Comparing Insurance for Vacation Rentals: What You Need to Know

Introduction

Insurance for vacation rentals is essential to protect your property and the income it generates. Whether you rent out a vacation home, a cabin by the lake, or a condo in a bustling city, having the right insurance coverage can give you peace of mind.

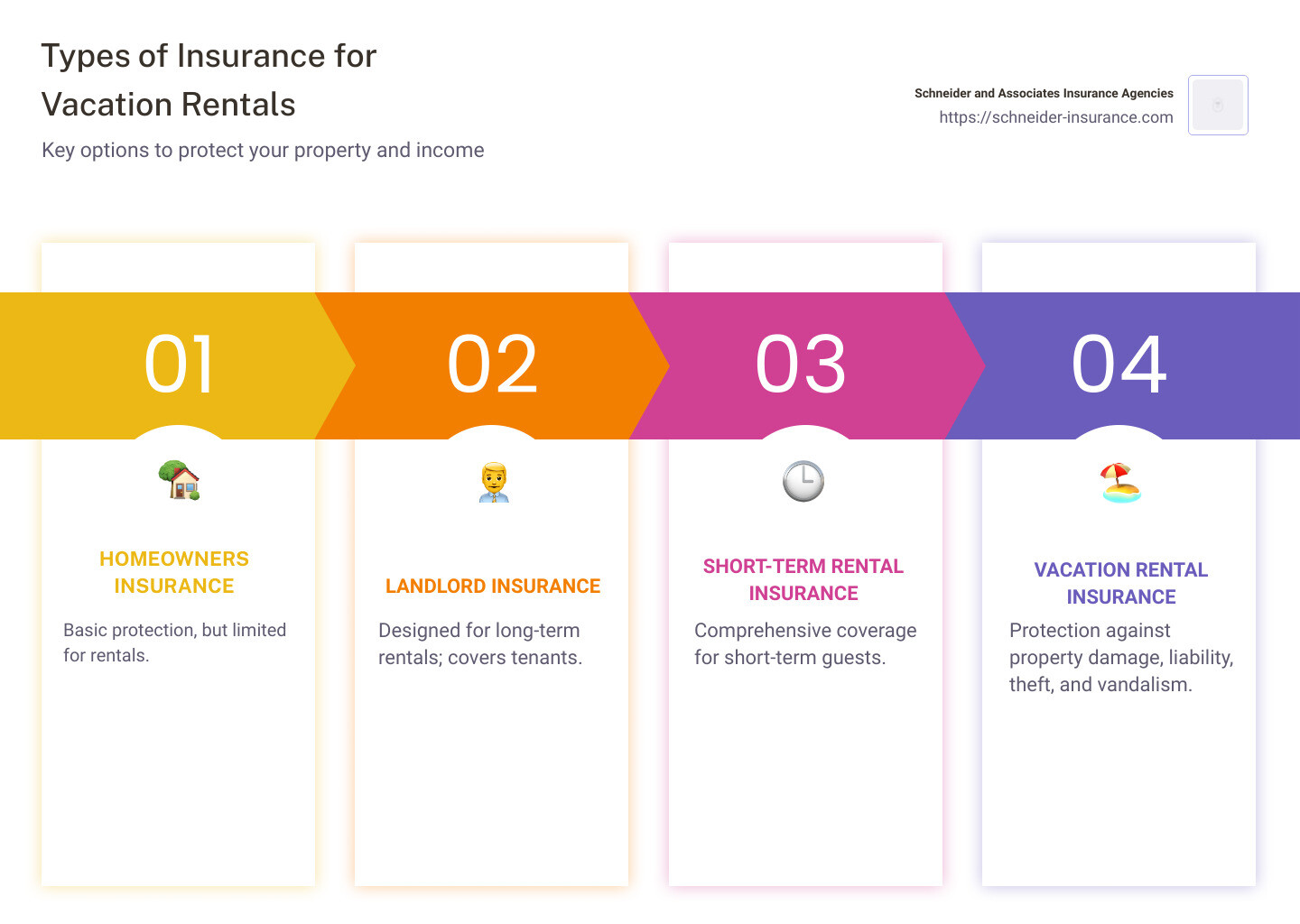

Here are the basics of what you need:

Homeowners insurance: Basic protection, but limited for rentals.Landlord insurance: Designed for long-term rentals; covers tenants.Short-term rental insurance: Comprehensive coverage for short-term guests.Vacation rental insurance: Protection against property damage, liability, theft, and vandalism.

Vacation rentals come with unique risks, from accidental damage to liability issues. Ensuring you have the right insurance is vital to safeguard your investment and secure your financial future.

Types of Insurance for Vacation Rentals

Homeowners Insurance

Homeowners insurance is your standard policy for your primary residence. It covers damage to your home and personal property from events like fires or storms. However, it has limitations when it comes to vacation rentals. If you rent out your home, even for a short period, homeowners insurance might not cover damage or liability issues arising from renters. For example, if a renter accidentally sets fire to your kitchen, your homeowners policy likely won’t cover the repairs.

