Claims Review 2020

Following the success of last year’s claims review, I have conducted a similar survey for 2020 approaching a number of claims professionals from different areas of the claims market, to understand their thoughts and opinions on a number of topical issues impacting the sector this year and moving into 2021.

In what has been perhaps the most challenging year in most people’s lifetime and with so many topics to cover the survey is longer than last years!

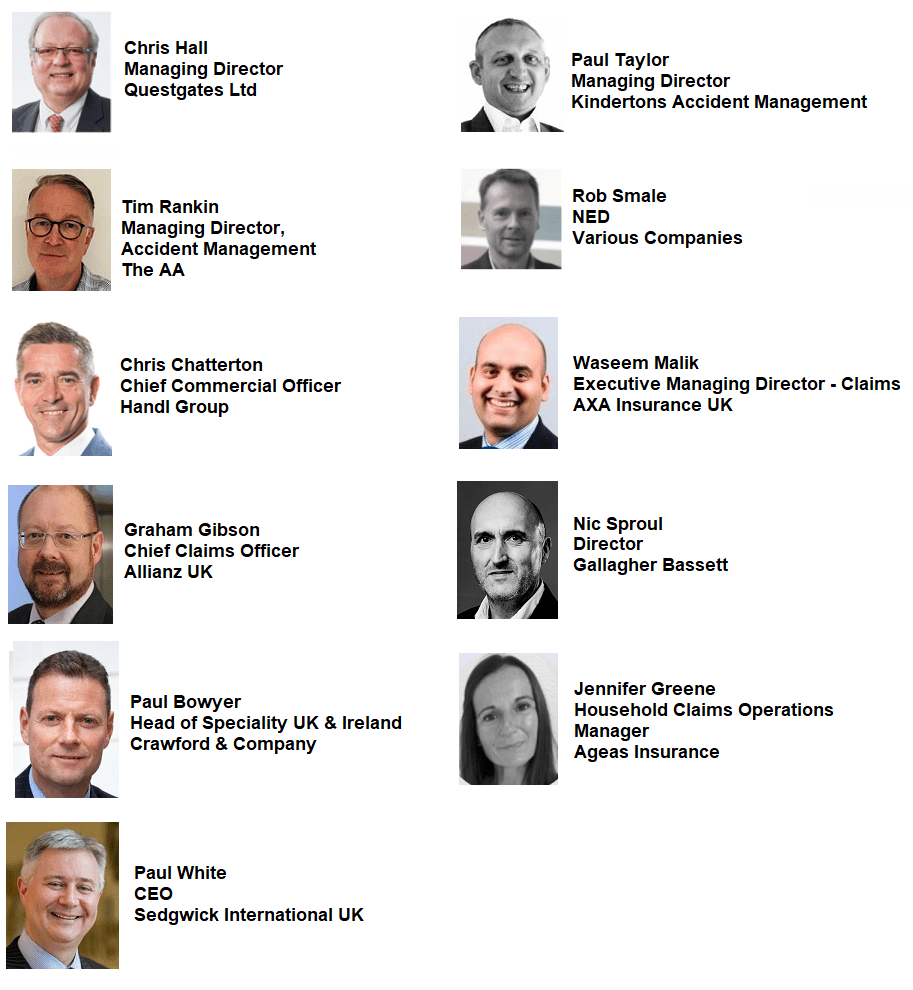

Some individuals who contributed include:

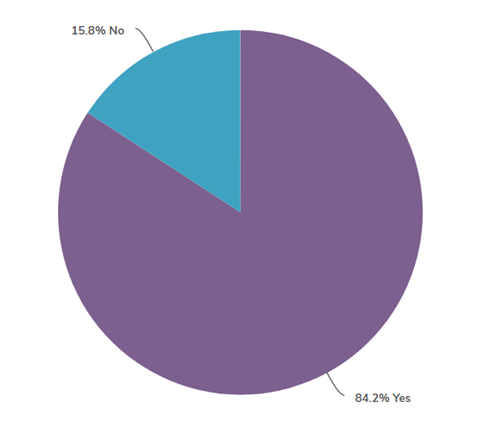

1. Has the industry’s response to Covid BI claims damaged the industry’s reputation?

Chris H:

Unfortunately, but understandably the public expect insurance to pay in full regardless of what the policy wording is or what premium they have paid, and this misconception is perpetuated by the way journalists report insurance related matters. Inevitably the severity of the implications and the involvement of legal proceedings has added to the reputational damage and the likes of the ABI seem to have allowed negative publicity to continue unchallenged. However, where claims have been accepted payments have been made very quickly and resulted in very high levels of customer satisfaction

Paul T:

Yes, I think so in the short term, but it has highlighted the need for businesses to take expert advice and seek appropriate cover so longer term will lead to better protection and awareness.

