Claims Review 2021

Following the success of the last 2 year’s claims surveys, I have conducted a similar survey for 2021. I’ve approached several claims professionals from different areas of the claims market, to understand their thoughts and opinions on a number of topical issues impacting the sector throughout the year and looking at the key challenges and opportunities for 2022 and beyond.

Some individuals who contributed include:

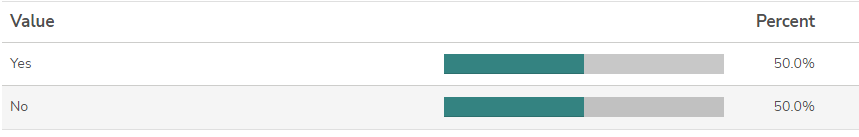

1. Has the potential damage to Insurers reputation from BI legal proceedings had a wider impact than first thought?

Chris:

The extent of the issue (and how it has been reported) has exacerbated the public perception that insurers look to deny rather than pay claims. Some insurers exclusion wordings were clearer than others and whilst the outcome was the same it has been better perceived by policyholders.

Rob:

I am sure that in the commercial insurance market there will be businesses and people who feel the market has somehow let them down. However, I believe the damage will be confined to this section of business. In personal lines I suspect it confirms folks’ views about insurers as a necessary evil and may open doors for new starts untainted by history. In claims we may well see some fraud activity as a result where people gold plate claims.

Huw:

No! This is perhaps a controversial answer, but I’m not sure insurers enjoyed a stellar reputation before the BI fall-out, so it’s probably no better or worse than it always has been – plus, so much has happened since and organisations (even small ones) have short memories. So in the short-term, there is largely no change – still a relatively transactional relationship between insurer and insured. Interestingly, SME insurance is a target market for almost every insurer I speak to (in both the retail/GI and specialty space) so there is clearly recognition that this is a target rich sector.

Paul B:

With some certainty being provided by the Supreme Court ruling almost 12 months ago, and insurers being seen to progress claims through to agreed settlements across an unprecedented number of claims, insurers could be said to be seen in a more positive light than in the early months of the pandemic when legal advice was being obtained. That said, not all issues have been resolved. There are a number of areas subject to litigation throughout 2022 on key matters which the market is eagerly watching. These could have an impact and appeals may follow any decision. Other issues continue to be in the spotlight such as the treatment of furlough receipts. There have also been a number of smaller, industry specific, technical matters that have taken some time to resolve.

Graham:

It was pretty clear from the outset that most claims would not be covered so the FCA Test case in itself did not have a further impact. This is very specific to the commercial market but it is clear that many customers were unhappy that their policy did not respond. The FCA “league table” does show how insurers responded to this issue.

Have Brokers and Insurers learnt any lessons from the issues over BI wording?

Rob:

I may be being harsh but I am not sure lessons are being acted upon as yet. I am surprised at how little real critique seems to go into wording and how the creation of policy wording seems to remain an art rather than a science. My experience in a life in claims was that the art form that is policy wording creation caused claims staff unnecessary effort in interpretation in more cases than I might have expected. This was a known issue over the last 20 years, and I saw little effort to rectify hence my scepticism above.

Graham:

Pre pandemic it was very clear how BI cover responded and had been very settled for a long time. Having looked at more BI wordings than enough in the last couple of years its clear the wordings were quite dated, as there was simply no need to mess with something that worked well! This has now changed.

Huw:

Undoubtedly insurers are tightening up wordings and reducing the amount of grey terms which is only a good thing for all parties. Brokers will have felt the pinch from their clients and will be working harder through renewal to find not just better prices but less ambiguous and more rounded terms and services. There’s a better mutual understanding of what is/isn’t covered between insurer, insured and broker, but insurers and brokers must be mindful of short-term memories should something similar happen in the future…

Chris:

The public often assume that insurance covers everything and don’t ask the right questions/ listen to the answers/ read the documentation and then blame the insurer and/ or broker regardless of the background. There is evidence that insurers and brokers are working harder to address this as a result of the adverse reporting of covid cover issues.

