Create your own Personal Budget in 3 steps [You only need 20 minutes]

![Create your own Personal Budget in 3 steps [You only need 20 minutes]](https://www.cheapsr22.us/wp-content/uploads/2022/01/1643633465_Create-your-own-Personal-Budget-in-3-steps-You-only.png)

Almost everyone underestimates the rewards of budgeting. (Or the perils of not having one)

But not you, obviously.

Don’t ever forget this masterpiece

You are willing to take the effort and put in the psychological steel. Though a budget won’t give you instant gratification, though it won’t give you more money, you know that it will ultimately give you control.

(Most people that run into heavy debt do not have an income problem, they have a spending problem)

Here’s the rub.

It’s actually easy to create a budget. All you need is a pen and paper (let’s do it old school, none of that tablet/ mobile crap), and perhaps a cup of coffee.

Many other sources might suggest you start with examining your income, but let’s man up and deal with the tough stuff first: Work out what you actually want to spend on stuff, vs how much you actually spend on stuff.

This FINALLY makes sense

From there, you can make decisions more easily: If you have been overspending, then cut back or find cheaper alternatives. Yes, no one said budgeting was rocket science, even if it has the effect of taking your finances to the moon.

Strap in, and lets blast off.

(All calculations should be done on a monthly basis.)

Step 1: Face the truth of your expenditure

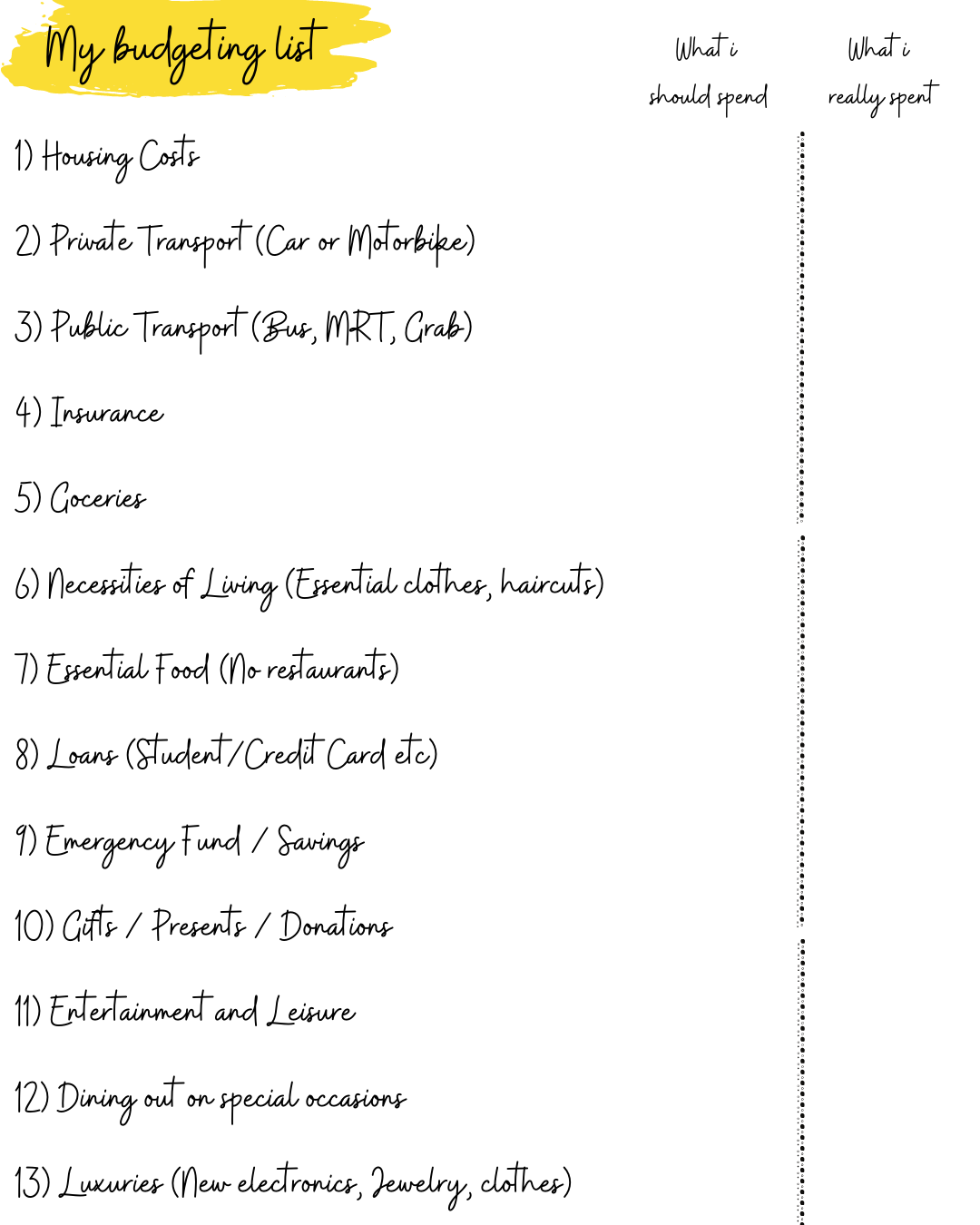

On your piece of paper, itemize your spending into these 13 categories and create 2 separate columns: What you think you spend, vs how much you actually spend on that category. For your actual expenditure, you may need to hunt around your bank statements or credit card bills etc, but do it anyway.

Here is the list:

1. Housing

2. Private Transport (Include Car/Motorbike)

3. Public Transport (Bus, MRT, Grab)

4. Insurance

5. Groceries

6. Necessities of Living

(Haircuts, essential clothes etc)

7. Essential Food

(Don’t count the cost of restaurant dining)

8. Loans – Other than housing

(Student/Renovation/Credit Card)

9. Emergency Fund / Monthly Savings

10. Gifts / Presents / Donations

11. Entertainment and Leisure

(Movies, gym memberships, books, games)

12. Dining out for Special Occasions

13. Luxuries

(New electronic gadgets, jewelry, extra clothes)

Step 2: Close the gap(s)

Now look at the mirror and tell yourself that you will be honest. Then look at the list to address any negative gaps in the list that you just created. (Negative gap = You spend MORE than you think you should spend)

