Cruise travel insurance in the US: A Guide

Cruise travel insurance in the US: A Guide | Insurance Business America

Guides

Cruise travel insurance in the US: A Guide

Cruise travel insurance protects you financially if your vacation plans go awry, but is it worth the investment? Read on and learn more about this coverage

Cruise lovers are returning to the high seas in droves, booking trips at rates not seen since the onset of the pandemic, indicating that travelers are once again comfortable boarding cruise ships as fears of coronavirus infection dissipate.

But if there’s one thing that COVID-19 has taught us, it is that a single event or mishap can throw a wrench in even the best-laid travel plans, costing us thousands of our hard-earned cash, especially without proper coverage.

Enter cruise travel insurance.

In this article, Insurance Business discusses how this type of coverage works and whether it is a worthwhile investment for both first timers and cruise travel veterans. We will also explain when the best time is to take out such policies and what inclusions you should be looking for.

If you’re planning to board a cruise ship and currently working out if purchasing cruise travel insurance is worth it, then this piece can help you make an informed decision. Read on and find out the benefits and drawbacks of this form of coverage in this guide.

Cruise travel insurance works just like conventional travel insurance. It provides financial protection if something goes wrong before and during your trip, including health-related emergencies and other disruptions. In fact, the most comprehensive travel insurance policies already provide cover for cruises.

For policies offering specialist cover, the features and benefits vary depending on the travel insurance company. That is why it is important that you read the policy details carefully before purchasing a plan, so you can be sure that it matches your coverage needs.

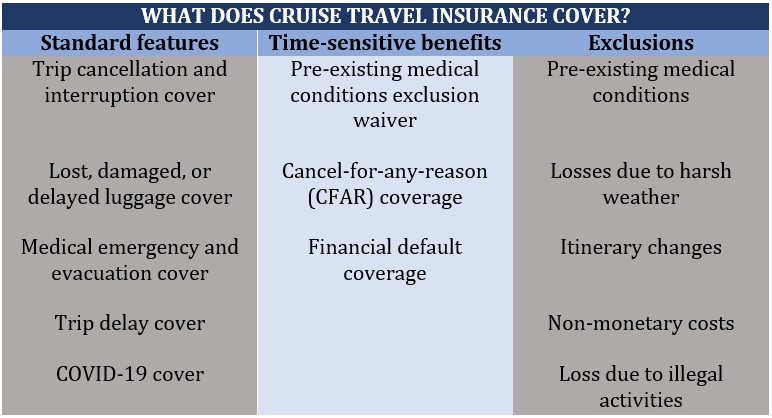

Different cruise travel insurance policies provide different levels of protection. Most plans, however, offer the following coverage which are also commonly present in traditional travel insurance.

Trip cancellation insurance: This pays out the non-refundable costs of the trip if you need to cancel, as long as the reason is covered by your policy. This type of coverage also enables you to reschedule your cruise.

Trip cancellation insurance can be broken down into:

Trip interruptions, delays, lost luggage and missing passports

Trip interruption coverage: This reimburses any unused non-refundable expenses if you need to cut your trip short due to a covered event. These include shore excursions that you never got to take. Some policies allow you to use this feature to pay for a return flight home.

Trip delay coverage: This covers additional travel expenses – including cruise catch-up, rebooking fees, missed flights, accommodation, and food – resulting from a travel delay. Just like lost and delayed baggage insurance, specific time limits apply, usually after six hours.

Delayed/lost luggage cover: This pays for the cost to replace personal items – including clothing, toiletries, and the luggage itself – if these are lost, damaged, or fail to arrive at your destination on time. Specific time limits apply. For instance, most policies provide coverage only after 12 hours of delay.

Lost passport assistance: This comes in the form of travel assistance service which helps you connect with the US embassy or consulate to get a replacement passport.

Health-related coverage

Medical emergency cover: This pays for hospital and other medical-related costs you incur if you suffer an injury or illness during your trip.

Medical evacuation cover: This pays the cost to get you to the nearest medical facility or even back home in the US if medically necessary.

COVID-19-related costs: Most policies cover cancellations and interruptions caused by the coronavirus. Coverage includes unused travel expenses, medical treatment, and emergency evacuation.

Pre-existing medical conditions waiver: Subject to eligibility requirements, this allows you to waive the pre-existing conditions exclusion of your policy so you can access coverage if a medical condition flares up during the trip. If you want to find out how this feature works, you can check out our travel insurance for pre-existing conditions guide.

Cruise ship-related mishaps

Cruise-ship disablement coverage: This provides fixed compensation if you’re stuck on the cruise ship due to a power interruption with no access to food, water, and toilet facilities. This benefit is subject to time limits, usually after five hours. It may also provide travel assistance to help arrange transportation for you and your travel companions back to the US if necessary.

Financial default coverage: Some travel insurers offer compensation if a cruise line, tour operator, hotel, or airline goes into financial default, but only for a select number of companies.

Cancel-for-any-reason (CFAR) coverage

This is an add-on feature that reimburses a portion of your non-refundable travel costs, usually between 50% and 80%, if you decide to cancel your trip for whatever reason, even those not covered by your policy. This, however, can cost about 40% to 60% of your travel expenses. Read more about cancel-for-any-reason travel insurance.

One important thing to remember is that these features come with a maximum limit. Coverage may also extend to your travel companion or even non-traveling family members. In addition, some benefits are time-sensitive, meaning you can only access them if you purchase cruise travel insurance within 14 to 21 days after your initial trip deposit.