Paul B:

The negative perception of the insurance industry that was generated by business interruption claims from the pandemic did not reflect the fact that so many companies across the sector rose to the challenge. Mounting losses will no doubt affect pricing and greater clarity is needed in wordings. Some insurers are looking to change their underwriting practices and going forward it may be harder for brokers to apply their own wordings as the market seeks to develop greater consistency of coverage. The way business interruption claims were successfully handled was a high point for the claims adjusting sector. Crawford created a BI portal to speed up the claims process and to help policyholders provide the correct information to validate their claim. We are proud of our claims response during the pandemic.

Has this led to any changes in either covers or attitude?

Graham:

Across the market reinsurers have withdrawn pandemic cover and this has had an impact on primary cover. Exposure management was always important but now ever more so.

Huw:

We’ve seen pandemic exclusions written into a number of lines of business in both commercial and retail insurance. Interestingly, unlike other big-ticket exposures (war, terror etc.) we’re starting to see them being written back into policies with clearer wordings and relatively extensive coverage. Risk appetite reduced in the short-term, but clearly underwriters generally think they are comfortable to take at least some of these risks on. Only last week my own travel insurer reinstated its Covid cover.

Paul B:

The most noticeable change has been in respect of the withdrawal of any cover that might have been construed to have provided coverage for COVID, or similar type circumstances. We are now seeing an increase in demand for pre-loss work and business interruption training from a number of brokers. The expertise of our teams is proving invaluable in assisting people upskill from the business interruption surge created by the pandemic.

Chris:

With the pandemic ongoing and businesses focussed on short term survival it is too soon for this to be considered.

Rob:

I am not aware of a step change but I hope I’m wrong.

As the industry opens up after the Covid lockdowns has the relationship between Insurers and suppliers changed?

Paul W:

We’ve always had close relationships with our insurer partners but certainly after the last 18 months these relationships have deepened as we’ve worked more closely together through very challenging times. We managed 60% of all the COVID-19 BI claims in the market plus supported thousands of customers affected by storms and floods, over and above our usual volume of claims and so we know that our insurer partners appreciate our work.

Tim:

If anything, more frequent interactions and focus on delivering to the changing landscape.

Paul B:

Crawford has worked closely with insurers that have been on both sides of the Supreme Court outcome in January 2021. Projects have ranged in scope from development of new technical business interruption solutions in preparation for the business interruption surge, to the scaling of “traditional” adjusting services focused on business interruption. The extent to which close collaboration has been required on these projects has only strengthened the relationships between insurers and suppliers, which we hope will continue in our ongoing work with clients.

Chris:

Relationships have become more collaborative with a better understanding that both need each other and that results can be improved if everyone focusses on the wider issues instead of solely lowest price and that blame cultures help no one.

Graham:

Our relationship with our strategic supply chain has always been positive. We did help with cashflow and increase rates to support or supply chain as Covid 19 hit. Other than this we continuously work hard with our supply chain for the benefit of our customers.

Rob:

I am fortunate to be involved with a number of claims supply companies and my observation is that insurers continue to exhibit behaviours that don’t match the rhetoric of partnership. There are still win / lose deals and unthought through risk transfer deals in the market that inhibit supply chain investment. There are some shining lights and I am sure the likes of LV= are seeing cost, service and efficiency benefits from some of their, in my opinion, more enlightened approaches.

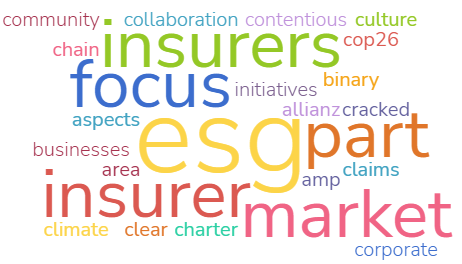

How have Insurers and Suppliers processes changed as a result of ESG?

Tim:

More discussions on ESG plans rather than fundamental changes to date.

Chris:

Insurers and suppliers now recognise that lowest price/ best profitability is not the only driver to success and that businesses have to be able to show that they recognise and seek to meet their role in society. This is encouraging better collaboration and improved focus on innovation, service and how we protect the world for future generations.

