Collateralized retrocession use up at global reinsurers, but retro cost put some buyers off: S&P

The use of collateralized retrocession limits has increased among the largest reinsurance companies as alternative capital continues to be a critical source of retro protection, but for some retro buyers the cost of coverage remains too high, S&P Global Ratings has said.

In fact, across reinsurance companies analysed by S&P, their January 1st 2024 in-force books suggests a decreased use of retrocession, with higher costs the main driver.

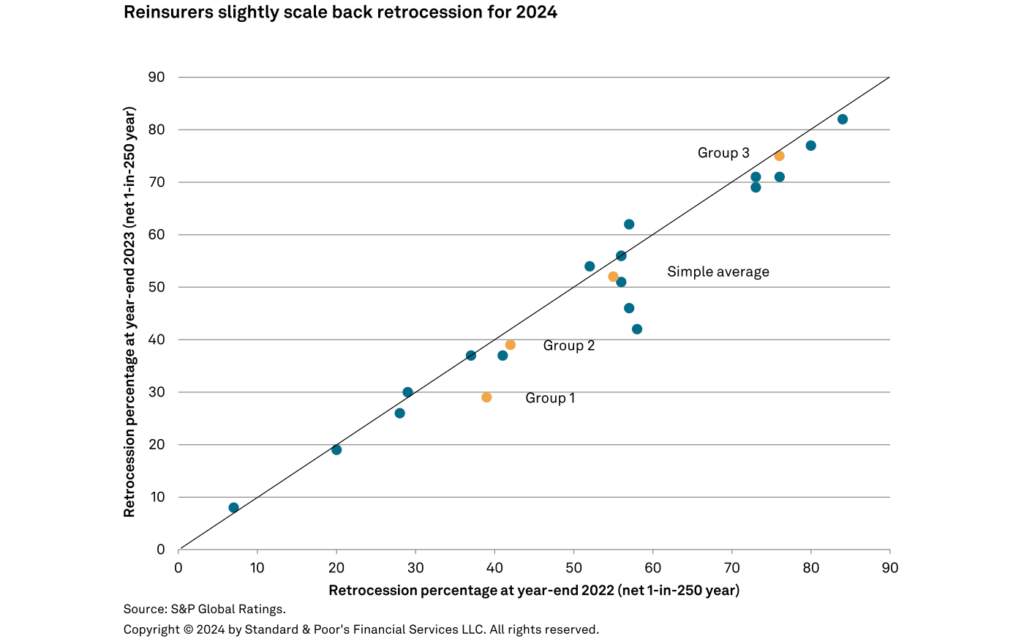

The rating agency explained, “Data from Jan. 1, 2024, in force book suggests that reinsurers are slightly scaling back their use of retrocession for tail risk, driven by increasing cost.

“Constraints on retrocession capacity, including use of third-party capital, and persistently tightening pricing conditions are likely to keep prices high in the retrocession market.

“If the high cost of retrocession persists, reinsurers could be forced to retain a higher share of risk.”

But, reinsurers still rely on retrocession, S&P noted, saying retro remains “a critical component of their risk management strategies.”

The approach taken to retrocession varies widely across the cohort of 19 reinsurance companies S&P analysed.

“But as of Jan. 1, 2024, the 19 reinsurers within our sample group ceded roughly half of their one-in-250-year exposure, on a simple average basis,” the explained.

However, the major global reinsurers have tended to retrocede less of their risk than their peers do, as you might expect given the depths of their balance-sheets (Group 1 in the chart below being the largest companies).

The chart above shows that most reinsurance companies in S&P’s analysis reduced their use of retrocession for 2024, over the prior year, ceding a slightly lower percentage of their net 1-in-250.

While the smaller reinsurers, towards the upper-right of the quadrant, have sustained a significant use of retrocession to support their businesses.

The use of alternative capital remained significant though and perhaps reflecting the fact retro capacity was generally more abundant from capital market and ILS fund sources through the renewals of late, some reinsurers use of collateralized retro increased for 2024.

