Could $25B in Social Security Payments Force a Debt-Limit Deal?

What You Need to Know

Those who are due to receive their money next week are retirees aged 88 and older, along with low-income individuals with disabilities.

The longer an impasse continues once the debt limit is reached, the bigger the late payments bill might get.

Millions of others would also be affected, including those getting civil or military salaries and recipients of food stamps, health insurance and other benefits.

On Friday, June 2, millions of Americans are due a total of $25 billion worth of Social Security payments. And more than anything else, that may prove a decisive element in forcing an end to the partisan standoff over raising the federal debt limit.

That obligation is “an enforcement mechanism we can’t ignore,” Democratic Senator Chris Coons of Delaware, one of President Joe Biden’s top allies in Congress, said on MSNBC Wednesday. “When they find out that they’re not getting that check, our phones will light up like a Christmas tree.”

Treasury Secretary Janet Yellen has repeatedly warned that her department could run out of sufficient cash to make all federal payments as soon as June 1, putting the obligations coming due the next day at risk.

She has also for months said it’s “unlikely” that Social Security benefits could be paid, but also said that there will be “difficult” choices to make if the debt limit isn’t raised and the Treasury runs out of funds. On Wednesday, she declined to specify “what exactly is possible and what is not possible.”

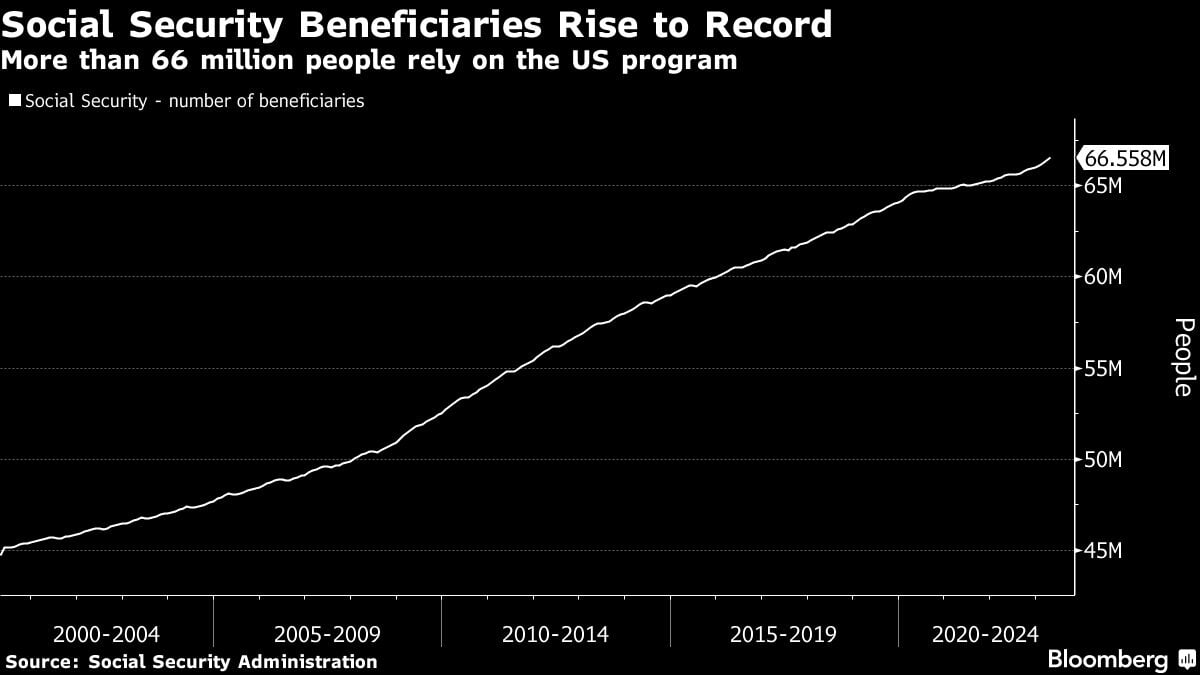

When it comes to Social Security — a vast retirement and disability program that had almost 66 million beneficiaries as of last year — what potentially makes an exception possible is that it has its own funding stream, separate from general government obligations.

But even if it’s a theoretical option for the Treasury to keep making payments, experts say it’s legally questionable and in any event logistically challenging.

Which leaves the beneficiaries at risk. Those who are due to receive their money next week are retirees aged 88 and older, along with low-income individuals with disabilities.

‘Cruel Twist’

“It’s a cruel twist of fate,” said Kathleen Romig, director of Social Security and disability policy at the Center on Budget and Policy Priorities in Washington. “The first people to have their benefits risked by this are the oldest and the poorest Social Security beneficiaries who are paid in week one.”

House Speaker Kevin McCarthy hasn’t included Social Security in the sweeping cuts to spending that Republicans are demanding in return for supporting an increase in the debt ceiling. So any payments that aren’t made on time would be distributed once the borrowing limit was lifted.

The Treasury is slated to make $100 billion in Social Security payments in four installments next month — June 2, June 14, June 21 and June 28, according to a recent analysis by the Bipartisan Policy Center in Washington. So the longer an impasse continues once the debt limit is reached, the bigger the late payments bill might get.

Millions of others would also be affected, including those getting civil or military salaries and recipients of food stamps, health insurance and other benefits.

Payment Mechanics

Social Security is somewhat separate from many other programs, however. The benefits draw on the contributions that workers have made. For decades, the system’s income was greater than the payouts, and a “trust fund” developed to park the excess.

The Treasury issued special, non-tradeable securities for that surplus — which is included in the $31.4 trillion statutory ceiling.

When payments are due, the special Treasuries are liquidated — giving room to the Treasury under the debt limit to sell tradeable bills to the public, which generates cash the department can then distribute to beneficiaries.

“The headroom created by trust-fund dynamics would give the Treasury added borrowing authority to raise cash in the market,” said Lou Crandall, chief economist at Wrightson ICAP, a veteran analyst of Treasury debt.