Landlord Insurance

Landlord insurance is designed for those who rent out their property long-term. It offers tenant coverage and protection from liability if a tenant gets injured on your property. This type of insurance is more comprehensive than homeowners insurance for rental properties. It covers the building, any personal property you provide for tenant use (like appliances), and lost rental income if the property becomes uninhabitable due to damage. However, it’s not ideal for short-term rentals.

Short-Term Rental Insurance

Short-term rental insurance is tailored for properties rented out for short periods, like those listed on Airbnb or Vrbo. This type of insurance provides comprehensive coverage for both commercial use and personal use. It fills in the gaps left by homeowners and landlord insurance, covering property damage, liability, and loss of rental income. For instance, if a guest damages your property or gets injured, short-term rental insurance can cover the repairs and medical expenses.

Vacation Rental Insurance

Vacation rental insurance is a must if you rent out your vacation home. It covers property damage, liability, theft, and vandalism. This type of insurance is similar to short-term rental insurance but is specifically designed for vacation homes. It provides protection against the unique risks associated with renting out a vacation property. For example, if a guest steals your artwork or your property gets vandalized, vacation rental insurance will cover the losses.

By understanding these different types of insurance, you can choose the right coverage to protect your vacation rental property. Whether it’s a short-term rental or a vacation home, having the right insurance can save you from financial headaches down the road.

Top Insurance Providers for Vacation Rentals

Proper Insurance

Proper Insurance is a top choice for vacation rental insurance. It offers comprehensive coverage for both property owners and property managers. The policy includes commercial business liability, which is essential for vacation rentals.

Key Features:

Building & Contents Coverage: Protects the structure and personal property.Business Revenue Protection: Covers lost rental income due to property damage.Unique Protections: Includes sinkhole collapse coverage, no time limit on loss of rental income, and ordinance coverage.

Proper Insurance is also exclusively endorsed by Vrbo, showing its credibility and specialization in the short-term rental market.

Allianz Travel Insurance

Allianz Travel Insurance offers a variety of plans suitable for vacation rentals. These plans are flexible, allowing you to choose the coverage you need.

Key Features:

Trip Cancellation: Up to $5,000 per traveler.Interruption Coverage: Also up to $5,000 per traveler.Rental Home Lockout: Coverage for being locked out of your rental.Rental Car Insurance: Additional protection if you rent a car.

Allianz’s plans also include emergency medical coverage, baggage insurance, and 24-hour hotline assistance.

Seven Corners

Seven Corners stands out for its domestic plans tailored for vacation rentals. This provider lets you pay only for the coverages you need.

Key Features:

Medical Coverage: Up to $50,000 for emergency medical expenses.Trip Protection: Covers trip cancellations and interruptions.Emergency Assistance: Up to $500,000 for emergency medical transportation.

Seven Corners is ideal for those who want customized coverage without paying for unnecessary protections.

AXA Assistance USA

AXA Assistance USA provides robust travel insurance options that are beneficial for vacation rentals.

Key Features:

Travel Assistance: 24/7 support for any travel-related issues.Medical Coverage: Comprehensive medical insurance for emergencies.Trip Protection: Covers cancellations, interruptions, and delays.

AXA’s plans are versatile, making them a good fit for various travel needs, including vacation rentals.

AIG Travel Guard

AIG Travel Guard offers extensive travel insurance plans that include benefits useful for vacation rentals.

Key Features:

Trip Cancellation: Protects your investment if you need to cancel.Interruption Coverage: Helps if your trip is cut short.Rental Car Insurance: Provides additional protection for rented vehicles.Emergency Assistance: 24/7 support and medical evacuation coverage.

AIG Travel Guard’s plans are well-rounded, offering peace of mind for both short and long-term vacation rentals.

By comparing these top providers, you can find the best insurance for vacation rentals that meets your specific needs.

Key Features to Look for in Vacation Rental Insurance

Liability Coverage

Liability coverage is crucial for vacation rental owners. It protects you if a guest gets injured on your property or if there’s damage to their belongings.

Commercial Liability: This type of coverage is essential because short-term rentals are considered a business. Companies like Proper Insurance offer commercial general liability that complies with hospitality laws, which is a big plus.

Traveler Injury: If a guest slips by the pool or gets hurt using your amenities, liability coverage will handle the medical bills and legal fees. Proper Insurance extends coverage to amenities like hot tubs, pools, and even bicycles.

Off-Premise Amenities: Liability coverage also includes off-premise amenities. So, if a guest gets injured while using a provided golf cart or small watercraft, you’re still covered.

Property Damage

Property damage coverage protects against various types of damage to your rental property.

