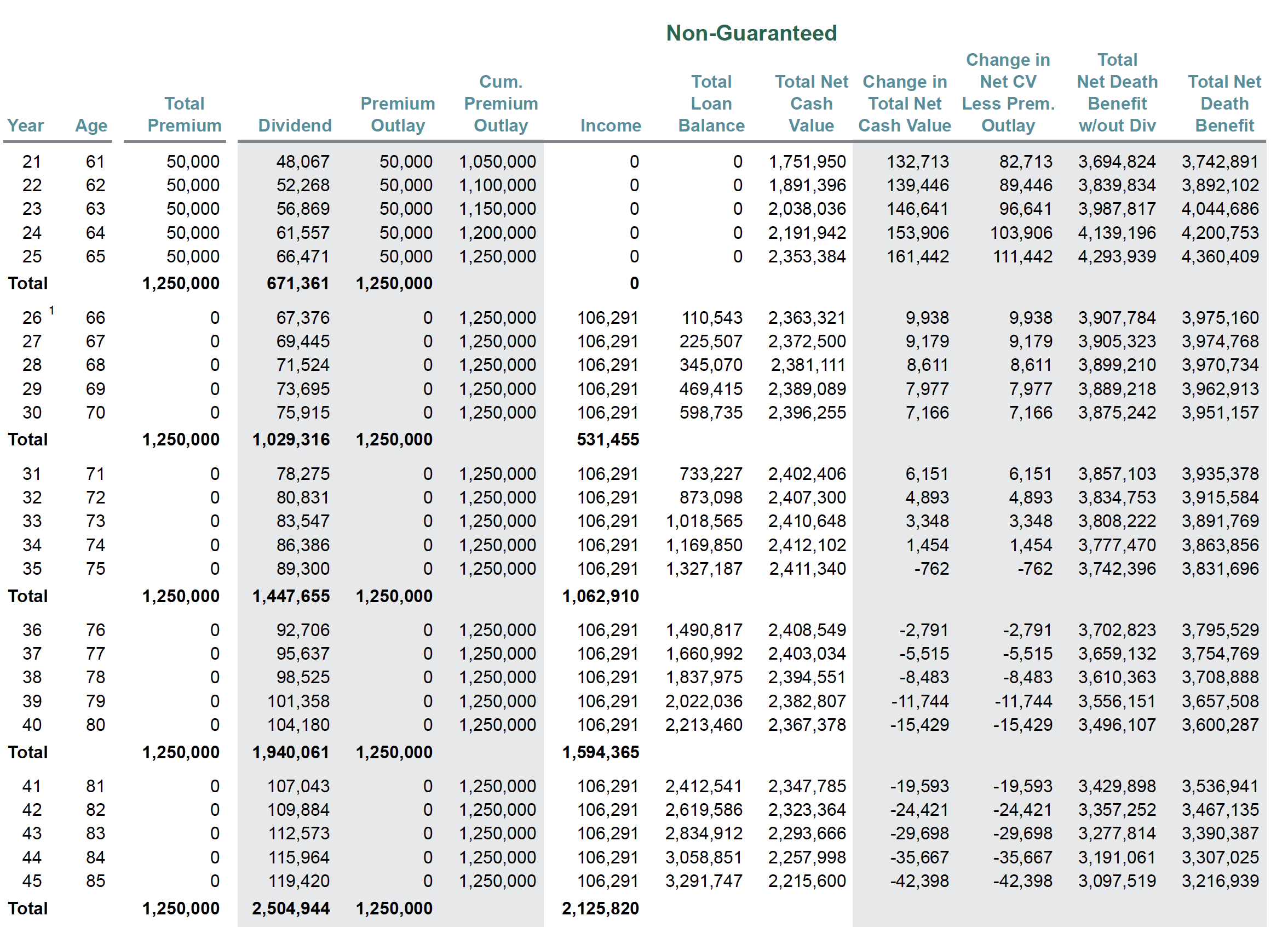

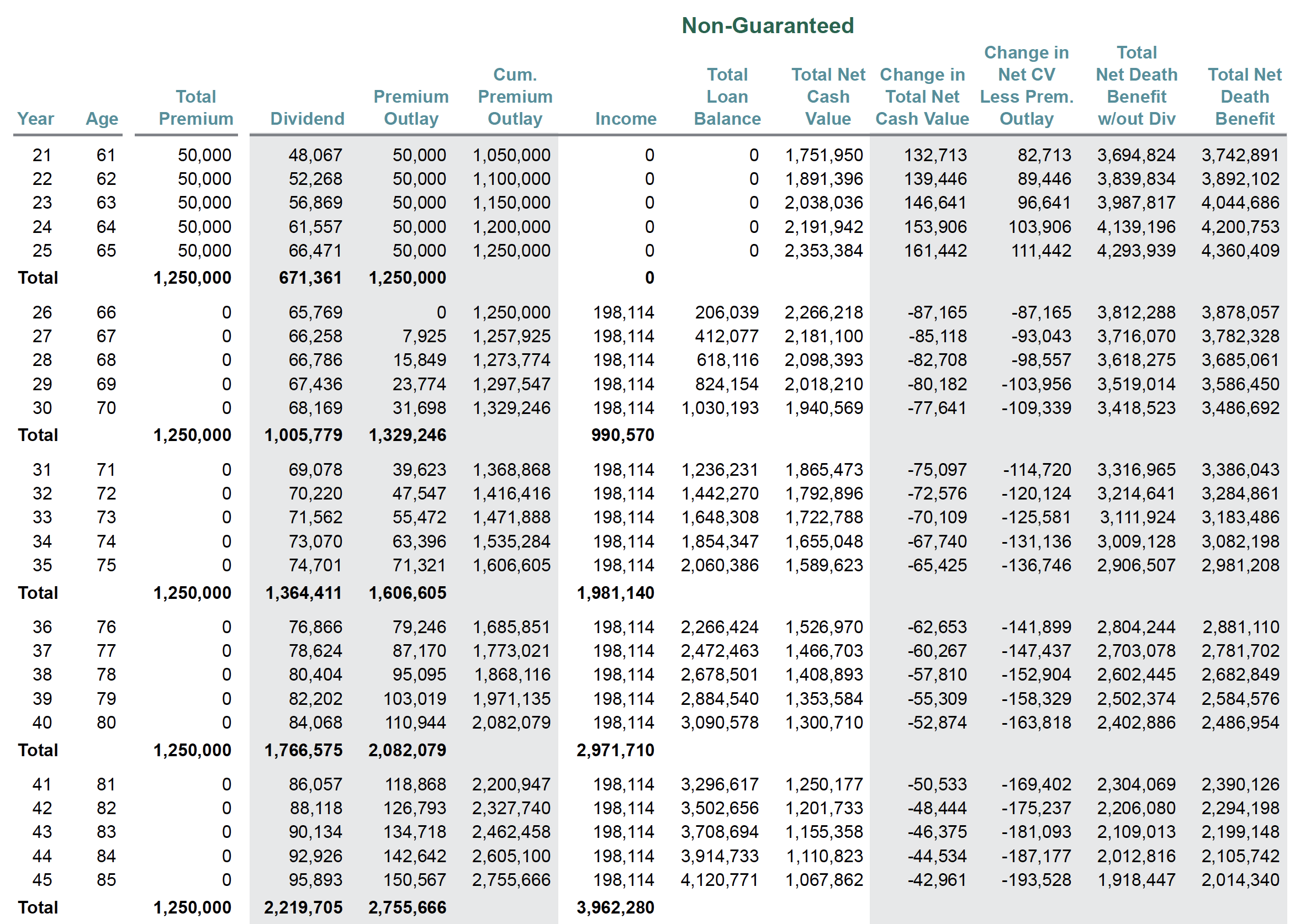

He’ll take $50,000 from the amount of his annual savings and use it in a whole life insurance policy. Normally, insurance agents might show him a scenario very close to this one:

This is perfectly fine and will work quite well as a retirement income asset. But we can make a few tweaks that potentially produce even more buying power from this asset, but coordinating it with his other assets as a de-risking strategy.

We know he’s going to accumulate wealth through other assets beyond just this whole life policy. So what if he took some of those assets and moved them to a less risky allocation within life insurance as he enters retirement?

The income projection above assumes several things about the whole life policy. It assumes a certain dividend. It assumes that the policy owner will take income to age 100 and then stop. It also assumes that the loan used to generate this income will accumulate interest each year and that interest will be added to the loan balance–i.e. not paid by the policy owner.

But what if he did pay the loan interest? What if he took some money from his other assets and made an interest payment each year? This is what happens:

He gains almost $92,000 per year in income. He accomplishes this by effectively moving some of his riskier assets into whole life insurance through loan repayment, thus providing himself with the ability to enhance the more stable and non-taxable income he received from his whole life insurance policy. Notice that during the first five years he pays a total of $79,246 in loan interest and gains $459,115 in income. That’s a sweet tradeoff.

Think of it like this, the income delta here is exactly $91,823. This means that if he’s going to leave money in his other assets, he needs to be sure that he can generate at least that much income–or whatever the equivalent value to him is–per year by leaving the money in the other assets.

Remember that life insurance lacks volatility making its income generation capabilities very strong against other assets. Also, don’t forget that life insurance income figures are net of everything–e.g. taxes and fees.

Even if he chose to stop selling off other assets to pay the life insurance loan interest at some point, he could still generate more income than the original $106,291. It’s at this point that a lot of people will get stuck on what is the precisely right mix. How much of my other assets should I re-deploy into life insurance as I get older to enhance my income? That’s an unknowable answer, and you shouldn’t torture yourself with it. The point of this thought experiment isn’t to prove undeniable the exact method one should take in all circumstances. It’s to point out what’s available. To help people realize just what options they have at their disposal when they incorporate life insurance into their portfolio. And most importantly, how strong an effect life insurance products have on minimizing risk when they are used in this fashion.

And you know what else? There are even more options than you’ll likely notice by reading this here article. And that’s a great subject for another day.