Rob:

I am not sure that ESG has advanced much beyond the ‘jaw jaw’ stage. There’s a lot of talk but as both a member of the industry and as a customer I don’t believe ESG has yet created a materially more sustainable, socially aware nor better governed insurance market. At present ESG is part of the share price conservation game where companies have to be seen to be considering it. Is it yet changing the product, process or leadership of companies? Not sure.

Graham:

Allianz is to our knowledge the first insurer in the UK to issue a ESG charter as part of our procurement process. It is clear we are all on a journey and we are keen to help and support development in this area. We have already delivered a number of market leading initiatives with more to come.

Huw:

Everyone is going hard on the ‘E’ in ESG at the moment, driven in part by wider climate focus (COP26 etc.) and the fact it’s somewhat easier to have a non-contentious perspective on climate vs. some of the more political (/politicised) elements of ESG. This is driving increased demand for things like green parts and reuse in the supply chain in quite a binary, physical kind of way. It will be interesting to see how the wider aspects of ESG get embedded through insurer and supplier relationships – for example, insurers wanting partners that go harder on D&I, social mobility, community impact, culture etc. No-one has quite cracked ESG at a root level yet, but there are some good examples of initiatives across the market in everything from underwriting to claims as well as at a corporate level.

Paul W:

ESG is now a very important part of any procurement and supplier management arrangement. In previous years it was much more of a tick box exercise but, quite rightly, we’re regularly being asked to demonstrate what we’re doing to minimise our environmental impact and make our workforce more diverse and inclusive. As loss adjusters we have an important role to play in reducing the carbon footprint of building reinstatement and we’re undertaking research with Universities and the BRE (Building Research Establishment) Group to help drive innovation in this area.

With supply chain shortages and the rising prices of goods, what measures are being taken to protect service and response times?

Chris:

The present environment is encouraging best practice, working together and the need to embrace alternative solutions. Processes are being changed to ensure that one party in the supply chain does not make promises that others can’t keep. Honesty and communication skills whilst always important are now recognised as vital to meeting customers’ expectations.

Rob:

There are a mix of insurer reactions not all of which have the customer’s interests at heart. Cash settlements shift the problem back to the customer and insurers are also hiding behind unsustainable terms of service with suppliers. Nothing new in either of these things. A few companies are trying new things like finding alternative supply chains such as the use of recycled parts in the motor repair transaction. However very few are altering their contractual positions with the established supply chain in light of the new realities created by Brexit and Covid 19. Imagination is required and I am afraid in speaking with the “claims director union” I get the impression that imagination and creativity are not avenues open to claims innovators these days.

Graham:

There are somethings we can influence and some we cannot. For instance, the global cost of steel is not something we can change. However, being one of the largest P & C insurers in the world does give us the reach to support our supply chain and therefore our customers in what is clearly challenging times.

Tim:

Proactively managing customers expectations have become even more important through the Covid epidemic. Use of multiple/dual suppliers for key goods and services rather than sole supply agreements to provide more resilience and risk mitigation.

Paul W:

It’s very difficult for the insurance industry to mitigate the effects of increases in costs or delays which are being incurred by general contractors. However, where works are being managed through a repair network there are opportunities to manage these increasing costs. For example, in Sedgwick Repair Solutions our supply chain managers are focused on managing contractor cash flow, something that is fundamental to ensuring contractors can continue to provide a first-class service at the lowest cost. Having reduced debt and prompt payment for work done helps contractors then, in turn, manage their purchases taking advantage of the best possible purchase terms.

Is claims becoming more important in the insurance value proposition?

Rob:

Would that it was! As previously we are once again in a period of “faux” interest and innovation in claims but it’s at the surface level and seems more concerned with justifying investments in “efficiency” by doing the same thing with fewer people and calling it progress. In a world where one can’t get through to a busy call centre to talk about a claim, it probably feels like progress to the customer to fill in some web pages and get lots of encouraging text messages ping onto one’s phone. If the back-office process hasn’t been thought through, then insurers are simply moving the log jam and not positively influencing the customer outcome. Doing a broken process more quickly or differently without fixing the process just makes failure more likely and there are fewer humans able to rescue the situation.

Chris:

Regulation, ESG and customer needs/ expectations is driving the acceptance that the quality of claims service is the single biggest differentiator.

