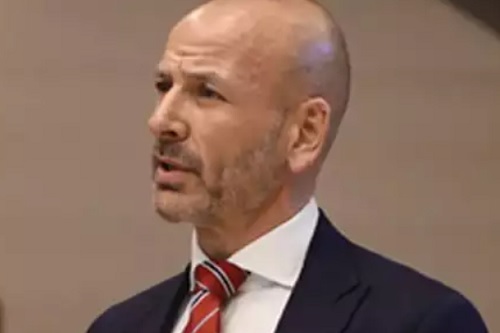

Dave Carey discusses how Aviva is investing in Commercial Lines

Authored by Aviva

In this year’s Insurance Times Broker Service Survey, you rated Aviva’s Commercial Lines service Five Stars*. I’m particularly proud of this recognition and I’d like to say ‘thank you’ for your continued support.

Brokers are integral to our distribution strategy and are the heartland of our business. Through a difficult and challenging period, we’ve made sure we’ve showed up – keeping our teams accessible and increasing capacity so we could stand up and be counted on when you needed us most.

Securing investment, accelerating growth

We’ve been listening to feedback and investing across our Commercial Lines business to meet the needs of you and your clients.

This partnership approach has been one of the key elements to our success. Looking back just five years ago, in 2017, our Commercial Lines business was writing c£1.7bn of Gross Written Premium (GWP). Fast forward to 2022, the business has grown by nearly £1bn, with plans to accelerate further to c£4bn by 2026.

To achieve this, we’ll continue to listen, respond and improve upon what we believe is already a market-leading proposition – from distribution, underwriting and digital infrastructure, through to risk management and claims expertise. Below is a snapshot of some of the changes we’ve made and will be making in response to feedback:

Increasing regional underwriting footprint – we’ve secured investment to expand our already 400-strong underwriting team by 10% – with 21 underwriters already in role. To help support you, our underwriters will have greater authority and expertise to help speed up decision-making. And this is underpinned by using data to drive better conversations, meaning underwriters can quickly identify potential underinsurance cases and provide data-driven reports so your client can make informed decisions. Increasing capability in Specialty – we’re bringing in expertise and creating new solutions to help react to emerging trends in the market. Whether it’s Cyber, Management Liability, Engineering, Accident and Health or Marine Cargo, we’re increasing capability and expertise to make it easier to place this business with Aviva.Greater efficiencies when trading online – across Fast Trade and eTrade, we’re aligning our propositions to bring consistency, no matter how you choose to trade with us. The pandemic highlighted the importance and convenience of online trading and our focus now is to stretch the boundaries of what trading online can offer. We’ve a clear focus on Commercial Combined to be able to place more complex business online, which will be further supported by additional underwriting resource to provide a more seamless journey between online and offline.Digital-first solutions – we know digital is important and it’s an area we place huge emphasis on. Fast Trade has been widely recognised in the industry and the relaunch of our Aviva Broker website enabled us to move to a platform that provides greater opportunities for integrations and developments in the future. As we look to expand our capability, we’ll shortly be launching a new digital tool that’ll give you the ability to make common changes to offline commercial business, as well as functionality on Fast Trade that will automatically read presentations for a faster quote journey.

Growing together

As we grow, we want to make sure you’re growing with us.

All I ask for is to keep the dialogue open – whether it’s through events like our recent Broker Roadshows, speaking to your sales manager or underwriter, or through formal feedback in surveys. Please continue to share and let us know where we’re getting it right, as well as where we need to improve, and we’ll do everything we can to ensure the service and support we provide is what you need from us.

And again, thank you for your support.

Dave Carey

Director of Mid-Market and Specialty Lines, Aviva