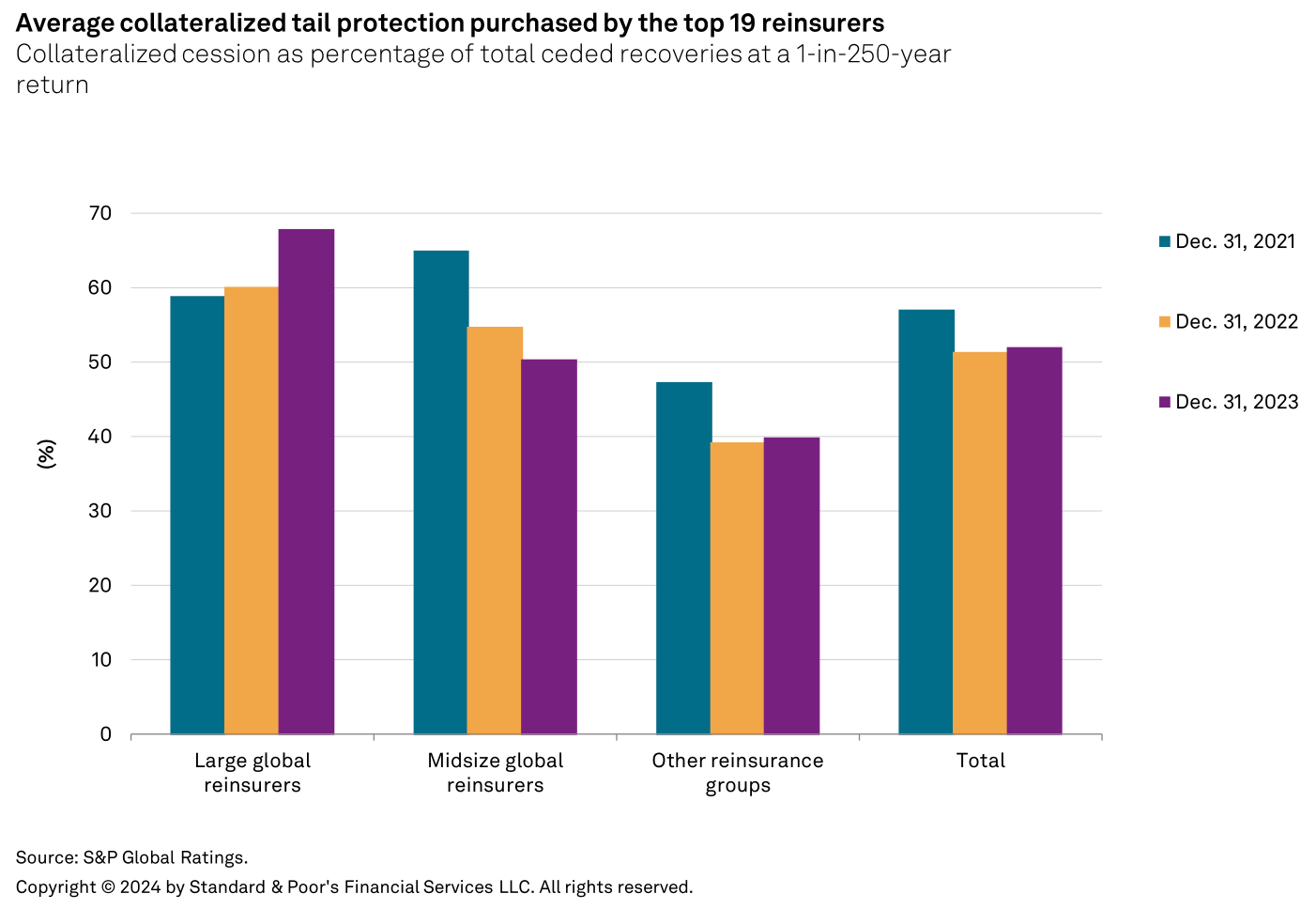

S&P said, “We observe that alternative capital continues to be a critical source of capacity and has further increased its importance, in particular for large global reinsurers’ retro strategies.”

The chart above shows that collateralized retrocession protection use grew quite significantly for the large global reinsurance companies in 2024.

Part of this may have come from the increased activity in the catastrophe bond market, as well as the expansion of a number of reinsurance sidecar structures for this year.

Midsize reinsurers decreased the amount of collateralized retro protection it seems, while other groups increased it only slightly.

The dynamic displayed in this chart reflects the growing and maturing partnership with alternative capital at the world’s largest reinsurance companies, as they increasingly find ways to integrate it into their businesses, both for protection and as a source of elasticity for their own balance-sheets.

While price may be putting some reinsurers off using more retrocession, so they are buying less, as the alternative capital partnership continues to mature they too should find ways to integrate alternative capital into their reinsurance businesses in such a way that it is additive (driving growth, making own capital go further, delivering fee income), rather than a pure cost.

Looking at third-party capital purely as a source of retro protection now is relatively unsophisticated. Instead its a capital source that has a cost, but that cost can be offset through efficient and aligned use of it.

It still does its job of protecting peak exposures, but at the same time it’s a capital source that can fuel growth, moderate results, and deliver income at the same time.

As the reinsurance industry becomes increasingly adept at managing third-party capital, we expect the use of pure retro protection and aligned third-party capital strategies will increasingly blur, which is good for the reinsurers, the investors backing them, and the insurers receiving their protection.

Also read: The alternative capital partnership matures. But what about the reinsurance cycle?