Huw:

Yes – and not before time! Pricing reforms have absolutely widened the focus on how other parts of the value chain can contribute to customer acquisition and retention, and Claims is front and centre. Price will likely still be king in the short to medium term but will not be the only thing in play. If customers become less price sensitive, other factors become the differentiator – claims service, wider proposition, ease of doing business etc. I see a lot of focus on the Claims function from both a technology and service perspective. One thing that is perhaps lacking from a lot of approaches is the front-to-back view – too many Claims initiatives are isolated from underwriting and product considerations, and as a result can only go so far in their ability to impact business or customer outcomes.

Paul W:

Claims are becoming more important in the insurance value chain because of the insight that can be gained from claims data. This insight can identify market trends, or trends within certain books of business, information which is becoming more and more valuable to insurers. One example of the insight we provide insurers is the building cost review which we undertake every quarter. We examine all the building costs data from Sedgwick claims and track the movement in prices and consider the reasons behind any price changes for material and labour. Our insurer partners find this reliable information extremely useful.

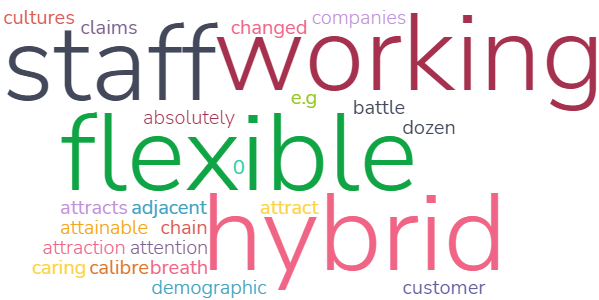

What impact is a hybrid working model having on retaining and attracting talent?

Graham:

This is a strength and weakness all in the same breath. We were tethered to offices historically, but we now live in a world with “no walls” So location is no longer as important as it once was. IT is all about providing the right employee proposition

Huw:

There is definitely a realisation that other opportunities are more attainable than before, particularly in companies adjacent to insurers (e.g., technology providers, supply chain, insurtech etc.). Many vendors and suppliers recognise insurers are paying more attention to Claims as a whole and are scrapping for high-calibre Claims SME talent to support their own ventures. They will absolutely make it worth their while, with better packages and more flexible cultures – it’s a real battle. In the last 12 months alone I’ve seen half a dozen very talented Claims people move to the supplier/vendor side for precisely these reasons.

Paul W:

Hybrid working offers many benefits to colleagues as they’re now able to have a better work life balance with their commuting time removed. Many colleagues have said they prefer the mix of home and office working which helps keep retention rates high. We also offer positions which are 100% home working which enables us to spread the search for talent more widely and outside of the local catchment area which has been beneficial. The challenges have been when we’ve had new starters join when it’s been 100% home working. Our induction process is now a slick online process and has excellent feedback, but it’s definitely more challenging for younger people just starting their careers to learn from others. Our team leaders work hard to make sure new starters feel included and are effectively supported but it’s not the same as being able to do this in the office.

Tim:

Quite simply to attract and retain the best staff in the future, offering a hybrid working model is the only way to effectively compete. It allows greater geographical reach and together with flexible working, does attract a more diverse demographic, in particular to Customer Servicing roles.

Chris:

Hybrid working has not changed the factors influencing staff attraction and retention but has made the right habits even more vital. Employing the right staff for the role, flexibility, caring management at all levels, supporting staff welfare, mentoring and training, recognising, rewarding and encouraging remain vital.

Rob:

In truth I think it’s too early to say whether the impacts are positive especially for customers. Leaders need to rethink their processes and the way they lead to really drag out the benefits that hybrid working could in theory bring. Such working practices are very much in their infancy with much maturing and evolving to be done before we can really answer the question with certainty.

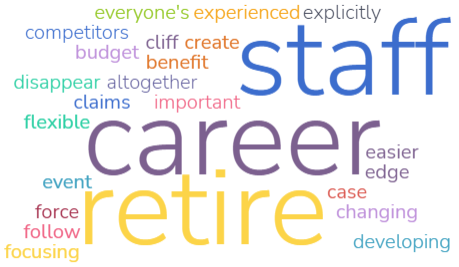

What measures can be taken to address the severe shortage of skilled claims professionals in certain sectors and the impact of a highly skilled generation reaching retirement?