Accidental Damage: This covers unintentional damage, like spilled wine on the carpet or a broken appliance. Faye offers plans that include accidental damage protection.

Intentional and Malicious Damage: Some guests might intentionally damage your property. Policies like those from Proper Insurance cover both intentional and malicious damage, ensuring you’re not left out of pocket.

Replacement Cost Valuation: Companies like Proper Insurance offer replacement cost valuation, meaning you get “new for old” replacements for damaged items.

Theft Protection

Theft protection ensures you’re covered if a guest steals or vandalizes your property.

Guest Theft: Imagine a guest walks away with your expensive artwork or electronics. Theft protection will compensate you for these losses. Vrbo offers up to $1 million in liability coverage, but having additional theft protection is wise.

Property Entrustment: When you hand over your keys to a guest, there’s always a risk of theft. Proper Insurance includes coverage for theft and vandalism with no sub-limits, giving you peace of mind.

Business Revenue Protection

This feature is a lifesaver if your property becomes uninhabitable due to damage.

Lost Income: If a fire or water damage makes your property unrentable, business revenue protection will cover the income you lose from canceled bookings. Proper Insurance pays on an “actual loss sustained” basis, which means you get reimbursed for the real revenue lost.

No Time Limit: Unlike some policies that have a time limit, Proper Insurance offers coverage with no time limit, only subject to the limits you choose. This ensures you have the necessary time to make your property rental-ready again.

Additional Coverages

Pet Liability: If you’re a pet-friendly rental, pet liability coverage is crucial. It covers damages or injuries caused by a guest’s pet.

Bed Bug Protection: Bed bugs can ruin your rental’s reputation. Some policies offer coverage for extermination and even lost revenue due to infestations.

Squatter Protection: Squatters can be a nightmare for property owners. Some insurance plans cover the legal costs and lost income associated with evicting squatters.

Liquor Liability: If you provide alcohol to guests, liquor liability coverage protects you from claims related to alcohol-induced incidents.

By understanding these key features, you can choose the best insurance for vacation rentals that covers all your bases.

Frequently Asked Questions about Insurance for Vacation Rentals

Should I get travel insurance for vacation rental?

Yes, you should. Travel insurance for vacation rentals can protect your investment against unexpected cancellations, changes in your travel plans, and other unforeseen events.

Cancellation policies for vacation rentals can be strict and non-refundable. If something unexpected happens, like a family emergency or a natural disaster, travel insurance can cover the costs you would otherwise lose.

Travel changes are another reason to consider travel insurance. If your flight is delayed or canceled, travel insurance can cover unplanned hotel nights or additional transportation costs.

Investment protection is key. By covering the pre-paid, non-refundable costs of your trip, travel insurance ensures that your money isn’t wasted if something goes wrong.

What kind of insurance do I need for Vrbo?

When renting through Vrbo, liability insurance is crucial. Vrbo automatically provides up to $1 million in liability coverage, but you may need more depending on your situation.

Traveler injury is a risk. If a guest gets hurt while staying at your property, liability insurance can cover medical expenses and legal fees.

Property damage is another concern. Whether it’s accidental damage like a broken lamp or more serious issues like fire or theft, having the right insurance can save you from costly repairs.

Additionally, Vrbo’s liability insurance offers extra coverage on top of any primary policy you might have, providing an extra layer of protection.

Do I need vacation rental insurance for Airbnb?

Yes, you do. Airbnb’s host liability insurance provides some coverage, but it may not be enough for all situations.

Host liability insurance covers you if a guest gets injured or causes damage to your property. However, this coverage might not be comprehensive, and additional insurance can fill in the gaps.

Theft is a real risk when renting out your property. Vacation rental insurance can cover stolen items, even if the theft is caused by a guest.

Fire is another hazard. Whether it’s a kitchen fire or an electrical issue, having the right coverage ensures that you won’t be left with a huge bill.

Short-term rentals come with unique risks. Standard homeowner’s insurance often doesn’t cover these, so specialized vacation rental insurance is essential for protecting your property and income.

By understanding these aspects, you can make an informed decision about the right insurance for vacation rentals for your needs.

Conclusion

When it comes to protecting your vacation rental, having the right insurance is crucial. At Schneider and Associates Insurance Agencies, we understand the unique challenges that come with renting out your property.

We offer personalized solutions tailored to meet your specific needs. Whether you own a cozy mountain cabin or a bustling beachfront property, our team can help you find the right coverage.

Our tailored coverage options ensure that you are protected against common risks like property damage, theft, and liability. We also offer specialized protections like business revenue coverage and liquor liability, so you can rent out your property with peace of mind.

With a local touch, our agents are familiar with the specific risks and regulations in your area. This ensures that you get the most relevant and effective coverage.

We pride ourselves on offering top-rated options from reputable insurers. This means you can trust that your policy will be reliable and comprehensive.

Ready to protect your vacation rental? Visit our Secondary Home Insurance page to get started.