pssst… Pointing is optional. Really.

For example, if my public transport expenditure is actually $600 when it was only supposed to be $400, then I can strategize on how to bring that number down. Plan my journeys carefully? Leave the house earlier instead of Grabbing from point to point?

Work through these gaps until you have a plan to address each one.

Congratulations, you have mastered this serious adulting skill.

Step 3: Get to know your Income

For some people, this would be rather easy because they have a single source of income (salary). For others, some sleuthing around might be necessary – dividends, freelance work, cottage industry service, part-time work, etc.

Since we are supposed to err on the side of caution, calculate your take-home pay for all intent and purposes.

And with your income on hand, check to see if you are spending too much on the essential items (Number 1 to 8). 50% expenditure of your take-home pay on these items is considered too much, so see if you can bring that number down.

As for the fun stuff, (Number 10 to 13), you know you are spending too much on them when you sacrifice your monthly savings (less than 5% of take-home) or when you have to roll over your monthly credit card bills (always a no-no)

Just tweak accordingly, and there you go. A personal budget is done – so you can live within your means, and happily ever after too.

Epilogue

Budgeting on a monthly basis can be tedious at first, but I assure you that it will get easier with time. And in many cases, it will ultimately become second nature.

The key to success of sticking to a personal budget is always factoring in some degree of flexibility, so you don’t beat yourself up on months that have massive online sales.

Ultimately, budgeting gives you control, and that is something sorely needed in these economically uncertain times.

Have a question?

Let us know in the comments below!

www.ClearlySurely.com is a refreshing new way to approach Life Insurance – with humour and fun, bound together by imagination.

Our Financial Discovery Platform provides hours of entertainment while providing an overall view of your insurance adequacy.

If you’re curious about how we can make a dry subject nearly as wholesome as Keanu Reeves, join our community today.

We have been eradicating the knowledge gap between consumers and Life Insurance since 2015, and have a vision that one day, every Man, Woman, and Child will be properly insured.