Rob:

The public and the media are out of sympathy with the industry and happy to believe worst of it. The industry’s reputation has been confirmed as much as damaged. Whilst one understands the point being made by those underwriters impacted, I don’t think it’s unreasonable of the businesses claiming to believe they were covered. The upshot is it once again highlights the need for better communication between underwriter and client and is perhaps a great opportunity for brokers to help their customers better understand what it is, they are purchasing. Many of the businesses involved are “unsophisticated” SMEs and perhaps policies sold to such customers should be more like personal lines policies and follow the trend towards using plain English and having wordings scrutinised for meaning by third party communication companies.

Chris C:

I think we have reacted well in difficult circumstances.

Graham:

The answer is yes and no. If you are a retail customer then probably not…in fact there are arguments to say Covid has increased the focus on risk protection and LTS…very different matter if you are an SME.

Nic:

Inevitably there will be an element of lost trust.

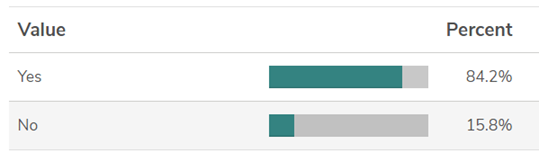

2. With the differing interpretation of BI wordings, what more can be done to help claims professionals, brokers and policy holders understand more clearly what is covered?

Chris H:

BI wordings are unusual in that not only do they set out what is covered, they also include how the claims payment is calculated. Unfortunately, other than the small percentage of claims professionals that handle these type of claims on a regular basis, most involved in arranging insurance do not understand this and there is a need for simpler cover explanations and training in basic principles.

Paul T:

Clear and simple one page guides with a combined view from major insurers on the principles of cover perhaps led by ABI under a single campaign.

Tim:

Common Standards, wording, and specific exclusions.

Rob:

Customers rarely take trouble to understand policies apart from at claim time. We could make wordings longer; not desirable. I’m not sure much more can be done apart from presenting a risk statement along lines of… if x happens you’re covered. If you are not however, this could get cumbersome. As for claims staff – train, train, train.

Chris C:

Simpler more straightforward policy wording in plain English.

Graham:

Having considered too many BI wordings of late what is really clear is that they were not written with a Pandemic in mind and many of the words and phrases relate to a bygone time. So, there is a lot of work required to modernize.

Nic:

Training updated after this year.

Paul B:

A full review of existing policy wording is required and will follow as a result of the Pandemic in 2020. Cover needs to be articulated in simple terms, but it is complex too so requires a significant amount of further work on all sides.

Paul W:

We expect that insurers will look to reduce the number of policy wordings and move towards perhaps more standardised wordings which will help eliminate some of the confusion about cover.

