"Cybersecurity issues will continue to grow": Managing claims chaos in fraudulent scams

“Cybersecurity issues will continue to grow”: Managing claims chaos in fraudulent scams | Insurance Business America

Cyber

“Cybersecurity issues will continue to grow”: Managing claims chaos in fraudulent scams

Company president on how to navigate a complex cyber market

The risks facing law firms and accounting firms have become more complex and pervasive than ever before, with growing vulnerabilities stemming from the virtual workforce and cyber threats – so said Dean Myers (pictured), president of Core Insurance Agency.

While law firms setting themselves up to be 100% remote is accommodating the desires of modern professionals, it can also present unique challenges in maintaining control and oversight, he told IB.

“Tracking the quality of work, making sure that attorneys aren’t moonlighting is causing employers to lose a little bit of containment,” Myers said.

This loss of containment could potentially lead to “an uptick in severity” in claims, as lawyers navigate the complexities of remote work environments without the oversight of a physical office. And this shift is part of a broader evolution in how legal services are provided and consumed, with technology enabling practices to transcend geographic boundaries. However, this transformation isn’t without its pitfalls, especially when it comes to cyber risks.

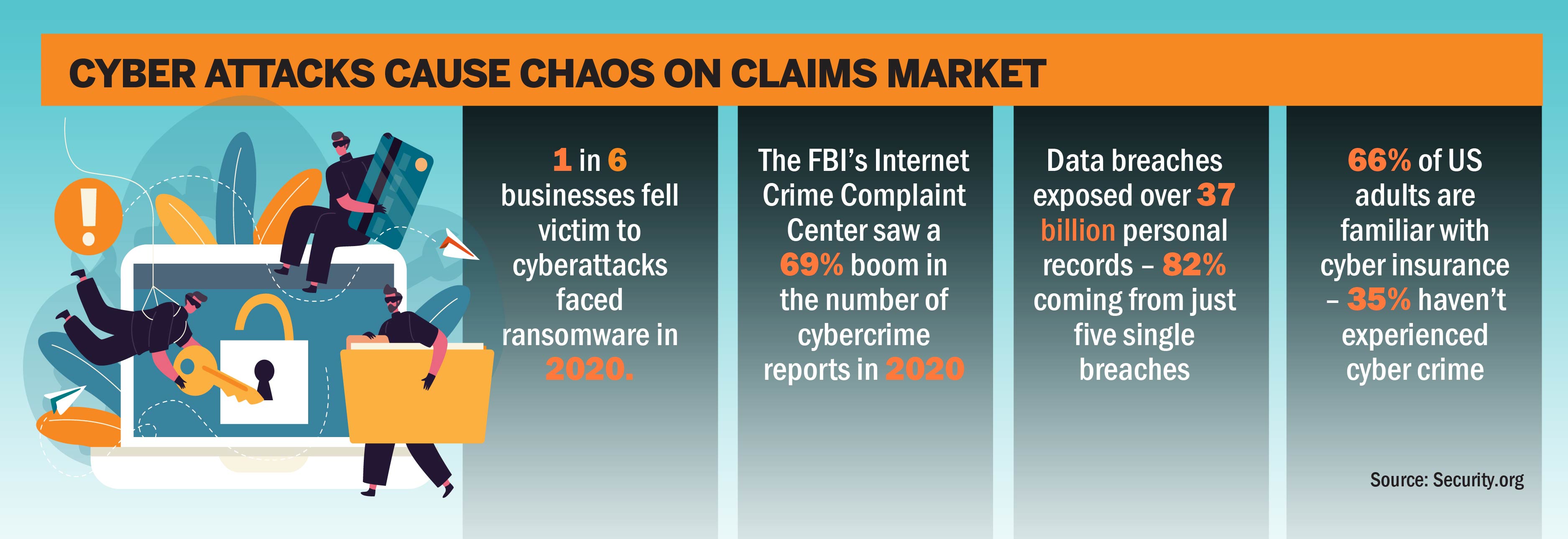

According to research from Statista, the cost of cybercrime globally will increase from $8.15 trillion in 2023 to $13.8 trillion by 2028. What’s more, cyber insurance claims have spiked by a staggering 100% in the last three years – with payouts rising by a further 200%. And, as Myers told IB, cybersecurity is an escalating concern for both law firms and accounting firms.

“One of the things that I’m seeing from cyber when it comes to accounting and law firms is not so much that they’re being hacked or compromised,” he said, “it’s their clients who are being hacked and compromised.”

Ransomware attacks, email-based fraud

The consequences of such breaches can be devastating, with Myers recently experiencing an insurance claim that resulted from $150,000 being transferred to the wrong bank as a result of a fraudulent request. Ransomware attacks and email-based fraud account for 80% to 90% of all claims processed by cyber insurers, and the breach of trust that follows a cyber incident like this is often far more damaging than the financial loss itself.

“The client had cyber insurance, and we could write a check for that, no problem, but now they’ve lost the trust of that client,” Myers said. “Pick up the phone if you have any doubts; verify requests, be proactive because your clients will appreciate it.”

This simple act of verification could prevent costly errors and preserve client relationships. However, the challenge extends beyond just managing the immediate fallout of such incidents. The broader issue is maintaining a robust cybersecurity posture in an environment where the stakes are continually rising.

And, the preference for remote work among today’s professionals just added another layer of complexity to the cybersecurity landscape. The desire for flexibility in the workplace is reshaping the traditional career path within law firms, with many opting to start their own practices rather than conform to the old model of staying with one firm for decades.

“The whole cybersecurity issue will continue to grow”

From an insurance perspective, these changes present both opportunities and challenges. But while Myers appreciates the shift towards more independent practices because it allows lawyers to be more selective about their cases and clients, he also knows it introduces new risks – and cautions that the lack of oversight in a virtual setting could lead to mistakes.

“The only issue is the quality of the representation, which usually involves missing a statute, an administrative error or, of course, cyber issues,” he said.

As law firms adapt to these new realities, customized risk management strategies are becoming increasingly vital. Here, Myers stresses the importance of tailoring solutions to the specific needs of each firm, whether they’re a large practice in a metropolitan area or a smaller firm in a more close-knit community.

Cybersecurity, however, remains a universal concern. The shift towards virtual operations requires firms to invest in robust IT infrastructure and cybersecurity measures to protect sensitive client information

“The whole cybersecurity issue will continue to grow,” Myers said. “You’ve got to bring an IT team on board now, as failure to do so could result in significant legal and financial repercussions.”

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!