Huw:

Promoting the career pathways you can have in Claims is really important – but you have to follow through and make these opportunities real for people. People shouldn’t have to wait for people to retire to be given their shot. I’ve heard a number of first-hand stories of young talent being explicitly told by senior leaders “I’d love to keep you, but I can’t create the opportunity quickly enough and don’t have the budget for it” – if that’s the case, don’t be surprised when your future superstars disappear to competitors or out of the industry altogether.

Paul W:

There is huge pressure to attract and retain talent into the insurance industry and with a very buoyant job market the competition is even more fierce. To address this issue, we’ve implemented a learning and development strategy which, rather than offering ‘training for training’s sake’, aims to elevate people across the company based on analysis of the skills gaps that are likely to emerge in the future. As individuals expand their skillsets, they are presented with tangible opportunities to move within the business, including the potential to move between commercial and home claims departments. Training and development is now absolutely at the centre of our business so we can bring on the next generation of loss adjusters and keep hold of the very talented colleagues we have.

Tim:

With hybrid and flexible working models, it is far easier to attract and retain older and experienced skilled workers. Allowing staff to gradually step-down their working hours/days toward their desired retirement will retain many who may otherwise traditionally have retired in one cliff-edge event. Putting in place career ladders for younger staff wishing to progress is more important than ever so that they can visualise their next step and how to get there. Celebrating success of those who have been promoted through the business demonstrates that individuals’ aspirations can be realised.

Chris:

Focusing on training, mentoring, supporting and rewarding staff so that they want to join and see that staying / developing will be to everyone’s benefit.

Rob:

I am not so glum about the loss of the current generation of insurance personnel. In my 25+ years in the business I was surprised by the recycling of the same faces around the market. I have a hunch that when my generation clears off out the way the next generation will flourish and perhaps embrace with more vigour some of the new opportunities afforded them by technology and other influences. It’s time we let them get on with it!

Graham:

The skills required are changing so it’s not just a one in one out. Strategic Work Force planning is certainly a help in understanding what is required going forward.

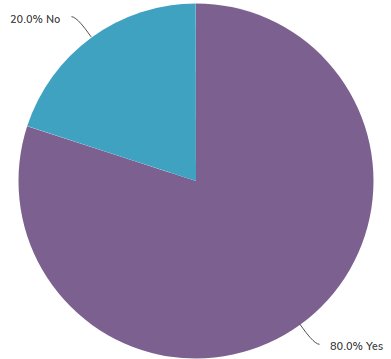

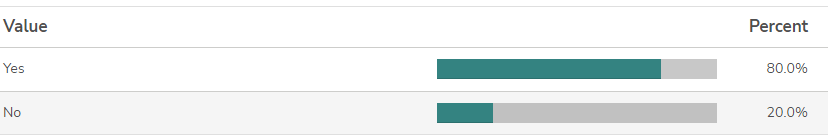

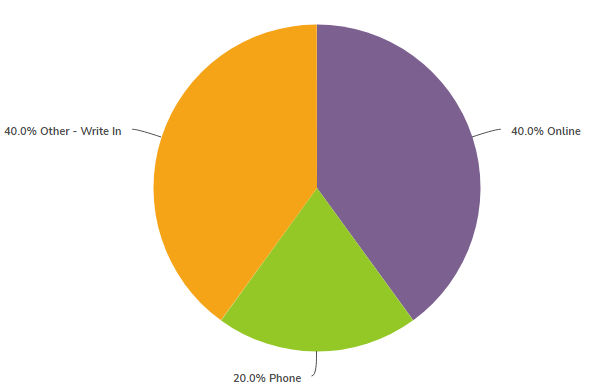

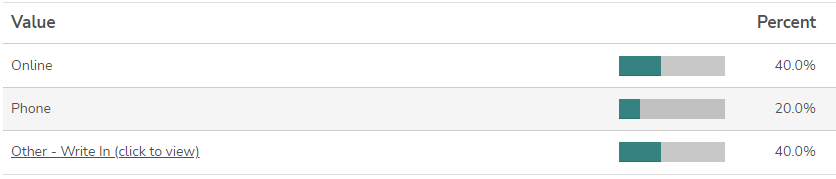

With technology gathering pace and an increase demand for ENOL, how does the customer want to interact, what’s the preferred route?

