Cyclone, floods leave $9bn repair bill in Auckland

Cyclone, floods leave $9bn repair bill in Auckland | Insurance Business New Zealand

Catastrophe & Flood

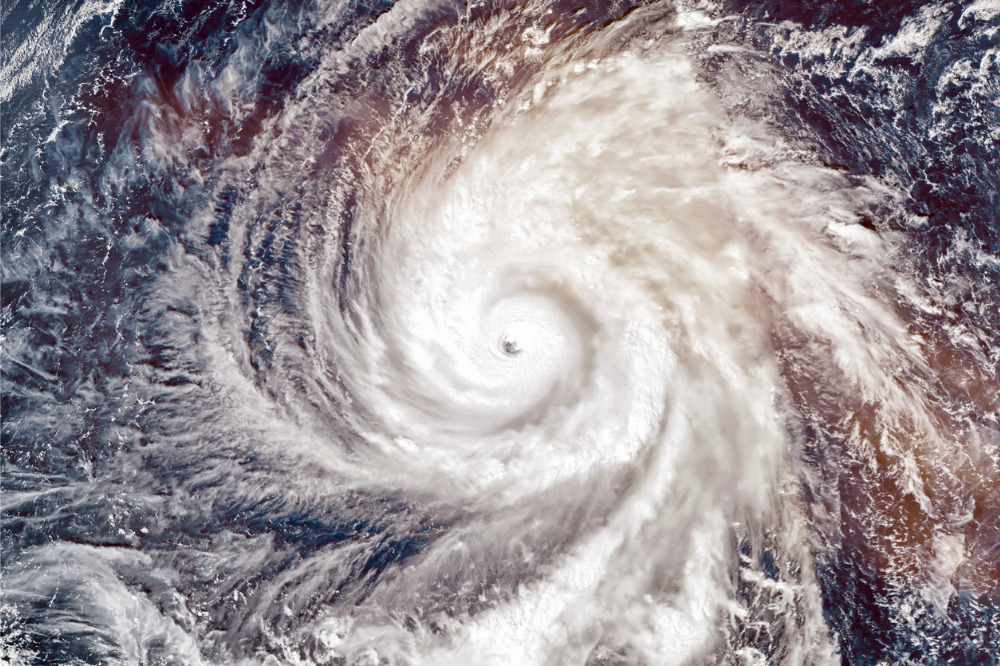

Cyclone, floods leave $9bn repair bill in Auckland

Auckland left reeling from the aftermath of devastating natural disasters

Catastrophe & Flood

By

Miko Pagaduan

Insurance companies are bracing themselves for a significant payout as New Zealand faces a mammoth repair bill from Cyclone Gabrielle and Auckland floods that hit the country in January.

The Treasury estimates the damage will add up to between $9 billion and $14.5 billion, according to a report by Stuff. These estimates include the costs of both insured and uninsured damage.

The damage caused by the cyclone and floods has affected residential property, businesses, and public infrastructure.

According to the Treasury, the damage to residential property is estimated to be between $2 billion and $3.5 billion.

The damage to businesses is estimated to be between $2 billion and $3 billion, and the damage to public infrastructure is estimated to be between $5 billion and $7.5 billion, Stuff reported.

Insurance companies will bear a significant portion of the costs. While some of the damage may not be covered by insurance policies, insured losses are likely to be substantial.

The government has already ruled out a cyclone levy to help pay for the cost of repairs, meaning that insurers will need to bear the costs of the damage, Stuff reported.

However, a temporary levy similar to the one imposed by the Australian government in 2011 to help pay for the damage caused by Cyclone Yasi in Queensland could have made only a small contribution of a few hundred million dollars, according to calculations by Stuff.

Much of the repair bill will be accounted for by damage to transport and water infrastructure, such as roads and bridges. This damage is likely to result in lost economic output, with primary industries bearing the brunt of the costs.

The Treasury has estimated that there will be a $400 million to $600 million hit from the loss of crops and other agricultural production during the first half of this year, with “persistent losses” of about $100 million a year due to longer-term damage to orchards.

The cost of repairs is expected to have a significant impact on insurance companies operating in New Zealand.

However, with many insurers having a solid financial base and adequate reinsurance, the industry is expected to be able to cope with the losses, according to Stuff.

The Treasury’s estimates appear to broadly tally with an estimate from Federated Farmers in March that the extreme weather would cost farmers about $1 billion.

However, the total cost of repairs could be higher if further damage is identified, which may impact the insurance industry further.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!