Cyber reinsurance must triple by 2030, capital markets are key: Howden

Cyber reinsurance capacity needs to grow threefold by 2030 to support the cyber insurance segment in fulfilling its potential, and focus is needed to maintain momentum in making third-party capital a key component of the cyber market’s capital structure, broker Howden has said.

Cyber is different to almost all other classes of direct insurance business, that it utilises a significant amount of reinsurance capacity.

In fact, Howden said that roughly 45% of cyber insurance premiums are currently ceded to reinsurance capital, making expansion of the cyber reinsurance market a critical element of cyber insurance market expansion.

Any capacity constraints in reinsurance generally, as well as price corrections, such as we’ve been seeing with the hard market environment, can present a limitation on cyber insurance growth, therefore.

Howden explained, “If the cyber market is to scale up to rival other major lines of business, cyber reinsurance supply will need to increase significantly in order to meet demand between now and 2030.

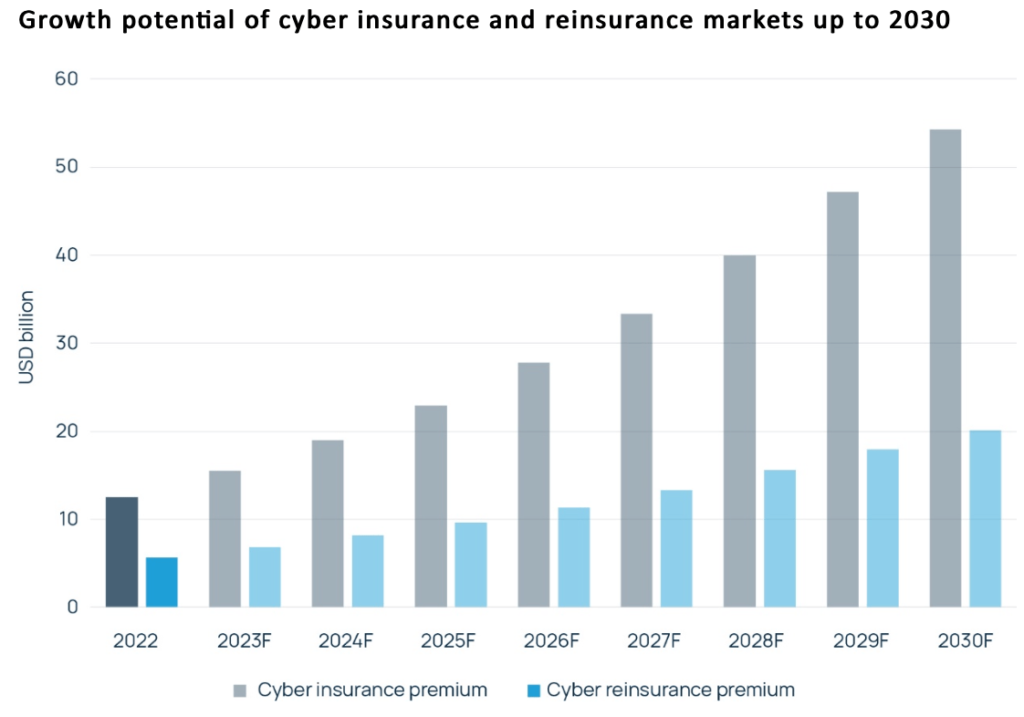

The chart below shows the brokers’ forecasts for the kind of growth required in cyber reinsurance capacity, with as much as $20 billion of cyber reinsurance required to support insurance growth.

“Whilst cyber reinsurance premiums are currently in the range of USD 6 billion, they would need to increase more than three times over in order to fulfil growth expectations by the end of the decade.

“Such high levels of growth would be ambitious during favourable market conditions, let alone when supply is as constrained as it is currently in the reinsurance market.”

In addition, Howden notes that capital is a critical element on advancing the cyber insurance market and seeing it reach its full potential.

“Capital is key to unlocking the full potential of the cyber market by facilitating product innovation tailored for new territories and an expanded client base, as well as building resilience against extreme tail risk events,” the broker said.

Here, Howden points to the growing use of insurance-linked securities (ILS) capital to support cyber reinsurance and retrocession needs.

A still-developing trend that is fast becoming the recognised source of growth potential for cyber reinsurance limits, but one that requires focus to be maintained and effort to be spent in getting investors up to speed.

“Further innovative thinking around matching risk to capital is needed to realise the full potential of cyber (re)insurance from here,” Howden explained.

Adding that, “Growing consensus on risk definitions, alongside product innovation around systemic exposures in particular, are already attracting third-party investors.

“Maintaining focus and momentum in this area will be crucial to seeing alternative capacity becoming an integral part of the cyber market’s capital structure.”

Shay Simkin, Global Head of Cyber, Howden, said, “Ensuring that cyber insurance is relevant to clients of all sizes is paramount to improving access in new territories and across different sections of the economy. Attracting capital is also crucial to this goal, a task which should not be underestimated given current macroeconomic challenges and capital constraints.”

The importance of reinsurance capital to support cyber insurance market growth cannot be understated and the chart further up from Howden makes this clear, as the overall cyber insurance market is forecast to grow from around $12 billion today to around $54 billion by 2030, while cyber reinsurance grows from $6 billion to $20 billion.

Market engagement with ILS funds and investors is critical, Howden believes, as too are continued developments in the cyber risk modelling world.

The broker said, “Continued investments into modelling solutions to help carriers manage and price (systemic) exposures, and, in turn, better articulate results to alternative capital providers, is a key requirement to unlocking more capacity. Another related point is increased engagement with capital markets.”

Reinsurance structure is also key and the market needs to get more efficient in how it utilises reinsurance capital, Howden believes.

Saying there is a, “Need for the cyber reinsurance market to develop more products that enable insurers to retain more risk, especially now that cedents are more comfortable managing attritional losses.

“Large insurers are already moving away from quota share to more efficient capital structures (such as excess-of-loss and tail-risk occurrence covers), a development that will facilitate a wider availability of reinsurance capital to support future growth.”

Those moves will also open up more opportunity for the capital markets, given ILS investors preference for XoL and similar reinsurance transactions.