Paul W:

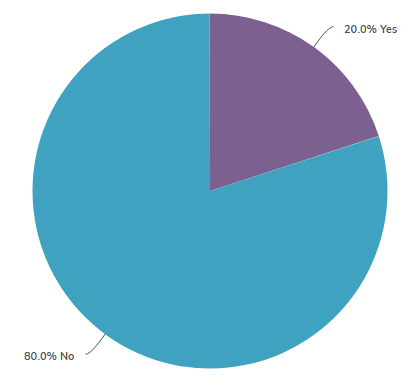

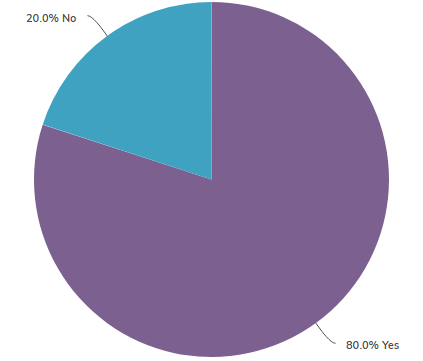

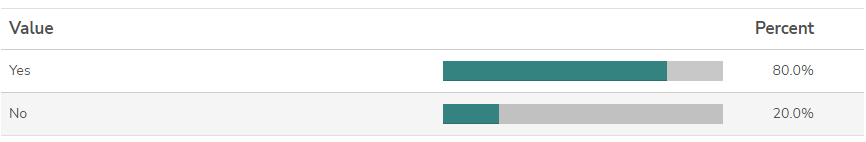

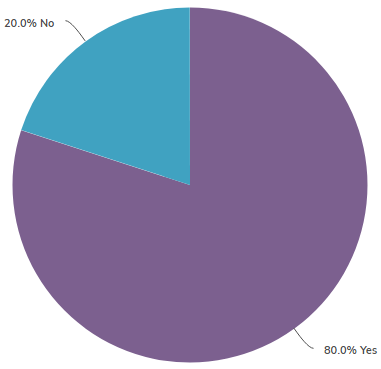

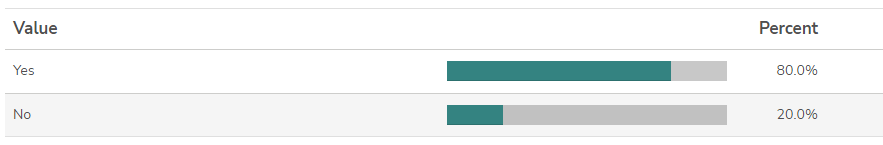

There is certainly a significant desire from most customers to report their claim online and even manage their entire claim through an app with very few, if any, interactions by phone. Even with the thousands of COVID-19 BI claims, we received 80% of these claims came through our portal which helped us manage the volume and certainly made the process more efficient. However, not every customer is the same and how they wish to report their claim and interact with us during the whole process, very much depends on a number of factors. These include the type of claim, how confident they are with technology or whether they want immediate reassurance and advice from a claims handler. As a business we need to be able to support customers in a way that suits them and so we take an omni-channel approach to FNOL. Our helpline service was extremely busy during Storm Arwen. There is no doubt that under certain circumstances, customers still want to speak to someone that can help in their hour of need.

Chris:

Customers want flexibility and the ability to communicate in the preferred way which will not always be the same. The ability to use multiple/omni channels to handle claims is vital as is linking this back to how the policy was procured.

Rob:

Any of the above if the result is action, activity and assurance. Changing FNOL into ENOL is easy. Less easy is ensuring back-office processes keep pace with enol. If done systemically and well then, I’m sure online and app-based transactions will become the preferred route for customers. This seems to be born out in the experience of other b2c markets. However, I am always cautious in interpreting customers use of a new channel as their choosing to do it. Are they actually displaying an impatience or distrust of more traditional pathways and grasping at any straw in the hope of progressing a claim? In the end insurers may take the opportunity to differentiate by embracing or indeed not embracing the technology and we shall see how the customer reacts. The winner will not be who has the flashiest app but who actually delivers a repaired car, a habitable house or sustained business in a fair and prompt manner.