All cruise travel insurance policies exclude pre-existing medical conditions from coverage, but you can access a waiver if you meet certain eligibility criteria. Plans also rarely cover losses caused by weather-related issues – for example, if you missed a shore excursion due to heavy rain. Itinerary changes are not covered as well. These include instances where you missed a port or are taken to a different port.

In addition, cruise travel insurance will not reimburse you for non-monetary costs like travel expenses you paid for using loyalty points or by cashing out on your frequent flyer miles. All travel policies also do not cover losses you incur by engaging in unlawful activities.

The table below sums up what cruise travel insurance covers, which features are time-sensitive, and what are excluded from coverage.

Cruise travel insurance premiums typically range from 5% to 10% of your total non-refundable expenses. Your age – the age of your travel companions – and the length of your travel – also greatly impacts the cost of insurance.

You can access some time-sensitive benefits, including a pre-existing medical conditions waiver, at no extra cost provided you meet certain eligibility requirements. Adding cancel-for-any-reason coverage, however, can raise your premiums by between 40% and 60% of the non-refundable travel costs.

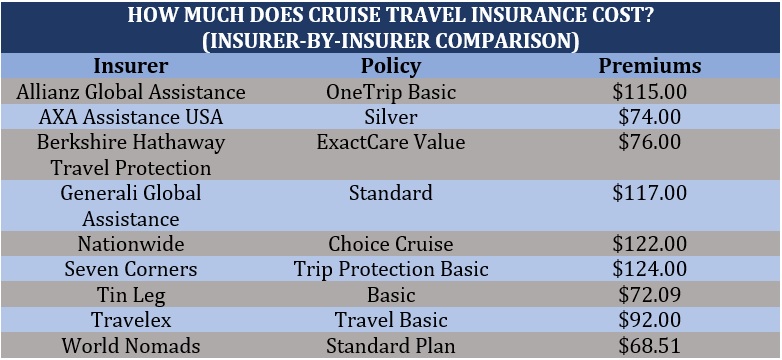

To find out how much cruise travel insurance costs from some of the country’s top providers, Insurance Business gathered quotes from the insurers featured on our top travel insurance companies in the US list. Here’s how much coverage costs for a hypothetical 35-year-old male tourist from Texas spending $3,000 on a weeklong trip to the Bahamas:

You can purchase cruise travel insurance immediately after booking your trip until just before your departure. But the best time to take out coverage is as soon as you have made your booking. This way, you will have a longer coverage window for trip cancellation.

If you delay buying insurance until the last day, for instance, and something happens before your trip that forces you to cancel, then you will not be able to get back the non-refundable expenses of your trip.

In addition, many essential features of a cruise insurance plan are time-sensitive. This means you will only be eligible if you buy your policy within a certain time frame, usually within two to three weeks after making the initial deposit. These benefits include the pre-existing conditions waiver – which is free of charge – and cancel-for-any-reason coverage – which can raise your premiums significantly.

If you’re reluctant to purchase coverage because you’re not sure yet how much your entire trip will cost, you can pick a travel insurer that allows policyholders to change trip dates and add items to their itinerary.

There are three main ways you can purchase cruise travel insurance. These are through:

1. Travel insurance companies

The best way to purchase cruise travel insurance is through travel insurance companies as they can offer the most comprehensive coverage. They can also allow you to customize your plan to match your travel needs. This can be done directly through the insurer’s website, by contacting a travel insurance agent, or by visiting a travel insurance aggregator site where you can compare quotes and benefits from different plans.

2. Credit cards

Credit cards often provide coverage for your travels if you use them to pay for your trip costs. Some premium cards even offer a level of protection comparable to what standard travel insurance plans deliver. Coverage can include trip cancellation and trip interruption, baggage delay, and medical emergencies.

Credit travel insurance, however, has several limitations. These include caps imposed on the number of days and travelers covered. Most plans also do not allow waivers for pre-existing conditions and have a limited list of incidents covered.

3. Cruise operators

Some cruise lines offer their own insurance policies, but the coverage is often restrictive. Financial default cover is certainly not included under these policies. In addition, most cruise operators offer only a travel voucher or credit for future use, not a refund, if you decide to cancel your trip.

When choosing a travel insurance plan, it can be tempting to pick one based solely on price. Purchasing a policy just because it offers the cheapest premium might not be a smart decision. Apart from the cost, here are other factors that you need to consider when choosing cruise travel insurance to ensure that it suits your needs:

Level of coverage: A policy should have all the necessary coverages that help protect you financially should something goes wrong with your travel plans.

Amount of coverage: It should also provide reasonable maximum limits to standard benefits.

Customizability: You should be able to add or upgrade your coverage to match your travel needs.

A cruise is an expensive investment for many, so it pays to have it insured, especially with all the uncertainties brought about by the current economic climate. It also involves so many moving parts – like visiting multiple locations and doing a range of activities in different countries. If something goes wrong and you don’t have insurance, that’s money down the drain for you.

If you can’t afford to lose the hard-earned cash you spent on the non-refundable expenses of your trip, then cruise travel insurance can give you peace of mind, as well as financial protection if your trip doesn’t go as planned.

The cruise travel industry is on the rebound and with it, an upsurge in demand for travel insurance. Keep abreast of the latest developments within the sector by checking out and bookmarking our Travel Insurance News section. Here, you can find breaking news and industry updates to keep you informed.

Do you think cruise travel insurance is a worthwhile investment? Are there tips on finding the best coverage that you want to share? Key in your thoughts in the comments section below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!