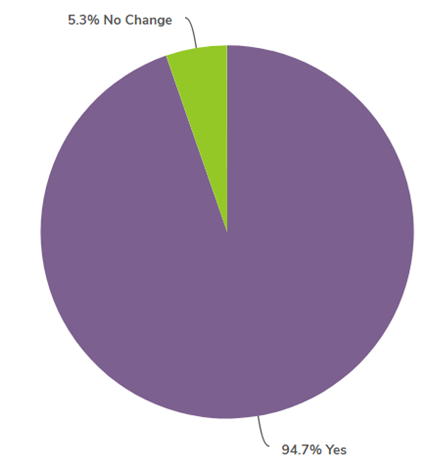

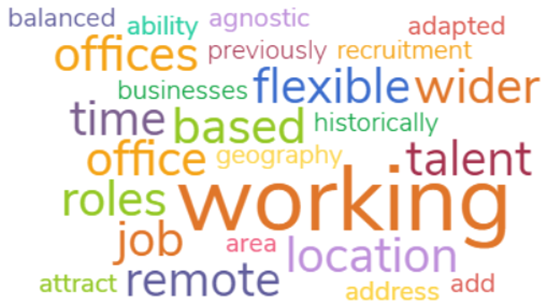

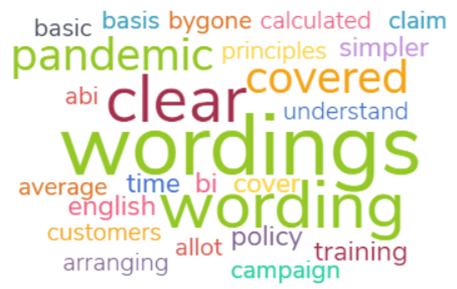

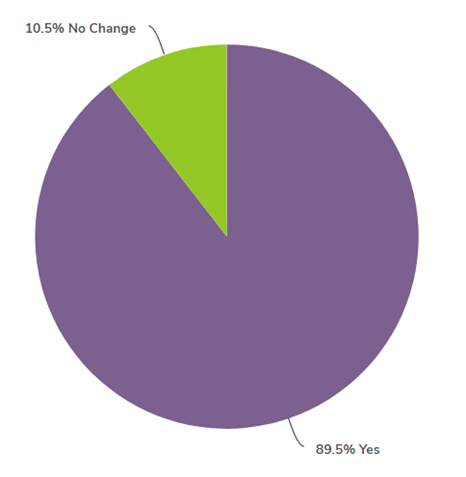

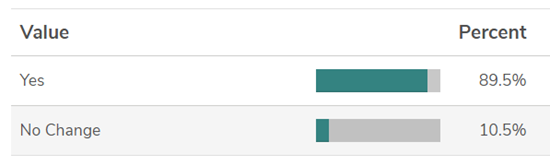

3. If remote working becomes the new norm: Will it enable organisations to recruit a wider pool of qualified individuals?

Chris H:

The ability to be flexible regarding working hours and geographic locations will have a profound impact but needs to balance against the need for interaction, mentoring and the need to recognise and address mental health issues.

Paul T:

Yes, definitely and especially in more technical and bespoke roles. Historically businesses with main offices outside of the main cities would have to pay more to attract talent outside of their area to move but now the best people can add value from anywhere.

Tim:

Without doubt, location will become less important for office based roles. Important to retain connection and a business culture with changes in management, to support remote workers general wellbeing.

Rob:

Yes. Large office centres and HQ set ups over recruit locally.

Chris C:

Geography becomes less of a concern.

Waseem:

Working from home is here to stay and will allow us as an example to not be restricted to local recruitment pools, which for Claims is a big positive given we are often based in more remote locations and not big cities.

Graham:

Historically we have been tied to bricks and mortar and we use phrases like “which office do you work in”. Although Covid has been a horrible experience on so many levels, one of the few positives is that we can now think beyond walls.

Nic:

Yes, those that would not be available due to logistics or geography.

Paul B:

Yes definitely. We are seeing this already. Instead of restricting the talent pool to a geographical region typically linked to an office location the search for a candidate can become a national one.

Paul W:

We are already recruiting individuals based on their skills and attributes rather than focusing solely on their insurance experience. This allows to reach a wider pool of talent including those with caring responsibilities or disabilities which prevent them from being in an office five days a week.