Huw:

It’s a mix – critically, it’s important for insurers to provide equivalently across all channels

With advancements in vehicle technology and the increased demand and use of EV’s, how should the industry deal with the impending skill shortages in bodyshops and the increase in claims costs?

Rob:

This is quite simple. Insurers might perhaps listen to their own rhetoric and act in real partnership with bodyshops. Current contract arrangements could be reviewed for unintended consequences and changed, data could be exchanged and mutually understood, engineering teams could be freed up from routine audit to use their expertise on the variances and outliers as at present it is in this category of claims that EVs lie. AI and a rethinking of key roles in the transaction present an opportunity to create such freedoms but will require letting go of some ingrained behaviours that come under the category my generation will remember being described by the phrase “you don’t get the sack for buying IBM”.

Huw:

I have no empirical evidence here, but the rules of economics suggest claims costs will even out over time – we’re already seeing road prices for EVs being close to their ICE equivalents. Having said that, cost is firmly back on the agenda for many insurers across the board – the challenge for many is managing it in a sustainable way. Marginal gains is the approach most will take unless there is a serious cost problem.

Tim:

EV’s are already here, there are now many bodyshops that are making significant investments for the future – and we must support them. Higher average repair costs for EV’s are inevitable (labour & parts), however they may ultimately have lower accident frequencies due their advanced technology – the combination of which may balance off but ultimately will filter through to insurance premiums

Graham:

As the Chairman of Thatcham I am fortunate to have an amazing insight to how vehicles are changing and what this means to us all. I could write pages on this but rather than that, why not reach out to the global experts that Thatcham have developed over many years. If you are a member they will be delighted to help.

What is the greatest challenge facing the claims market moving into 2022 and beyond?

Tim:

Move to Digital and away from an analogue claims experience will require significant investment by insurers – how quickly we respond to customer driven requirements whilst retaining sound controls remains to be seen.

Chris:

Recognising and addressing staff and claimants’ mental health given the situation over the last two years that it is ongoing and will continue to have an impact for many years to come.

Huw:

Generally speaking, it is having the ability, capacity and capability to fight on a number of fronts simultaneously. The regulator will keep regulating, the customer will keep demanding, competitors will keep competing, cost will keep costing etc – the number of challenges facing Claims Directors is not insignificant. The art is being able to still drive and improve outstanding business outcomes (in this case, bottom line performance and CX).

Graham:

Creating digital and date journey for our customers that are quick easy to use and provide an amazing service.

Paul W:

All businesses are now having to really demonstrate that they are taking ESG seriously and must show the impact their business is having on the environment and wider society. Some businesses will be making great progress in this area, but for others, where it’s not so high on the agenda, it will be a significant challenge. Another threat which affects us all is the rising threat of IT security breaches. Cybercrime is an unwelcome but increasing phenomenon and causes significant damage to businesses. This challenge to ensure our IT systems are secure and to keep one step ahead of the cyber criminals will be something we all need to keep focussed on. We expect claim costs to carry on rising in 2022 as supply chain problems continue to have an impact. These global issues are being compounded by Brexit and shortages building materials and skilled labour.

Rob:

Embracing the opportunities afforded by technologies such as artificial intelligence, the redesign of work, the freeing of people to behave as skilled humans, real customer centricity and supply chain innovation. Then handing over the reins to a new and more diverse generation of leaders, technicians and claims management people for whom the past is history not a handbook for operating practice.

I would like to thank all the individuals who contributed to this survey.

I’ll allow you to draw your own conclusions and time will tell how the events of 2021 have impacted the industry.

Right International is a market leading recruitment firm who specialise in sourcing the top talent across the claims and wider insurance market.

If you have a vacancy or are looking for your next career move, please contact me.

If you would like a PDF version of this review, please email me.

All the best,

Gary Pike

Founder & MD Right International

*The thoughts and opinions expressed in this document are not mine or Right International’s, but the individuals that have engaged in this survey and given permission to publish their comments.