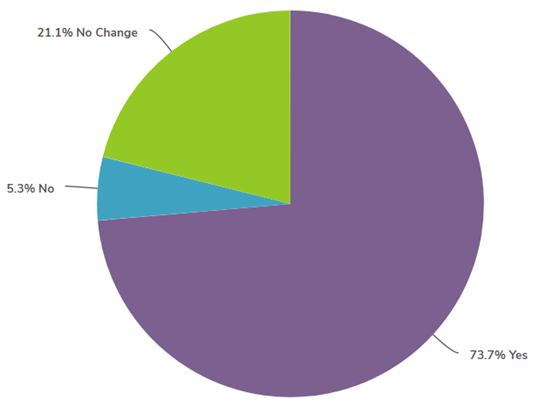

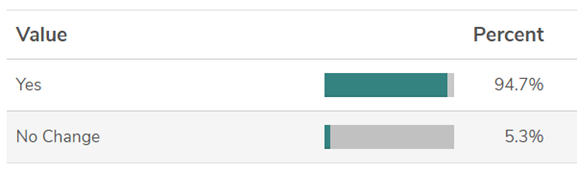

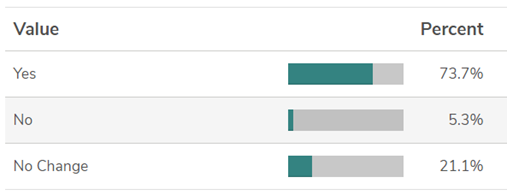

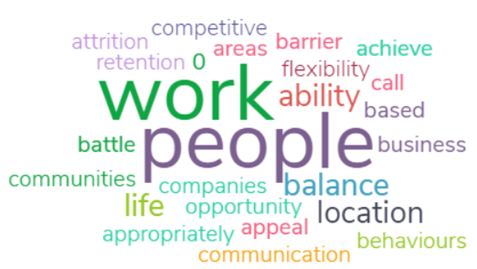

4. If remote working becomes the new norm: Could it also subsequently impact attrition rates and a company’s ability to retain highly qualified individuals?

Chris H:

Flexibility will inevitably impact attrition rates, but retention will depend on how remote workers are managed and what steps are taken to prevent isolation and ensure staff ” grow” and achieve the right work/life balance.

Paul T:

Yes, again I think so. Much more opportunity for the best people to work anywhere and therefore becomes a more competitive marketplace.

Tim:

Ability to offer flexible working will be important to retain the best people and appeal to their work/life balance. Companies who insist on 100% office based roles will be perceived as old fashioned and not progressive.

Rob:

Flexibility is expected and folk now have a taste for it. If you can’t facilitate the new work style I believe you will lose staff.

Chris C:

Companies will need to consider how to keep individuals engaged as opposed to isolated.

Waseem:

A positive here, at one level as I think flexible working will really aid everyone having a better work life balance but at same time it becomes one big labour pool which has little restrictions so people can and will move more freely.

Graham:

I think initially yes but as companies work out what the new norm looks like the battle ground for talent will shift into new areas. When there is not enough to go around, supply and demand will always drive behaviours. What will be interesting is when we look back in 10 years’ time…will there be change on the scale on an industrial revolution or will Covid be a blip in history?

Paul B:

It might do. Too early to say yet but I think the normal rules apply i.e. it remains a challenge and all Employers need to be committed to retain top talent with training investment, career progression plans etc.

Paul W:

We expect that in the longer-term companies will be offering more flexible working arrangements. This will mean giving colleagues the option to work from the office or from home or a mix of both. With the right work life balance organisations will be able to retain talent more effectively.

5. If remote working becomes the new norm: How will companies retain highly qualified individuals?

Chris H:

Management styles will need to change, and greater efforts will need to be made to ensure that staff ” enjoy” work and have the appropriate opportunities to network (internally and externally). Mentoring, communication and identifying individual needs and opportunities will become increasingly important.

Paul T:

Good base salary start points, incentive programmes that pay more regularly than annual, autonomy to influence strategy at higher levels and make decisions and more flexible work / life balance options.

Tim:

Common purpose, motivation, communication and good leadership will continue to be key to retaining staff – we must all adapt to delivering this differently in the new world.

Rob:

By working with them to establish mutually rewarding working patterns and providing 21st century tech. Leadership has to be rethought.

Chris C:

Flexible working arrangements that fit around lifestyle choices.

Waseem:

Has to move beyond basics like pay etc. and engage individuals in what they are doing e.g. by being innovative, interesting and varied work, customer focused, company brand will mean more and what the brand represents, working culture etc.

Graham:

The key here is flexibility…be that when and how you do your job, location, benefits, learning style and so on. Organisations that provide this flexibility will be the ones that win.

Nic:

Engagement and leadership.

Paul B:

True commitment to agile working. Modern technology and IT Kit. Wellbeing investment in people and Leaders who can inspire individuals through remote working.

Paul W:

Once the threat of COVID-19 has passed we expect many of our colleagues will want to return to the office to some extent. The key to retention of talent will be allowing them to find the right work life balance to suit them. Flexibility will be key.

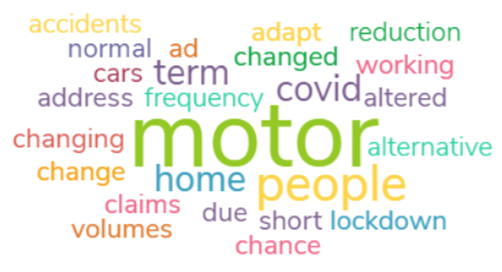

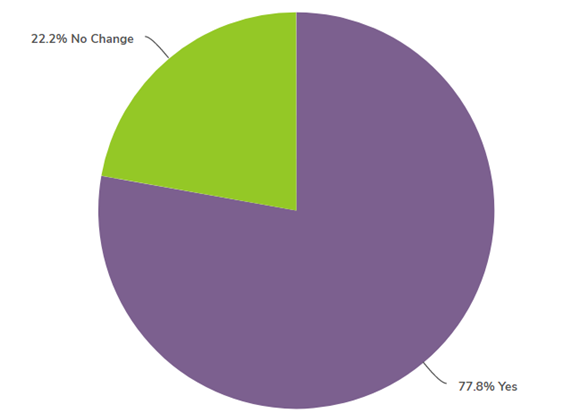

6. People’s lifestyles have been fundamentally changed by COVID-19. Has this impacted the type of claim, claims frequency and severity?

Chris H:

It is too soon to draw any conclusions and we are not yet working in what will be ” normal ” circumstances or environments. However, in the short term the frequency of motor and liability cases has reduced due to the downturn in the amount of footfall and movement, and there was some initial drop off in certain first party areas such as accidental loss, theft etc., as people remained at home and also in the severity of EOW claims as these were discovered much earlier.

Paul T:

Yes, in motor for the short term the road use frequency has changed. On one hand more people using cars when they do go out as alternative to public transport but working hours are less fixed – could this be the end of the traditional rush hour?

Tim:

Frequency has been temporarily affected by Covid but expect frequency to pick up back to normal levels as lockdown eases. Motor claims daily peaks will be different due to reduced commuting, and home claims could increase due to increased WFH.

Rob:

Patterns have altered with individual peril frequencies changing relative to pre Covid.

Chris C:

Frequency is down as is severity.

Graham:

The simple example is motor where volumes have dropped due to a reduction in travel. Products will need to adapt going forward to address this lifestyle change.

Paul B:

Generally through the Pandemic we’ve seen a reduction in Motor & Liability claims but Property claim numbers have remained constant. Crawford produced an Insights Data Driven paper recently that showed a spike in domestic fire claims through the summer.

Paul W:

Each lockdown, with fewer car journeys and increased homeworking, we’ve seen less motor, commercial and domestic claims. We expect to see these trends continue into 2021 at least until the vaccine has been rolled out across a significant proportion of the population. The largest reduction in claim volumes have been in Motor and Liability. Unsurprisingly, Business Interruption and Travel claims have increased at considerable rates.

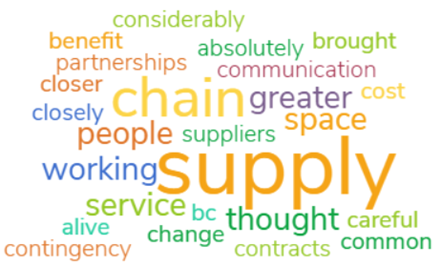

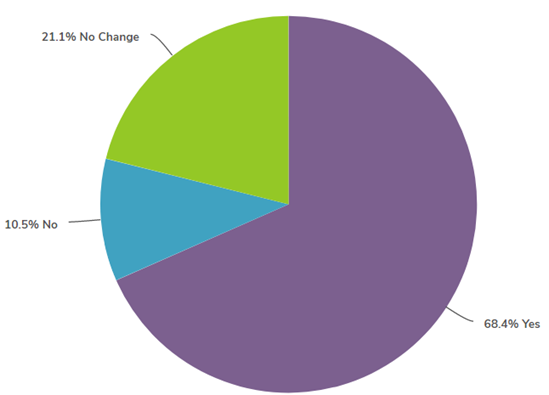

7. Has Covid made Insurers think carefully about the relationship with their supply chain partners and expectations moving forward?

Chris H:

Levels of communication and working together for mutual benefit have improved considerably. Hopefully, this will be maintained.

Paul T:

Absolutely. Be careful what you wish for as an insurer when you drive margins to the ground for suppliers and then expect the service. I expect there to be a much more rounded view of sustainable supply chain partnerships in the future and we are already seeing that in the motor space.

Tim:

Working closely with supply chain is of greater importance as its frequent communication.

Rob:

Most have relied heavily on suppliers to keep lights on. Whether this change is permanent will pan out as new contracts are negotiated. I fear the old transactional ways will return.

Chris C:

Sole supply relationships have become less common and there is greater thought around contingency planning.

Waseem:

Customer experience more important, push towards digital, connected experiences.

Graham:

Certainly, our Strategic Partnerships are very strong but Covid has driven further focus and work with our networks. In a very bazar way Covid has served as a test bed for what might come with Brexit.

Paul W:

Yes. Insurers need to know that their suppliers can respond quickly to very challenging circumstances, that they are being innovative and introducing the right digital tools to support the claims process. They will also want to know that suppliers can identify and respond sensitively to their more vulnerable customers.

8. Will the increased usage of AI reduce indemnity spend and/or improve customer service?

Chris H:

The real answer is potentially yes to both, but it really does depend on whether the AI is embraced correctly and in the right balance.

Paul T:

Inevitably yes, particularly on processes such as remote inspections, assessments of damages and decision making. In the service world also but we are a long way from substituting a top customer service employee with a robot and need to be wary of going too far away from the personal touch.

Tim:

Automation, consistency, efficiency…. all yes, but will AI really improve customer service? Need to be careful we don’t lose what the customer really wants from their insurance claims provider at their moment of truth.

Rob:

It will depend on the motives for deployment, how the AI is “taught” and whether skilled knowledgeable people are still involved in the claims process at key points.

Chris C:

But it has to be people plus tech; AI in isolation doesn’t work from a customer service perspective.

Waseem:

Yes, to both – better triage, quicker resolution, right first time – helps customers and also keeps costs down.

Graham:

We are moving to a world where the lines between digital, data and customer are disappearing, and AI is one of the tools that are available to help with this journey. We should always focus on the customer and their needs irrespective of the tool set. Get this right and the Indemnity spend control will follow.

Nic:

Possibly, depends to what extent used.

Paul B:

With some Insurers reporting straight through processes settling claims in minutes – yes this has to improve customer service. More work to be done, triage will still be key but improved service and better cost control should be achievable in the medium term.

Paul W:

AI used in the right way for the right claims, will definitely help reduce indemnity spend and potentially improve customer service. However, many more complex claims need the skills, expertise and empathy of claims handlers and adjusters to reduce costs and increase customer satisfaction.

9. Given the acceleration of change in 2020 what skills will claims departments value most in the future?

Chris H:

An appropriate balance of technical ability, empathy, service focus and flexibility.

Paul T:

Technical experts with real knowledge of their speciality in a fast-changing world. Familiarity with technology and the ability to make accurate, fast decisions.

Tim:

Being Human, retaining personal empathy, and not let the technology get in the way of doing the right thing.

Rob:

Data analysis and being able to filter claims accurately by a myriad of types including complexity, likelihood of conflict or customer disappointment/ confusion. Better prediction of issues should be used to trigger intervention by skilled staff only in those claims needing such an intervention. The rest can flow through untouched. Staff time is a precious commodity. At present we sprinkle a little time on all claims. Better to target the time where needed and where it can be applied purposefully.

Chris C:

Subject matter expertise.

Waseem:

Change agents, digital experts, analytical skills, technical claims handlers (as opposed to volume claim handlers).

Graham:

There is little doubt that digital and data skills will become more valuable, but providing help and support to our customers when problems arise will always be a key skill. So, empowerment in a regulated environment will be more important than ever.

Nic:

Customer skills.

Paul B:

IT skills linked to technical expertise.

Paul W:

Willingness to embrace change and use digital tools to support customers and empathy.

10. How will organisations attract and motivate a new generation of claims professionals with potentially different career expectations than previous generations?

Chris H:

The fact that insurance has largely remained unaffected during such a major crisis whilst embracing change and innovation should make it more attractive as a career. However, this will depend on whether this is maintained, whether flexibility increases or decreases and on the industry reputation in the long term.

Paul T:

Variety will be key – making sure roles are not one dimensional and allow claims professionals to experience different markets, products and jurisdictions. Also, benefits packages need to move with the times to include other lifestyle benefits that the next generation will embrace.

Tim:

Greater use of formal training & qualifications and giving wide career pathways. It will be interesting how the new WFH generation wish to drive their careers and how employers provide the environment & tools to allow staff to progress.

Rob:

By demonstrating claims as a worthwhile profession where human skills are facilitated by tech and where innovation and creativity is encouraged by knowledgeable, tech savvy and able leaders.

Chris C:

I think insurance careers no longer stay in claims – it is just one discipline that people need to have.

Waseem:

By showcasing the variety of the skills we need and the interesting projects and transformations we have ahead of us in Claims. For me, Claims is ripe for change and technology and data have a large part to play.

Graham:

We now have 5 generations in the workplace, which is a first. Skilled leaders need to be able to appeal to all of these generations and provide purpose mastery and empowerment in a way that appeals to all. Whether this is face to face or virtual will need to become irrelevant.

Nic:

Pathways to promotion and new challenges.

Paul B:

Flexible working arrangements.

Paul W:

Organisations will need to show that they are innovative and welcome the creativity and different perspectives that a new generation of claims professionals will bring. Also demonstrating that the organisation’s environmental impact is reducing will be important.

11. Should the relationship between the regulator and claims professional be closer?

Chris H:

To be successful in improving the industries reputation and seen as independent the regulator must inevitably be impartial. Unfortunately, the regulator has failed both sides over recent months as it has not placated policyholders and potentially alienated insurers. Whilst the intentions are good, and it is always difficult to meet the requirements of opposing sides, a reset of the regulator’s role is long overdue.

Tim:

It is about right just now – however the regulator also needs to understand and recognize the challenges the business itself is facing…. not just the customers perspective.

Rob:

They should work hand in hand, so issues of concern are managed promptly rather than building into legacy issues, treating customers unfairly and creating conflict.

Chris C:

I think it is about right.

Waseem:

It is already moving in this direction particularly on topics related to Customer and Conduct.

Graham:

Feels like it’s already close so I don’t anticipate any change.

12. What is the greatest challenge facing the claims market moving into 2021?

Chris H:

The greatest challenge is the lack of certainty or any historic precedents to work from. But out of this uncertainty there is no doubt the industry will be leaner and more dynamic. In addition, those that embrace the change and develop better services will flourish.

Paul T:

Certainty and stability. The ability to plan ahead, whether to invest to grow or stand still and protect what you have. The stability of firms will impact decisions to support or move to new partners and the inevitable hunger for acquisitions particularly for those wounded by 2020 will create a lot of opportunity as well as I am afraid a fight for survival for some.

Tim:

Retaining focus on what we already do well, whilst rapidly evolving to the new reality of the environment we now face.

Rob:

Rapid succession of events and trends causing huge uncertainties.

Chris C:

The Civil Liability Bill and the consequent handling of small claims without legal representation.

Waseem:

Rate of change and need for this, be this customer expectations, technological advancements etc.

Graham:

Covid has been highly disruptive with some positives and lots of negatives. The challenge is taking the positives forward and learning from the negatives.

Nic:

Recession and claims spend pressures driving the wrong outcomes.

Paul B:

Succession Planning. Despite all of the uncertainty in the market we still need to invest in training and attract top talent to deal with the challenges ahead.

Paul W:

We’re in the midst of winter when claims traditionally increase. With the threat of further lockdowns, the lessons learned throughout this year will undoubtedly help us support customers and clients in any surge events. This time the industry is better prepared.

During the pandemic, mental health issues have risen significantly, and followed by a prolonged recession, this will no doubt continue. As a sector, we must be alive to this. We need to talk about the mental health of our colleagues and support them. It’s also very important that we identify and respond sensitively to our more vulnerable customers.

I would like to thank all the individuals who contributed to this year’s survey.

I’ll allow you to draw your own conclusions and time will tell how the events of this year have impacted the industry.

Right International is a market leading recruitment firm who specialise in sourcing the top talent across the claims and wider insurance market.

If you have a vacancy or are looking for your next career move, please contact me.

If you would like a PDF version of this review, please email me.

All the best,

Gary Pike

Founder & MD Right International

*The thoughts and opinions expressed in this document are not mine or Right International’s, but the individuals that have engaged in this survey and given permission to publish their comments.